The process of filing Turnover Tax Returns on KRA Portal involves different phases. From downloading the Turnover Tax Returns Form, filling it, uploading it and now generating the KRA Turnover Tax Payment Slip, which you will use to make payment for the Turnover Tax that is due to Kenya Revenue Authority (KRA). Generating the Turnover Tax Payment Slip is part of the last steps that a taxpayer undertakes before making the final tax payment to KRA.

You need to take note that if you are registered under the Turnover Tax obligation, you need to be filing the turnover returns on a monthly basis on or before the 20th day of each month. After filing your monthly turnover tax returns, you are also supposed to pay any tax due on or before the elapse of the 20th day of the month deadline. This obligation requires a proper bookkeeping on the part of the taxpayer for his or her business gross sales per month.

Take note that you need to keep track of the sales for your business for purposes of proper tax payments in Kenya. To be able to generate the Turnover Tax Payment slip on KRA Portal (iTax Portal), as a taxpayer you need to login first using both your KRA PIN Number and KRA Password (iTax Password). Take note that these two form part of the most important requirements that is needed to access your iTax account with ease and convenience.

READ ALSO: How To Upload Turnover Tax Returns Form On KRA Portal

Requirements Needed In Generating Turnover Tax Payment Slip

For you to generate the KRA Turnover Tax Payment Slip using KRA Portal, you need to login first using both KRA PIN Number and KRA Password. Below is a brief description of what each of these two key requirements that are need in generating payment slips on KRA Portal entails.

-

KRA PIN Number

The KRA PIN Number is the most important requirement that you need to have with you when you want to login to KRA Portal (iTax Portal). If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of generating the KRA Turnover Tax Payment Slip on iTax Portal is your KRA Password (iTax Password), which you will need to access your KRA Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Generate Turnover Tax Payment Slip (In 5 Steps)

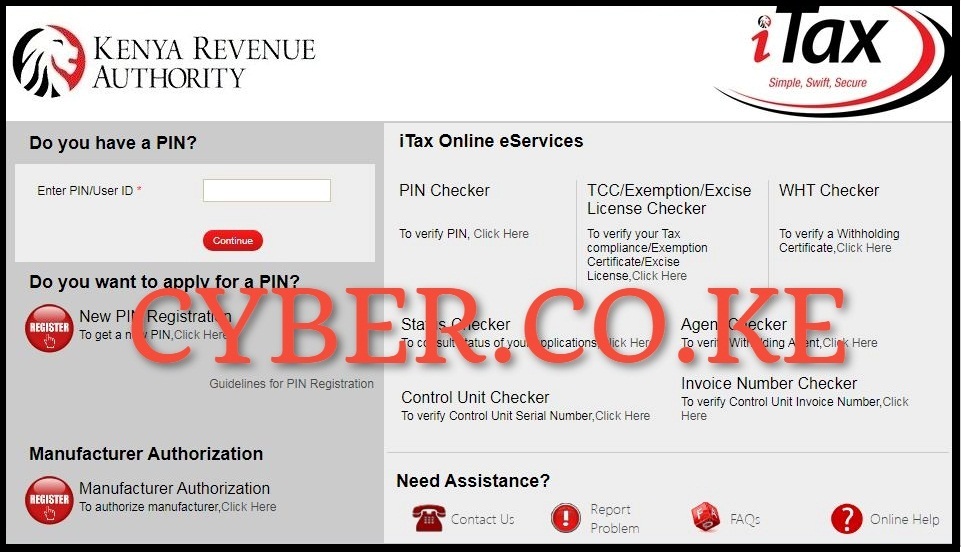

Step 1: Visit KRA Portal

The first step in the process of generating Turnover Tax Payment Slip involves visit the KRA Portal by using https://itax.kra.go.ke/KRA-Portal/

