Discover how to easily obtain and download your KRA PIN Certificate online using KRA Portal. Gain valuable insights on the steps on how to get your KRA PIN Certificate using KRA iTax Portal today.

There comes a time where you might be really needing a copy of your KRA PIN Certificate so as to submit it either for Job Application or even Tender Application or any other place that the document might be required. But most if not many taxpayers get faced with the challenge of How To Get KRA PIN Certificate on their KRA Web Portal Account. Taxpayers are faced with the question: “How Do I Get My KRA PIN Certificate?”

In this article, I am going to share with you the steps that you need to follow on How To Get KRA PIN Certificate Using KRA iTax Portal. This article will be of great value to those taxpayers who already have a KRA PIN Number that is on iTax Portal, if your are looking to get a new KRA PIN or Retrieve Lost KRA PIN, just submit your order online at Cyber.co.ke Portal.

READ ALSO: How To Reset Forgotten KRA Password Using KRA iTax Portal

So, if you are in need of getting your KRA PIN Certificate on iTax Portal, then you are at the right place. Not every taxpayer is good at remembering things leave alone carrying their KRA PIN Certificates. It is a common notion that taxpayers only require a copy of their KRA PIN Certificate when they asked to bring or forward the PIN Certificate.

In this article, I will be tackling some basics of getting KRA PIN Certificate on iTax Portal including: What Is KRA PIN Certificate, Features of KRA PIN Certificate, Reasons For Getting KRA PIN Certificate, Requirements Needed To Get KRA PIN Certificate and How To Get KRA PIN Certificate Using KRA iTax Portal.

To be able to get your KRA PIN Certificate, you need to login to your iTax Account using both your KRA PIN Number and iTax Password. The other option that is preferred by many Kenyans and taxpayers is to use the KRA PIN Retrieval services here at Cyber.co.ke Portal. With the KRA PIN Retrieval services, your KRA PIN Certificate will be retrieved and sent to your preferred email address quickly and conveniently.

What Is KRA PIN Certificate?

KRA PIN Certificate is a document that is issued by Kenya Revenue Authority (KRA) to a taxpayer in Kenya and it certifies that the taxpayer whose details appear on the KRA PIN Certificate has been registered with Kenya Revenue Authority (KRA) and a unique Personal Identification Number (KRA PIN) issued to the taxpayer also.

A taxpayer can obtain the KRA PIN Certificate by applying for KRA PIN Registration services online at Cyber.co.ke Portal and have the KRA PIN Certificate sent to his or her email address quickly and easily. The KRA PIN Certificate normally displays the taxpayer’s details. Gone are the days of queuing endlessly looking for a KRA PIN Certificate which you can apply and get at Cyber.co.ke Portal within 3 minutes.

The KRA PIN Certificate document has now become the must have document in Kenya second only to the National ID. So, when you turn 18 years and obtain your National ID Card, it is recommended that you apply for KRA PIN online at Cyber.co.ke Portal. This is because the KRA PIN plays an important role in the day to day life of a taxpayer in Kenya. I don’t think if there is any place in Kenya where the PIN Certificate and KRA PIN Number isn’t required.

Now, let us look at some examples why you really need to get your KRA PIN Certificate. First and foremost, to open a Bank Account in Kenya, this document will be required by almost all the Commercial Banks in Kenya even Saccos also. Thinking of getting a new Job in Kenya, KRA PIN is a must have requirement that should accompany your Job Application. All employers require job seekers to have with them their KRA PIN Number and the KRA PIN Certificate.

Next, to get the new Digital Driving Licence (Smart DL) from NTSA, you need to have with you your KRA PIN Number so as to facilitate creation of TIMS Account. To get the new East African Passport, the KRA PIN Number is required. I can go on and mention nearly 100 key areas where the KRA PIN Certificate is required, but can be a topic for another great article here at Cyber.co.ke Portal Blog.

Now that we have addressed the key basics of the KRA PIN Certificate, we need to look at the key features of the KRA PIN Certificate. When I talk of features, I mean the parts that make the KRA PIN Certificate document.

