Have you filed Turnover Tax Returns for your business and need to get the Payment Slip? Learn How To Generate Turnover Tax Payment Slip Using iTax Portal.

If you have filed Turnover Tax Returns for your business, the next step is normally to Generate Turnover Tax Payment Slip so as to be able to make Turnover Tax Payment to Kenya Revenue Authority (KRA) using either the KRA Paybill Number 572572 or any of the KRA Partner bank in Kenya. But not all taxpayers know How To Generate Turnover Tax Payment Slip Using iTax Portal. Knowing how to get the Payment Slip for Turnover Tax is very important for any taxpayer who owns and runes a business.

In this article, I am going to share with you the step by step guide on How To Generate Turnover Tax Payment Slip Using iTax Portal. By the end of this article, you will have learnt and know the steps that you need to take and follow in order to Generate the Turnover Tax Payment Slip using your iTax Web Portal Account. Normally when you have filed your Turnover Tax Returns, the next step is generating the Turnover Tax Payment Slip before making the final payment of the Turnover Tax due.

READ ALSO: How To File Turnover Tax Returns In Kenya Using iTax Portal

Every business that is eligible for Turnover Tax in Kenya needs to ensure that they file their monthly Turnover Tax Returns and make Turnover Tax Payments using the KRA Turnover Tax Payment Slip which can be generated through the KRA iTax Portal.

In this continuation of our Turnover Tax Returns series, we shall be looking at key concepts and terms such as: What Is Turnover Tax Payment Slip, Importance Of Turnover Tax Payment Slip, Features Of The Turnover Tax Payment Slip, Requirements Needed To Generate Turnover Tax Payment Slip and How To Generate Turnover Tax Payment Slip Using iTax Portal.

Kindly take note that due to COVID 19, Kenya Revenue Authority (KRA) reduced the Turnover Tax Rate from 3% to 1%. Since this article was written in 2020 during the prevalance of COVID 19, the rates that were used here were the old rates prior to the COVID 19 relief by the Government of Kenya through the Kenya Revenue Authority (KRA).

What Is Turnover Tax Payment Slip?

Turnover Tax Payment Slip is basically a Payment Registration Number (PRN) document that is generated using the KRA iTax Portal so as to enable a taxpayer who owns and runs a business in Kenya pay for the Turnover Tax for the business for a particular month. You need the Payment Registration Number (PRN) so as to be able yo Pay the monthly Turnover Tax for your business.

The first step in the process of paying for Turnover Tax is generating the KRA Turnover Tax Payment Slip that has the Payment Registration Number (PRN) that serves as the account number when you will be paying the Turnover Tax for your Business using either the KRA Paybill Number 572572 or by paying at the KRA Partner Banks in Kenya whereby you will have to present the Payment Slip for paying the KRA Turnover Tax.

The Payment Slip for Turnover Tax Payment is required so as to enable a taxpayer make Turnover Tax payments to Kenya Revenue Authority (KRA) on a monthly basis. This is because Turnover Tax is filed and paid monthly by businesses in Kenya at the rate of 3% of the monthly gross sales for that business. So, taxpayers need to file the Turnover Tax Returns first and afterwards generate the KRA Turnover Tax Payment Slip in order to be able to pay the Turnover Tax due for that month.

Having looked at the definition of Turnover Tax Payment Slip above, we now need to look at the Importance Of Turnover Tax Payment Slip. Why is this KRA Turnover Tax Payment Slip so important for businesses in Kenya? Well, the answer to this question follows below.

Importance Of Turnover Tax Payment Slip

Basically the Turnover Tax Payment Slip plays two important roles i.e. Payment of Turnover Tax and Tracking Status of Payment of Turnover Tax. These two are the most important functions of the Turnover Tax Payment Slip that is generated using the KRA iTax Portal. Let us now look at each one briefly below.