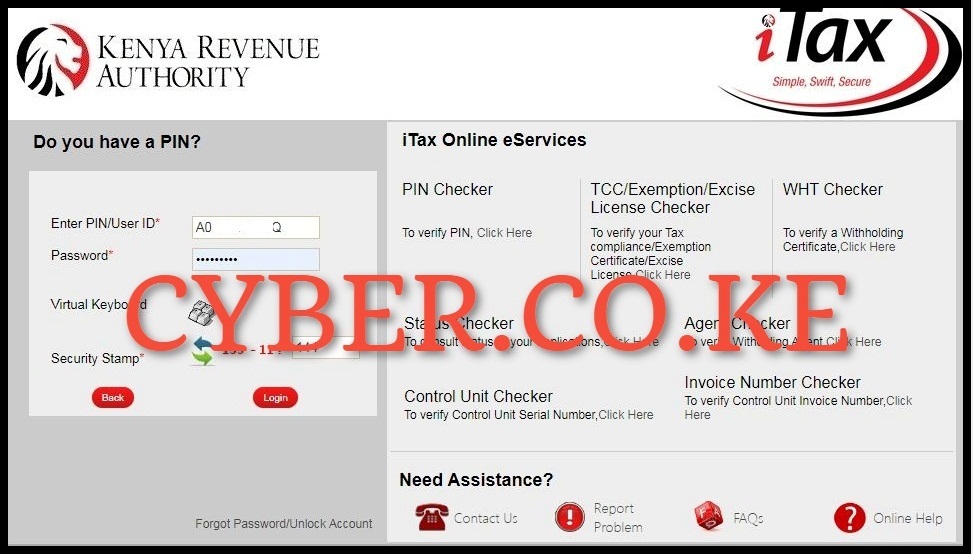

Step 2: Login to KRA Portal

Next, login to KRA Portal by providing both your KRA PIN Number and KRA Password, and solving the arithmetic question (security stamp). Once you have done this, click on the “Login” button.

Step 3: Click on Payments then Payment Generation

Once logged in successfully to KRA Portal, click on the “Payments” menu and from the drop down menu list, click on “Payment Registration” in your iTax account dashboard.

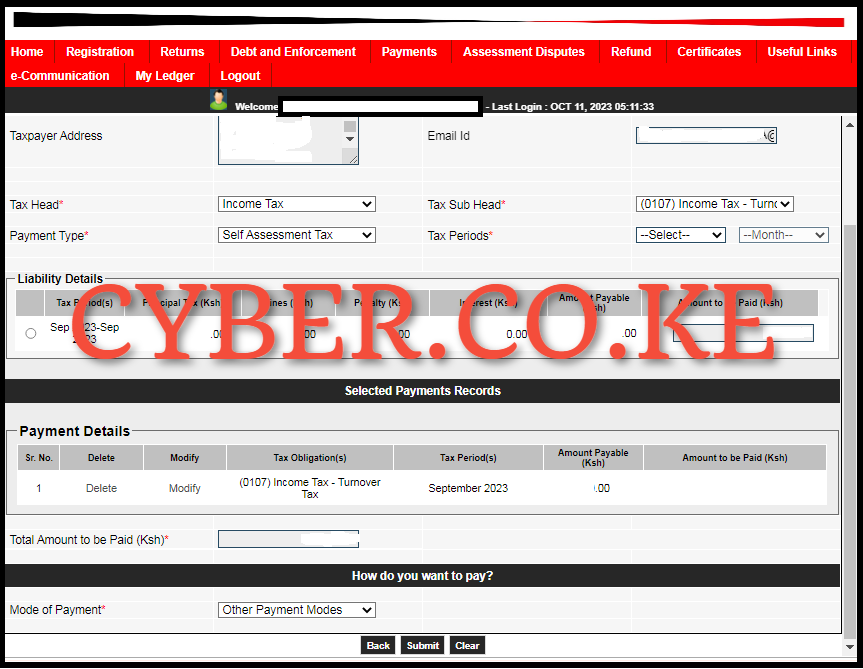

Step 4: Fill the e-Payment and e-Payment Registration Form

- e-Payment

In this step, there are two form involved. The first one is the e-Payment form that displays the applicant type, taxpayer KRA PIN Number and taxpayer name. There is not much to do here, so click on the “Next” button to load the e-Payment Registration Form.

- e-Payment Registration Form

In this form, there are two important parts i.e. the payment information and how do you want to pay part. The important fields that you are supposed to fill are the; Tax Head, Tax Sub Head and Payment Type. Since we are generating Turnover Tax Payment Slip, we will fill the fields as follows; Tax Head: Income Tax, Tax Sub Head: (0107) Income Tax Turnover Tax, Payment Type: Self Assessment Tax and Tax Periods: 2023 – September. (choose the month that you want to generate the KRA Turnover Tax Payment Slip for). Click on the “add” button to add it to the payment records.

In the how to pay method, you can choose RTGS or other payment modes like M-PESA. The choice of mode of payment of the Turnover Tax is yours to make. In this example we shall be paying the Turnover Tax by using M-PESA, so we selected other payment modes as the main mode/method of paying the Turnover Tax. Once you have filled in everything above correctly, click on the “Submit” button.

Step 5: Download Turnover Tax Payment Slip

The last step involves downloading the generated KRA Turnover Tax Payment Slip. You can download the payment slip by clicking on the “Download payment slip” text link, this will automatically download the Turnover Tax Payment Slip and save the PDF version of the payment slip in your device, from there you can use the generated KRA Turnover Tax Payment Slip in making the payment of tax due for the Turnover Tax obligation.

READ ALSO: How To Fill Turnover Tax Returns Form (In 3 Steps)

At this point, by following the above outlined 5 steps that are involved in How To Generate Turnover Tax Payment Slip on KRA Portal, you can now go ahead and use the payment slip to make payment for the Turnover Tax due to Kenya Revenue Authority (KRA). As mentioned above, you can pay the turnover tax using M-PESA or pay at any of the KRA Partner Banks (authorized banks) listed on the Turnover Tax Payment Slip.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS