For you to make any tax payment in Kenya, you need to first generate the Payment Slip onling using iTax Portal. This is normally the second step after you have successfully filed your KRA Returns whether Value Added Tax (VAT), Turnover Tax (TOT), Monthly Rental Income (MRI) or Pay As You Earn (PAYE) e.t.c, generation of the Payment Slip is important as it will enable you to make the tax payments due to Kenya Revenue Authority (KRA) on or before the elapse of the set deadline for each tax obligation in Kenya.

The generation of Payment Slip on iTax is very important as you will use the payment slip that you have generated on iTax to make payments either using the authorize Banks in Kenya or simply paying using the KRA Paybill Number 572572. Whichever method that a taxpayer uses to make tax payments in Kenya is his or her own personal decision. If you choose to make payment via Bank, you need to ensure that you use the authorized banks that are listed on Payment Slip. On the other hand, for simplicity, you can make tax payments using the Paybill Number 572572.

For you to be able to generate Payment Slip on iTax, there are two key requirements that are needed in the whole process. This includes the KRA PIN Number and KRA Password (iTax Password). These two form part of the iTax login credentials that are need for one to be able to login to his or her iTax account and generate the Payment Slip online. So, you need to ensure that you first have these two requirements with you before you can be able to generate the Payment Slip on iTax Portal.

READ ALSO: How To Print KRA PIN Certificate Online (In 5 Steps)

Requirements Needed In Generating Payment Slip On iTax

As mentioned above, for you to be able to generate the Payment Slip on iTax Portal, you need to use both your KRA PIN Number and KRA Password (iTax Password) to first login to your iTax account before proceeding with the process of generating the Payment Slip online using iTax Portal. Below is a brief description of what each of the requirements entails.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax Portal. If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of generating Payment Slip on iTax is your KRA Password, which you will need to access your iTax Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Generate Payment Slip On iTax (In 5 Steps)

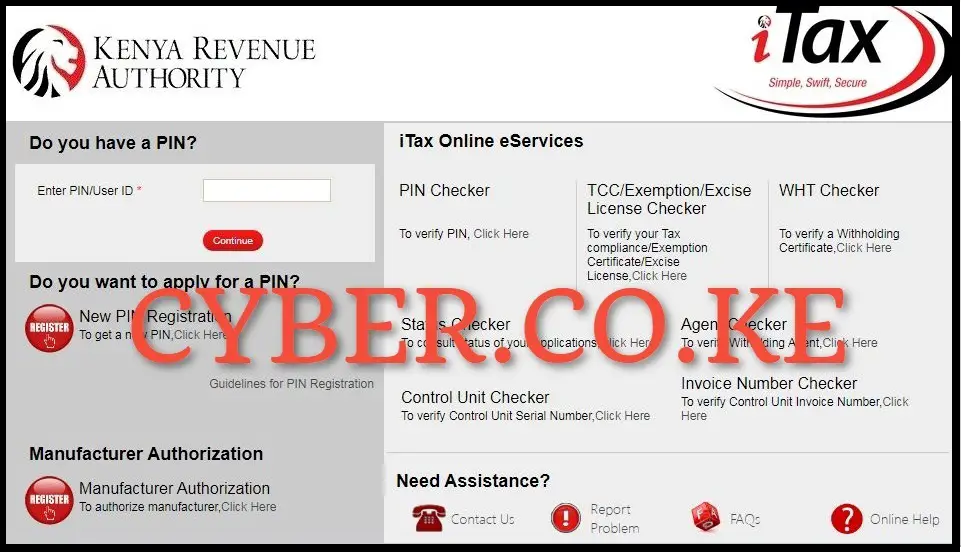

Step 1: Visit iTax Portal

The first step in the process of generating Payment Slip is to visit iTax Portal using https://itax.kra.go.ke/KRA-Portal/

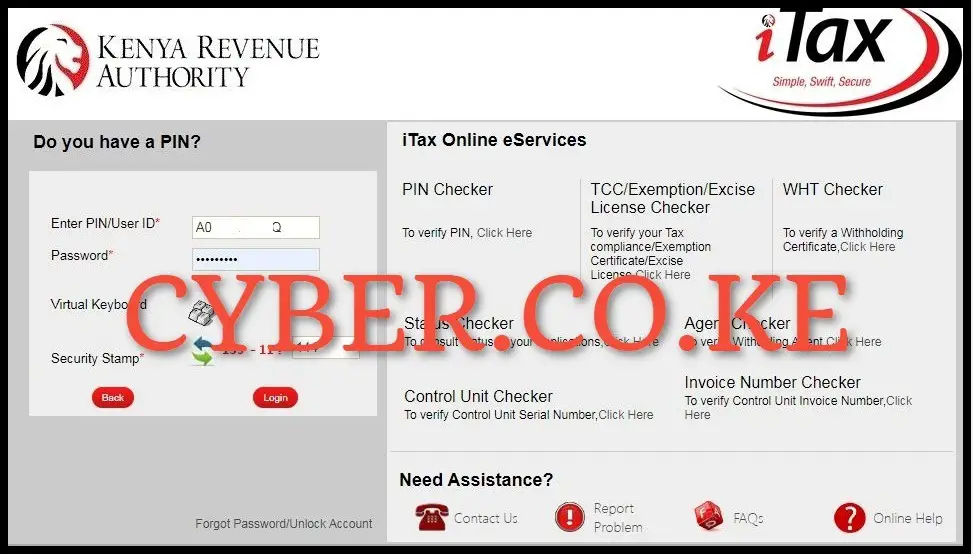

Step 2: Login to iTax Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access iTax account.