-

Payment of Turnover Tax

The most important reason why a taxpayer needs to generate the payment slip on the KRA iTax Portal is so as to be able to pay the Turnover Tax for business using the Payment Registration Number (PRN) that is displayed on the KRA Turnover Tax Payment Slip. You need the generated Turnover Tax Payment Slip so as to be able to pay the Turnover Tax for your business for a given month i.e. because Turnover Tax is due on a monthly basis on or before the 20th day of the next month.

-

Track Status for Payment of Turnover Tax

The other importance of the Turnover Tax Payment Slip is that it has a Search Code that you can use to track the status of your Turnover Tax Payment at Kenya Revenue Authority (KRA). The Search Code together with the Payment Registration Number (PRN) will allow you easily track the Turnover Tax Payment by using the Status Checker on the KRA iTax Portal.

Now that you know why the KRA Turnover Tax Payment Slip is very important, we now need to look at the Features Of The Turnover Tax Payment Slip. What are the different sections or parts that form the Turnover Tax Payment Slip? Well, the answer to this question is as outlined below.

Features Of The Turnover Tax Payment Slip

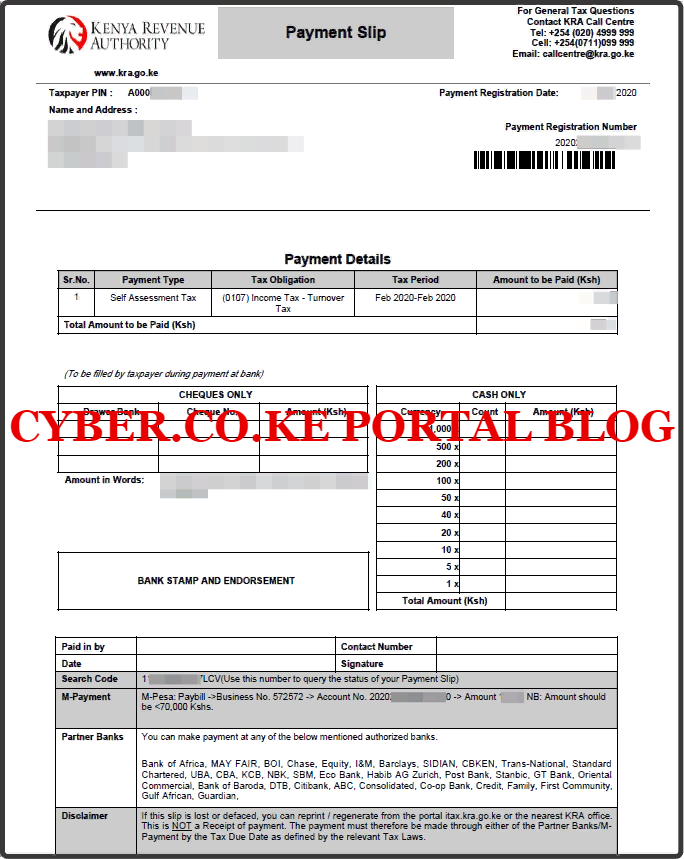

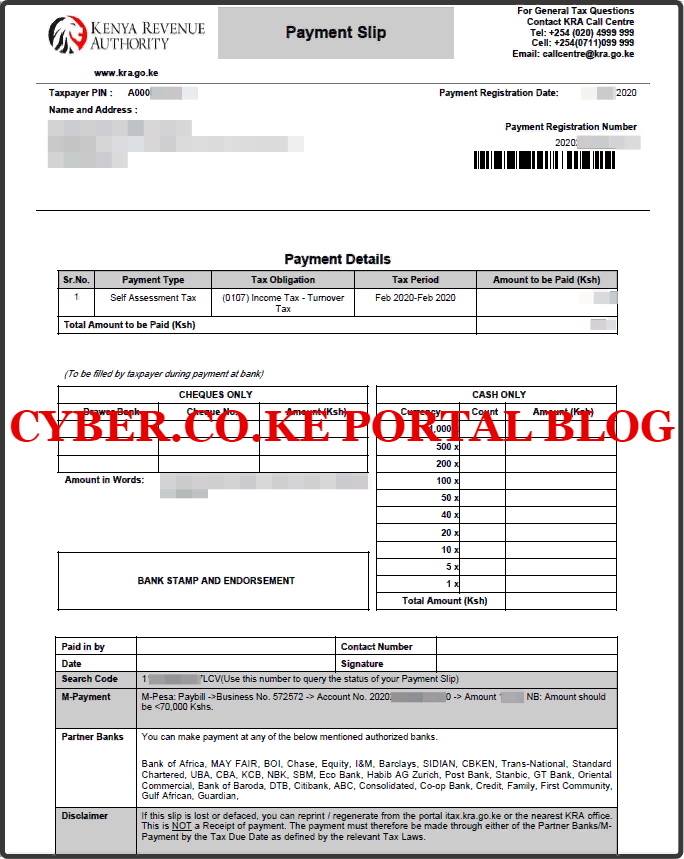

Just like any other document that a taxpayer can obtain from the KRA iTax Portal, the Turnover Tax Payment Slip has some sections or parts that as a taxpayer you need to understand what these sections or parts are. To be able to fully grasp and understand this, you can refer to a sample screenshot of the Payment Slip for Turnover Tax below.

From the above sample of a KRA Turnover Tax Payment Slip, you can see that there are different parts or sections of the Payment Slip. This includes the following: Taxpayer KRA PIN Number, Name and Address of Taxpayer, Payment Registration Date, Payment Registration Number (PRN), Payment Details and Total Amount To Be Paid.

I wont dwell much on the definition of each of those part as that will form part of future article blog series here at Cyber.co.ke Portal Blog, so always check out our site for the latest updates on Turnover Tax in Kenya. Having looked at the features of the Turnover Tax Payment Slip above, we now need to look at the Requirements Needed To Generate Turnover Tax Payment Slip.

Requirements Needed To Generate Turnover Tax Payment Slip

To be able to generate the Payment Slip for Turnover Tax on KRA iTax Portal, there is a set of requirements that you need to ensure that you have with you the KRA PIN Number and KRA iTax Password.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that you have known and have with you the key requirements that are needed in order to generate the Payment Slip for Turnover Tax on iTax Portal, we can shift gears and head towards the homestretch and look at the step by step guide of How To Generate Turnover Tax Payment Slip Using iTax Portal.

How To Generate Turnover Tax Payment Slip Using iTax Portal

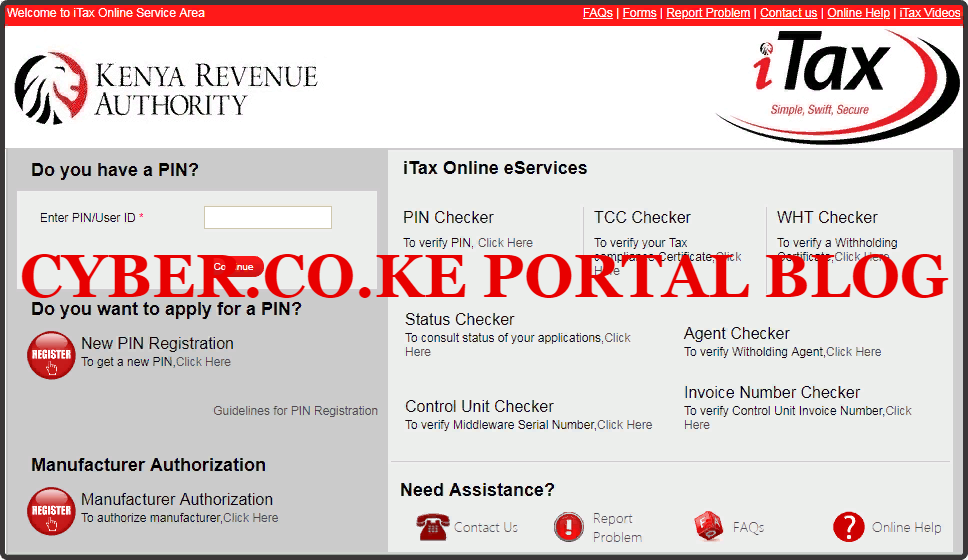

Step 1: Visit KRA Portal

The first step that you need to take in How To Generate Turnover Tax Payment Slip Using iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