Features Of KRA PIN Certificate

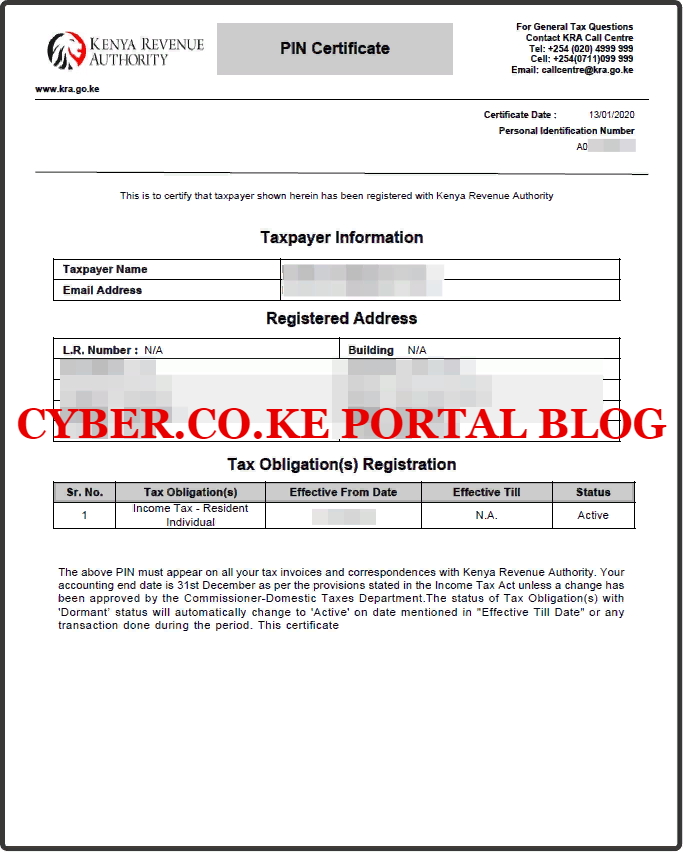

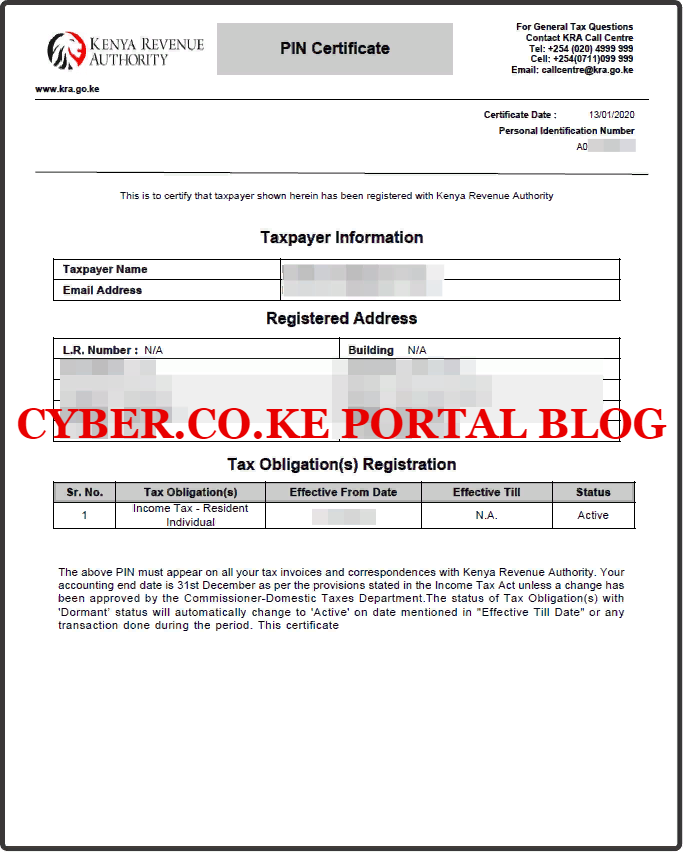

To understand the KRA PIN Certificate, we need to look at the parts or features that form the KRA PIN Certificate is a document. This is as illustrated below:

The above is a sample of a KRA PIN Certificate. You will take note that the KRA PIN Certificate has four key parts/features. This includes: Personal Identification Number, Taxpayer Information, Registered Address and Tax Obligation(s) Registration. Now let us take a look at each of those sections below.

-

Personal Identification Number

The most important number on the KRA PIN Certificate is the Personal Identification Number (PIN/KRA PIN). Once you apply for a KRA PIN online at Cyber.co.ke Portal, you will be issued with a unique 11 alphanumeric number that is called the KRA PIN Number i.e. A001234567B. You need to note that the KRA PIN is unique and automatically generated by the iTax System during KRA PIN Registration process.

-

Taxpayer Information

The Taxpayer information on the KRA PIN Certificate is normally limited to only the Taxpayer Name and Email Address. The Taxpayer Name is just the names as written on the National ID while the Email Address is the one that the taxpayer has registered the KRA PIN Number with and the KRA PIN Certificate and iTax Passwords are normally sent to that iTax Registered Email Address.

-

Registered Address

The Registered Address is comprised of the following: L.R Number, Building, Street/Road, City/Town, County, District, Tax Area, Station, P.O.Box and Postal Code. These form the registered address of the taxpayer in Kenya. So, it is just the information showing where a taxpayer in located or lives in Kenya.

-

Tax Obligation(s) Registration

The last part which is the Tax Obligation(s) part show the type of KRA Tax Obligation that a taxpayer is registered for on KRA iTax Portal. For most individual taxpayers in Kenya, the tax obligation is normally Income Tax Resident Individual. While for most non-individuals (companies) the tax obligations can either be Income Tax Company, Value Added Tax or Pay As You Earn (PAYE).

Now that we have looked at the features/parts of the KRA PIN Certificate, we now need to look at Reasons For Getting KRA PIN Certificate. We need to understand why a taxpayer needs to get the KRA PIN Certificate Using KRA iTax Portal.

Reasons For Getting KRA PIN Certificate

There are many reasons that can make a taxpayer need to get his or her KRA PIN Certificate on KRA iTax Portal. But one is the core one why you need to get your KRA PIN Certificate on iTax Portal. That is Applications.

Most taxpayers normally need their KRA PIN Certificate so as to make applications since the PIN Certificate is required in nearly many organizations in Kenya. This can range from opening bank accounts, job applications, tender applications, creating TIMS accounts, applying for Kenyan Passport, applying for HELB loans e.t.c.

When the KRA PIN Certificate is needed then knowing how to get KRA PIN Certificate comes into play. Once you know the steps that you need to follow to get KRA PIN Certificate, then no matter where the PIN Certificate is required, you can easily get the KRA PIN Certificate copy from your iTax Account.

Now that we have looked at the main reason for getting the KRA PIN Certificate on KRA iTax Portal, we need to look at the Requirements Needed To Get KRA PIN Certificate on KRA iTax Portal. By now you already know the main requirements that are need to access your KRA Portal Account. These are the KRA PIN Number and KRA iTax Password.

Requirements Needed To Get KRA PIN Certificate Using KRA iTax Portal

How To Get KRA PIN Certificate is basically a process that a taxpayer in Kenya needs to follow so as to get and download his or her copy of KRA PIN Certificate from KRA iTax Web Portal Account Dashboard. To be able to get your KRA PIN Certificate using KRA iTax Portal, you are going to need to have with you KRA PIN Number and KRA iTax Password. Let us now looks at each of these requirements that are needed to get KRA PIN Certificate using KRA iTax Portal.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Now that you have with you the requirements needed to get KRA PIN Certificate Using KRA iTax Portal above, we can now shift gears and look at the steps involved in How To Get KRA PIN Certificate Using KRA iTax Portal.