Step 3: Click on Payments then Payment Registration

Once logged into iTax Portal, on the top menu list click on “Payments” followed by “Payment Registration” from the drop down menu item list.

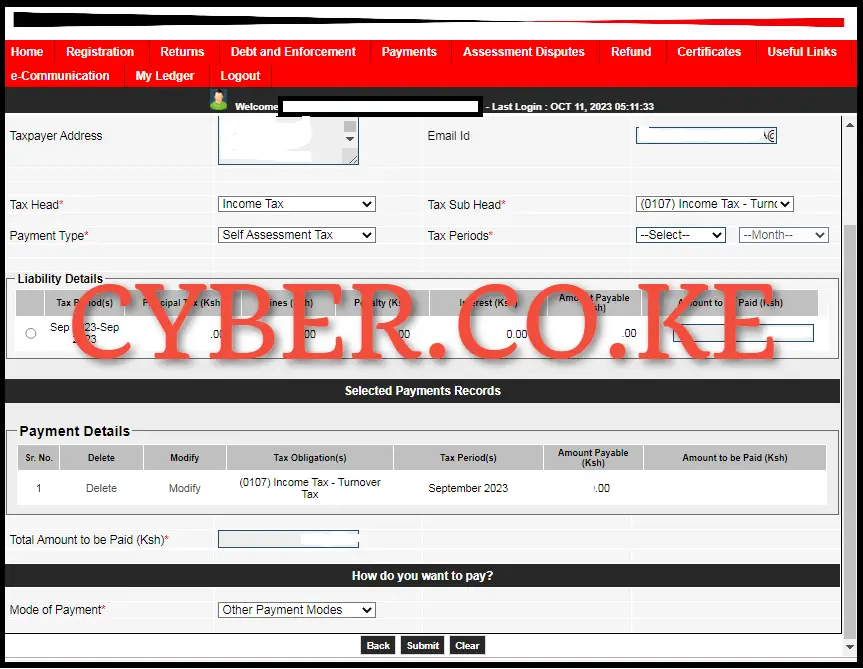

Step 4: Fill the e-Payment and e-Payment Registration Form

There are two forms under the Payment Registration on iTax i.e. e-Payment Form and e-Payment Registration Form. Below is what each of these entails.

- e-Payment

This is the first form in the Payment Registration module on iTax Portal. It displays the Applicant Type, Taxpayer PIN Number and Taxpayer Names. Click on the “Next” button to load the e-Payment Registration Form.

- e-Payment Registration Form

The e-Payment Registration Form is important since it is the one that will enable the generation of the Payment Slip on iTax Portal, the payment information and how do you want to pay part. The important fields that you are supposed to fill are the; Tax Head, Tax Sub Head and Payment Type. Since we are generating Turnover Tax Payment Slip, we will fill the fields as follows; Tax Head: Income Tax, Tax Sub Head: (0107) Income Tax Turnover Tax, Payment Type: Self Assessment Tax and Tax Periods: 2023 – September. Click on the “add” button to add it to the payment records.

Under the modes of Payments you can choose either RTGS or other payments modes like paying using M-PESA Paybill Number 572572. The choice of mode of payment of the tax depends on your chosen and preferred method. So, whether you choose payment via bank or M-PESA, the payment will still be received by Kenya Revenue Authority (KRA).

Step 5: Download The Generated Payment Slip

The last step involves downloading the Payment Slip that has been successfully generated by iTax Portal. You can easily download the Payment Slip that has been generated on iTax Portal by clicking on the “Download Payment Slip” text link, this will automatically download the Payment Slip and save the PDF version of the payment slip in your device, and from there you can use the generated Payment Slip in making the payment to Kenya Revenue Authority (KRA).

READ ALSO: How To Download KRA Nil Returns Receipt (In 5 Steps)

The above 5 steps outline the whole process that all taxpayers in Kenya need to follow when they want to generate Payment Slip on iTax. But to be able to do so, ensure that you have your KRA PIN Number and KRA Password (iTax Password) as you will need to access your iTax account by logging in first so as to be able to generate Payment Slip online thus ensuring that you use the slip generated to make tax payments for the KRA Tax Obligation that you want to make payment for, on or before the elapse of the set deadline for filing and making payments for any tax due to KRA.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.