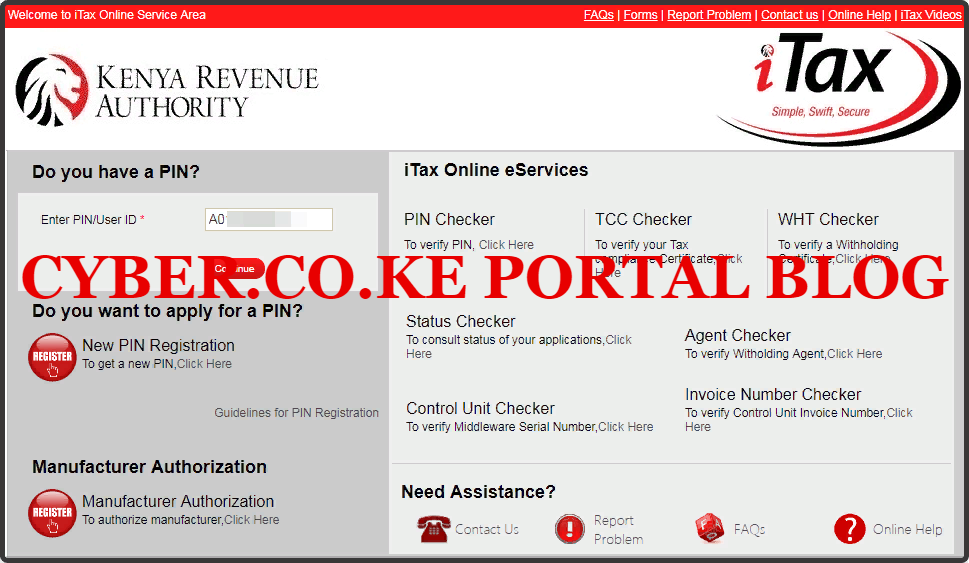

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

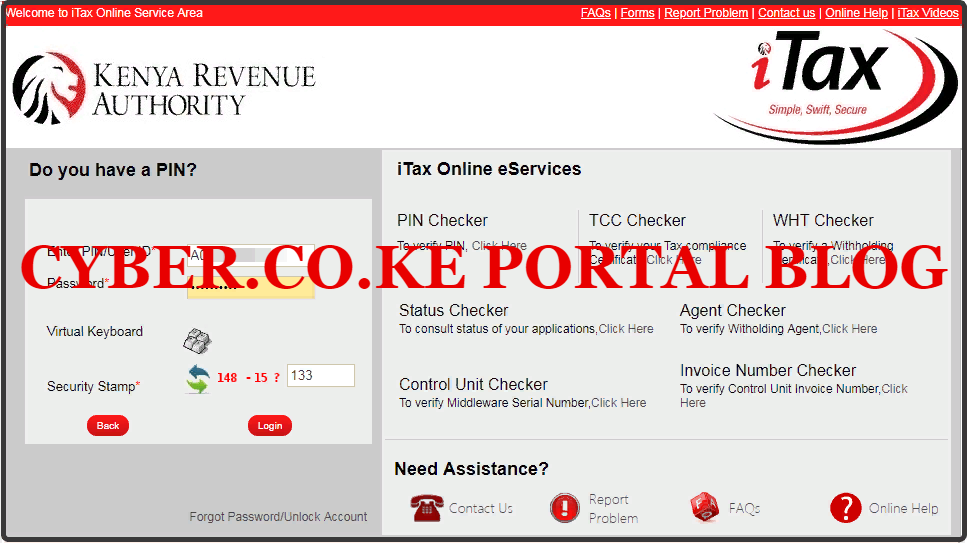

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Portal Account Dashboard. By entering the correct KRA PIN Number and iTax Password in the KRA Log In process, then you will be able to access you KRA Web Portal Account dashboard. Since we are generating the KRA Turnover Tax Payment Slip using the iTax Portal, we proceed to Step 5.