How To Get KRA PIN Certificate Using KRA iTax Portal

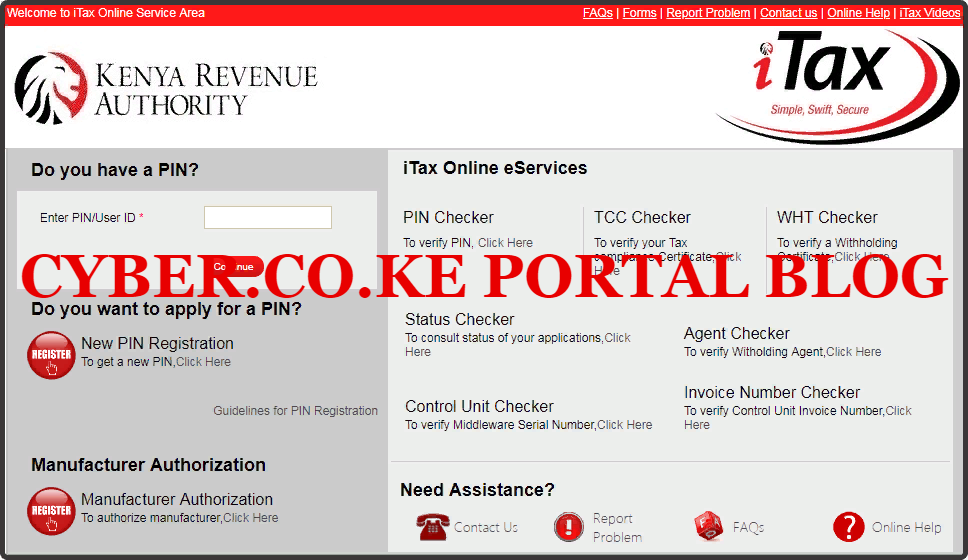

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Get KRA PIN Certificate is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

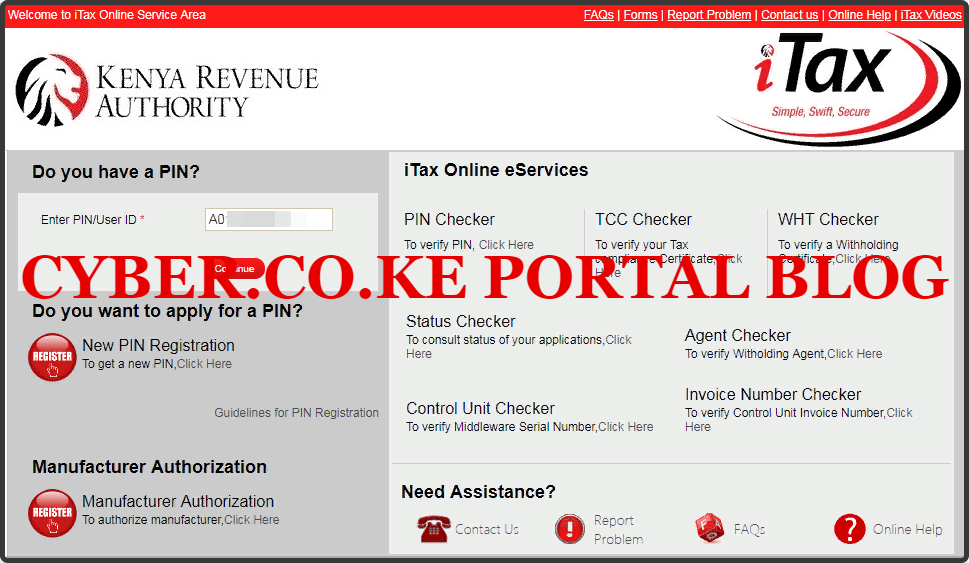

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

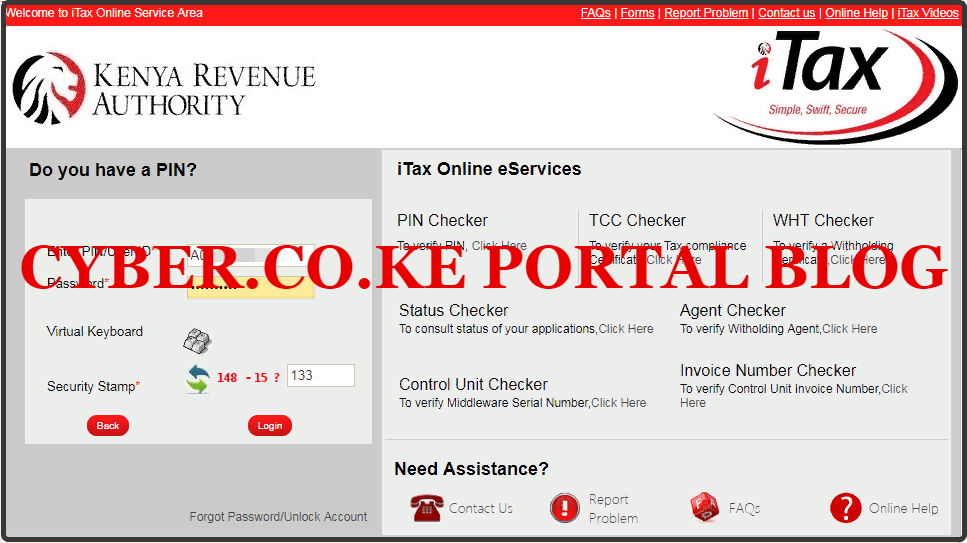

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to Get KRA PIN Certificate Using iTax Portal to download and print the KRA PIN Certificate, we proceed to step 5.

Step 5: Click On Registration Then Reprint KRA PIN Certificate

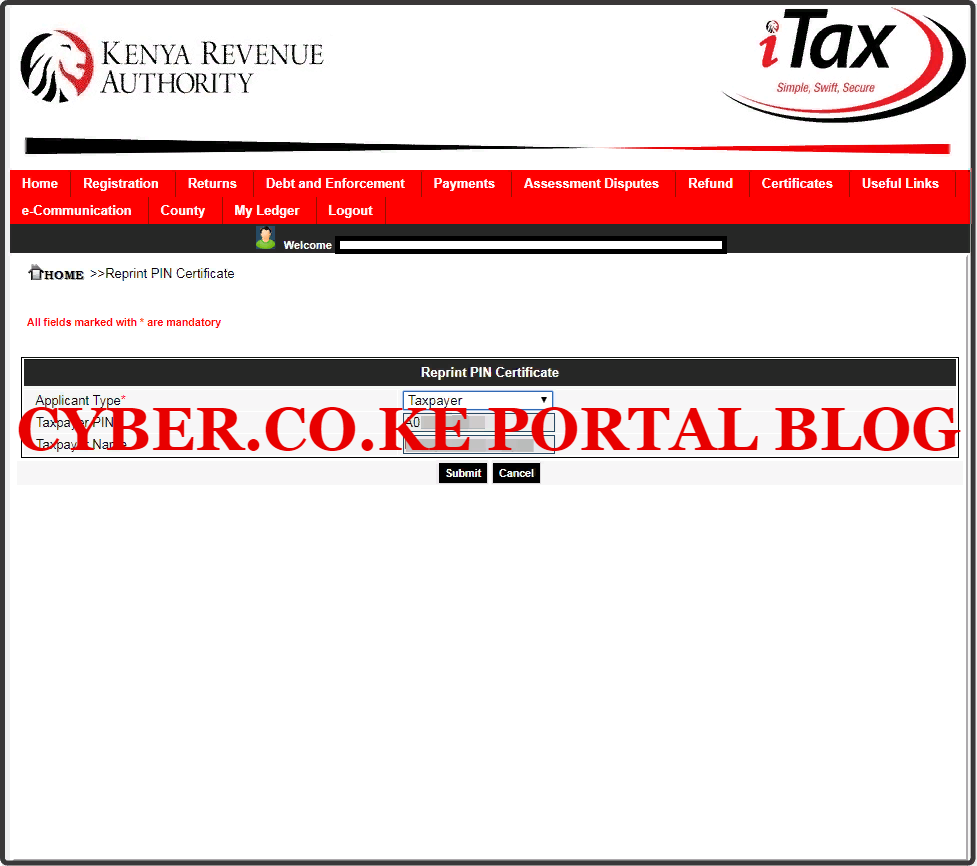

In this step, on the menu list items, click on Reprint PIN Certificate from the drop down menu list items. This is what is referred to as the KRA Portal Print PIN Certificate Functionality. This is as illustrated in the screenshot below.

