CYBER.CO.KE is an independent online Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). We charge a Cyber Services fee for the professional assistance provided to customers in Kenya.

The KRA Payment Slip is a very important document that allows taxpayers in Kenya make payment for any tax due under different tax obligation(s) to Kenya Revenue Authority (KRA). Each time that you file KRA Returns online and there is tax due, you are required to generate a KRA Payment Slip after you have completed filing the return for that specific tax obligation.

Taxpayers use the KRA Payment Slip to make payments for the taxes due as contained on the payment slip. It is important to note that the KRA Payment Slip contains important details such as the Payment Registration Number, Amount to Pay, Authorized Banks and even the M-PESA Paybill Number 222222 (Government’s Single Payment Platform) that can be used to make any tax payments to KRA.

To be able to generate KRA Payment Slip online using KRA Portal (iTax Portal), there are two key requirements that a taxpayer needs to ensure they have with them. This includes the KRA PIN Number and KRA Password (iTax Password) which are part of the login credentials needed to access iTax Portal (KRA Portal) account.

READ ALSO: How To Download KRA Clearance Certificate Online (In 5 Steps)

Requirements Needed In Generating KRA Payment Slip Online

To be able to generate KRA Payment Slip online using KRA Portal (iTax Portal), you need to login to your account using KRA PIN Number and KRA Password (iTax Password). Below is a brief description of what these two requirements entails in relation to the process of How To Generate KRA Payment Slip online.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax Portal (KRA Portal). If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of generating Payment Slip on iTax is your KRA Password, which you will need to access your iTax Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Generate KRA Payment Slip Online (In 5 Steps)

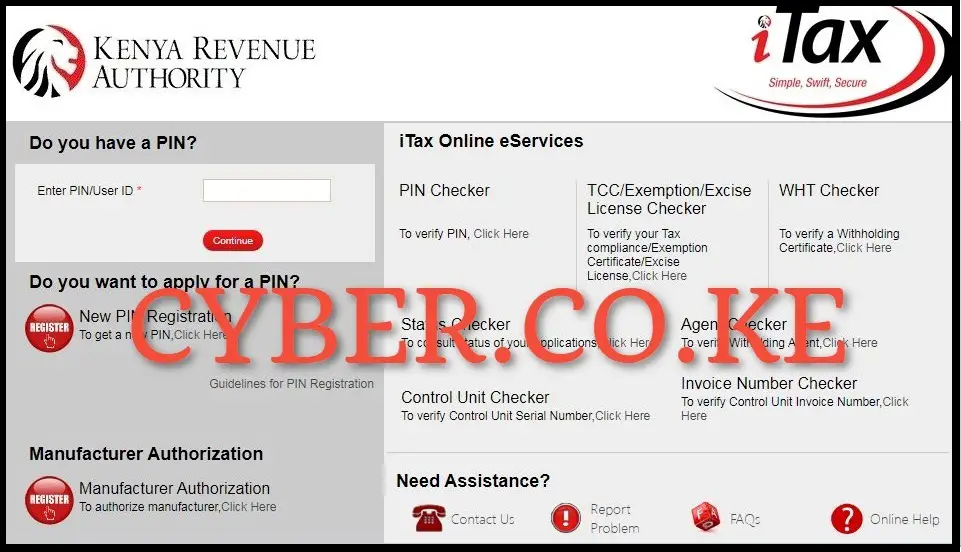

Step 1: Visit KRA Portal

The first step in the process of generating KRA Payment Slip online is to visit KRA Portal using https://itax.kra.go.ke/KRA-Portal/

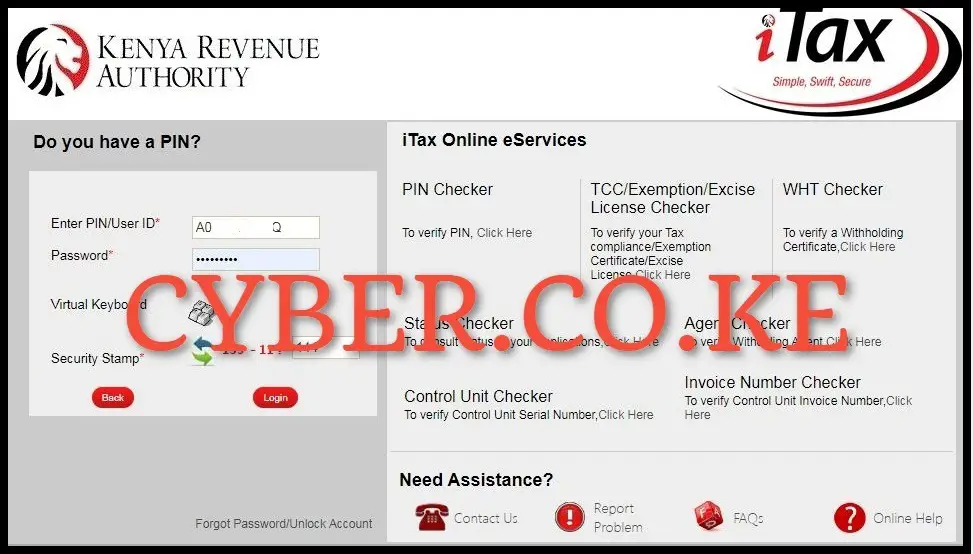

Step 2: Login to KRA Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your KRA Portal account and start the process of generating KRA Payment Slip online.

Step 3: Click on Payments then Payment Registration

Once you are logged into KRA Portal, on the top menu click on “Payments” followed by “Payment Registration” from the drop down menu item list.

Step 4: Fill the e-Payment and e-Payment Registration Form

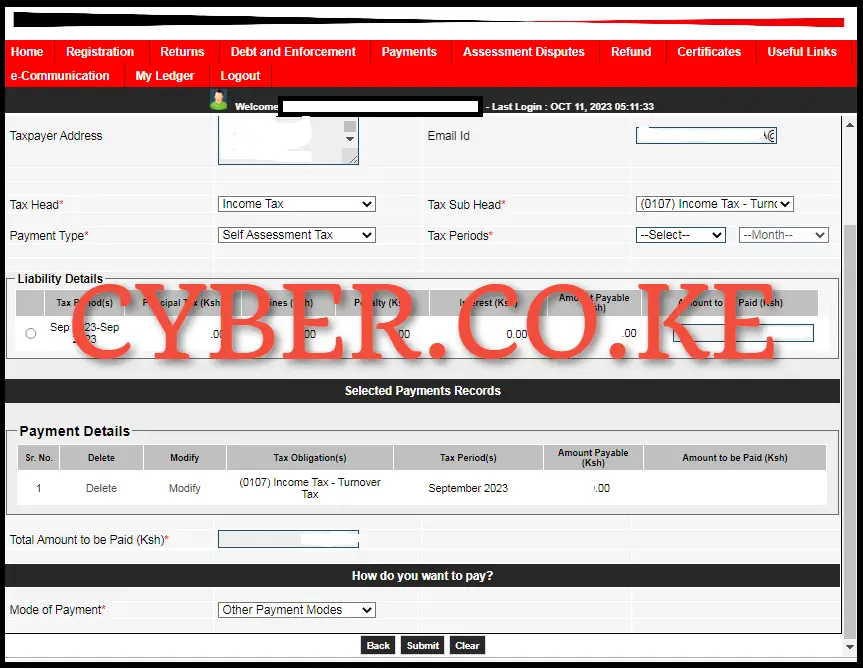

In this step, there are two forms under the Payment Registration on KRA Portal account dashboard i.e. e-Payment Form and e-Payment Registration Form. Below is what each of the forms entails in relation to generating KRA Payment Slip online

- e-Payment Form

The first form in is the e-payment Form of the Payment Registration module on KRA Portal. It displays the Applicant Type, Taxpayer PIN Number and Taxpayer Names. Click on the “Next” button to load the e-Payment Registration Form.

- e-Payment Registration Form

The e-Payment Registration Form is important since it is the one that will enable the generation of the Payment Slip on KRA Portal, the payment information and how do you want to pay part. The important fields that you are supposed to fill are the; Tax Head, Tax Sub Head and Payment Type. In this example, we are generating Turnover Tax KRA Payment Slip, we will fill the fields as follows; Tax Head: Income Tax, Tax Sub Head: (0107) Income Tax Turnover Tax, Payment Type: Self Assessment Tax and Tax Periods: 2023 – September. Click on the “Add” button to add it to the payment records.

Under the modes of Payments you can choose either RTGS, Bank or other payments modes like paying using M-PESA Paybill Number 222222 (Government’s Single Payment Platform). The choice of mode of payment of the tax depends on your chosen and preferred method. So, whether you choose payment via bank or M-PESA, the payment will still be received by Kenya Revenue Authority (KRA). The same process will apply for the different tax obligations that you want to generate the KRA Payment Slip for i.e. Income Tax – Resident Individual, Monthly Rental Income (MRI), Value Added Tax (VAT), Turnover Tax (TOT), Pay As You Earn (PAYE) e.t.c.

Step 5: Download KRA Payment Slip

The last step involves downloading the generated KRA Payment Slip on KRA Portal (iTax Portal). To download the KRA Payment Slip online on KRA Portal, click on the “Download KRA Payment Slip” text link, this will automatically download the KRA Payment Slip and save the PDF version/format of the KRA Payment Slip in your device and from there you can use the generated KRA Payment Slip in making the tax payment to Kenya Revenue Authority (KRA).

READ ALSO: How To Download KRA PIN Certificate PDF Online (In 5 Steps)

It is important to note that all tax payments via mobile money shall only be made through the Government Paybill Number 222222 with immediate effect in line with the Kenya Gazette Notice No. 16008 of 2022 and the Presidential Directive. When making any payments to KRA going forward, use the Paybil Number 222222 and use the Payment Registration Number (PRN) or the Reference Number on the KRA Payment Slip Generated from KRA Business Systems i.e. iTax (KRA Portal), iCMS, EGMS and KESRA iStudents as the account number while making tax payments via mobile money to Kenya Revenue Authority (KRA).

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.