Step 5: Click On Payments Then Payment Registration Menu Tab

In this step, you will need to click on the Payments menu tab and click on Payment Registration from the drop down menu list as shown below.

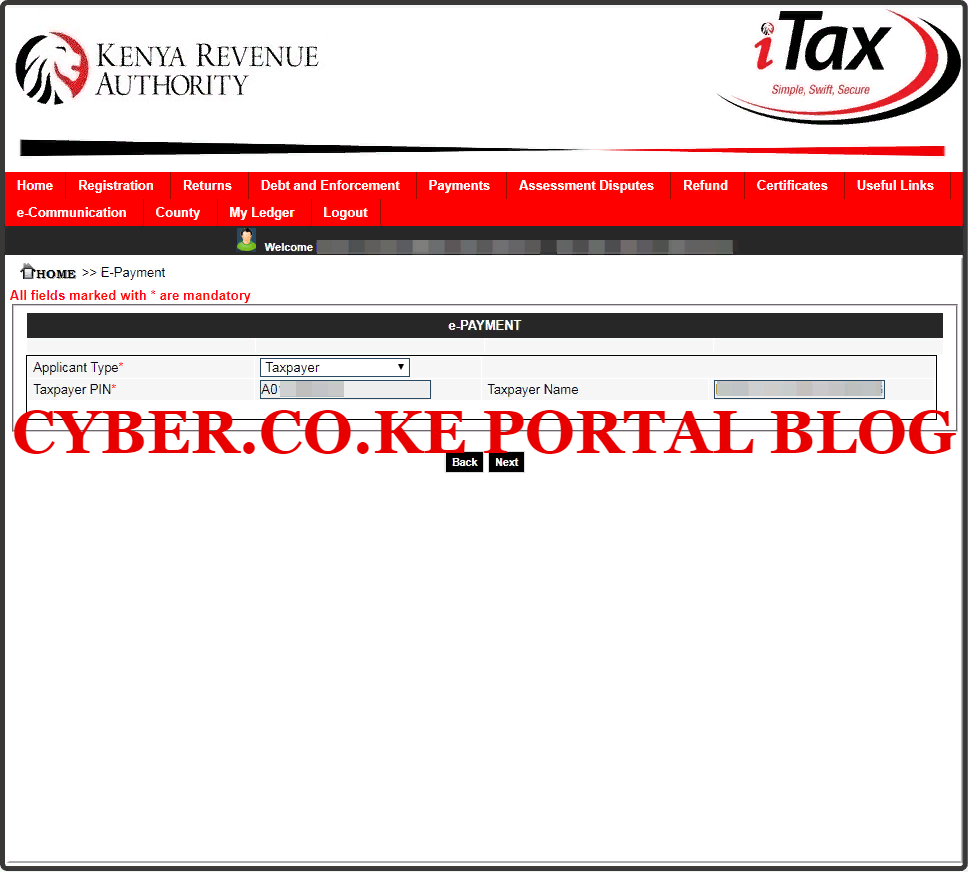

Step 6: e-Payment Online Form

There is nothing much to do in this step as the fields of Applicant Type, Taxpayer PIN and Taxpayer Name are automatically pre-filled by the system. You only need to click on the “Next” button.

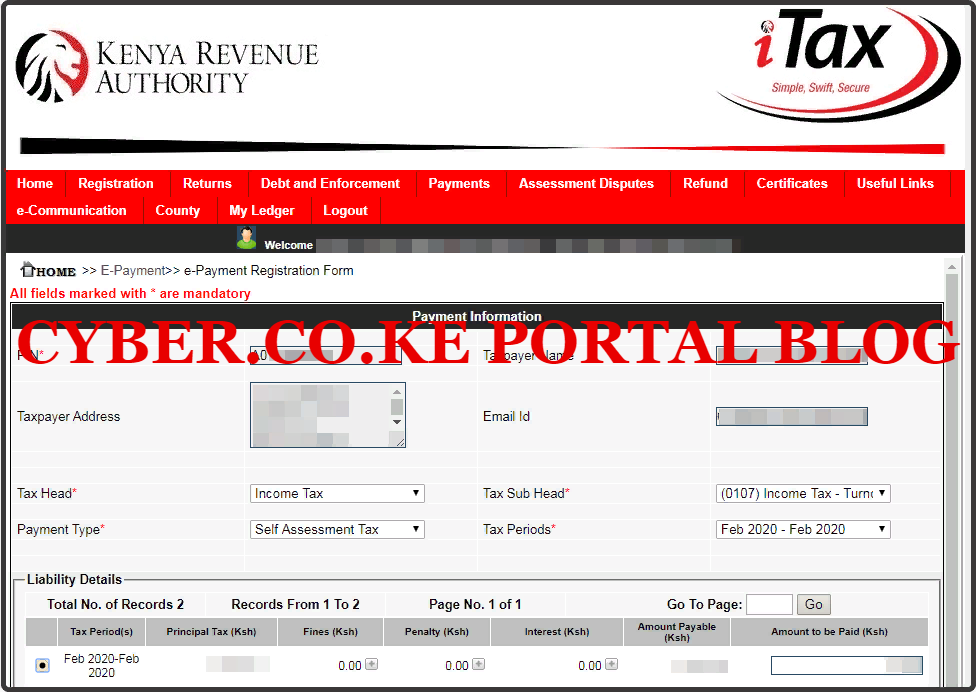

Step 7: Fill The e-Payment Registration Form

This is the most important step in the process of generating the KRA Turnover Tax Payment Slip using KRA iTax Portal. In this step, you will be required to fill the following fields; Tax Head (Income Tax), Tax Sub Head (Turnover Tax – 0107), Payment Type (Self Assessment Tax) and Tax Periods (February 2020). Once you have filled the above fields as shown, tick the check box for Payment Registration and this will load the Turnover Tax Details.

Once you have filled in the Turnover Tax details above, you will need to click on the “Add” button to add the details so as to generate the KRA Turnover Tax Payment Slip.

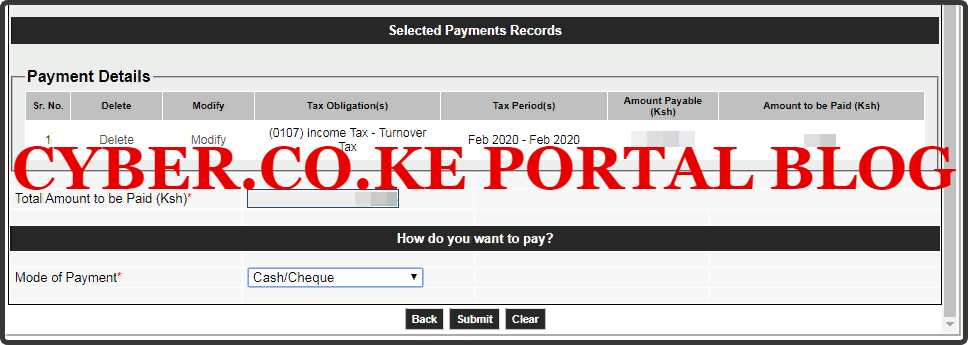

Step 8: Select The Mode Of Payment For Turnover Tax

Since we are going to pay the KRA Turnover Tax using KRA Paybill Number, the Mode of Payment we need to select will be “Cash/Cheque” Once you have done that, click on the “Submit” button. This is as illustrated below.

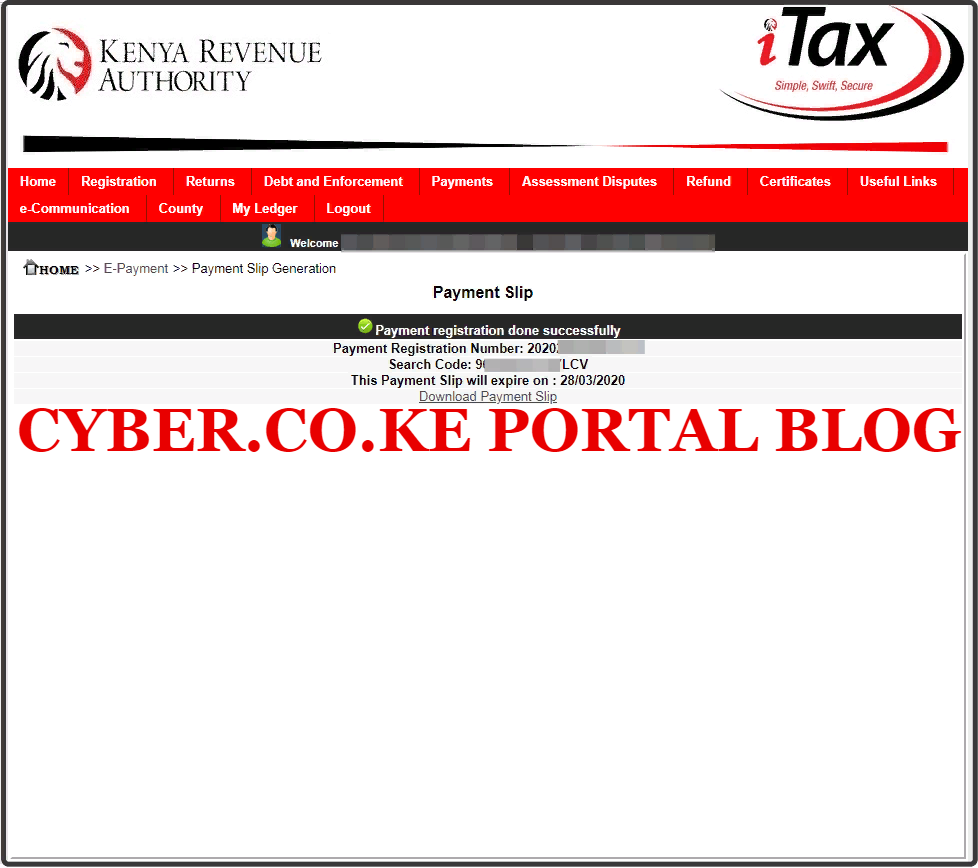

Step 9: Download Turnover Tax Payment Slip

In this last step, you will need to download the KRA Turnover Tax Payment Slip that has been generated successfully by the iTax Portal for your business. You do this by clicking on the “Download Payment Slip” link. This is as shown below.

On the downloaded KRA Turnover Tax Payment Slip, you need to take note of the Payment Registration Number (PRN) that will as serve as the Account number when you will be paying for the KRA Turnover Tax using either KRA Paybill Number or any of the KRA Partner Banks in Kenya. Below is a sample of the Turnover Tax Payment Slip that we have generated in this process.

The above steps sum up the step by step guide on How To Generate Turnover Tax Payment Slip Using KRA iTax Portal. Before you even generate the Payment Slip for Turnover Tax, you need to first ensure that you have filed your Turnover Tax Returns and downloaded the Acknowledgment Receipt and then proceed to generate the Payment Slip for Turnover Tax.

READ ALSO: How To Calculate Turnover Tax In Kenya Using Turnover Tax Form

If you need help with with Turnover Tax in Kenya, here at Cyber.co.ke Portal we have a team of experts who can assist you online quickly and easily. All you need to do is submit your KRA Turnover Tax Returns Filing request whereby we shall file the Turnover Tax Returns for you and at the same time generate the Turnover Tax Payment Slip so as to enable you pay for the Turnover Tax for your business on a given month.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Step-by-Step Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.