Step 6: Select Applicant Type As Taxpayer

In this step, you will need to select the applicant type as “Taxpayer” The fields for Tax PIN and Taxpayer Name will be automatically pre-filled by the system. This is as illustrated below.

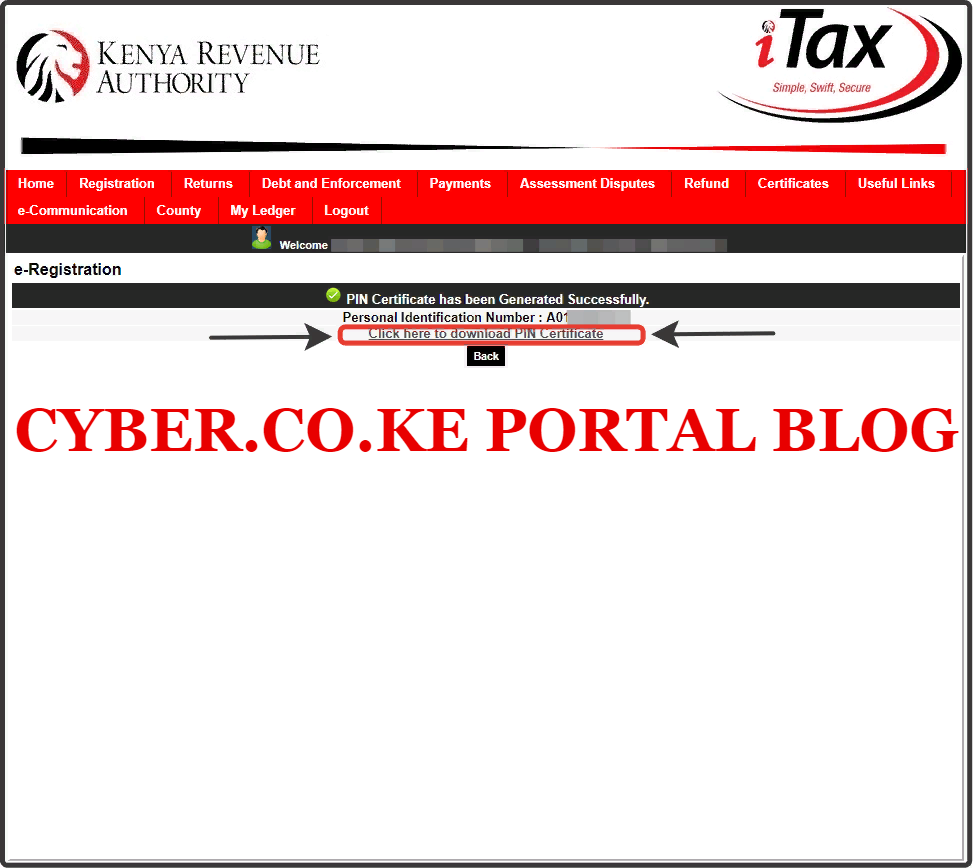

Step 7: Download And Print Your KRA PIN Certificate

The last step in this process involves downloading and printing the KRA PIN Certificate. You just need to click on the link that states “Click here to download KRA PIN Certificate” and you are all done and good to go.

Once you click the above link, you will be able to download your KRA PIN Certificate. One thing that you need to ensure is that you have installed the Adobe Reader since the KRA PIN Certificate is a PDF file.

READ ALSO: How To Access iTax Account Using KRA iTax Portal Login Page

That sums up the steps that a taxpayer need to follow online so as to get his or her KRA PIN Certificate using KRA iTax Portal. To be able to get your KRA PIN Certificate on iTax Portal quickly and easily, you need to ensure that you have with you two of the most important requirements i.e. KRA PIN Number and KRA iTax Password. Once you always have these two with you, then the process of How To Get KRA PIN Certificate will be a walk in the park for you.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.