Are you looking to get a new Tax Compliance Certificate online? Learn the steps involved in How To Get Tax Compliance Certificate From KRA Portal. In this article, you are going to learn the steps that are involved in How To Get Tax Compliance Certificate From KRA Portal.

Tax Compliance Certificate is one of those important documents that is issued to taxpayers upon filing of their KRA Returns and paid any tax liabilities due to Kenya Revenue Authority (KRA). It is always recommended that upon filing your KRA Returns on KRA Portal, one should apply to get a Tax Compliance Certificate that is issued by taxpayers who are tax compliant.

The most common challenge amongst the millions of taxpayers in Kenya is that majority of them don’t know the necessary steps and procedure that they ought to take on How To Get Tax Compliance Certificate From KRA Portal. In this article, I will be sharing with you the most important steps that you should follow when you are looking to get the Tax Compliance Certificate from KRA.

READ ALSO: How To File KRA Nil Returns For The First Time On iTax

Tax Compliance Certificate (TCC) is an official document issued by Kenya Revenue Authority (KRA) to taxpayers both individuals and non-individuals, as proof of having filed all KRA Returns and paid all taxes and liabilities due to KRA. Taxpayers who are seeking to get Tax Compliance Certificate must be compliant in: filing of KRA Returns on or before the due date for all applicable tax obligations that they are registered for, payment of tax on or before the due date and clearance of all outstanding tax debt(s) or tax liabilities and penalties.

In this article, I will be sharing with you the necessary steps and process that you need to take when you are looking to get Tax Compliance Certificate from Kenya Revenue Authority (KRA). So, whether you need the KRA TCC for job application or even tender application, knowing the steps to follow so as to get your Tax Compliance Certificate from KRA something that all Kenyans with active KRA PIN Numbers need to know.

The process of getting Tax Compliance Certificate from KRA is much easier if you know the process, steps and procedure that you are supposed to follow. But above all that, you need to ensure that you have with you the KRA Portal login credentials that comprises of the KRA PIN Number and KRA Password. Once you have the two credentials with you, then you can easily follow the step by step procedure that is outlined in this article on How To Get Tax Compliance Certificate From KRA Portal.

Requirements Needed To Get Tax Compliance Certificate From KRA Portal

To be able to get a Tax Compliance Certificate from KRA, there are two important requirements that you need to ensure that you have with you. This includes; KRA PIN Number and KRA Password. These two play an important role as you will need them in order to login to KRA Portal so as to be able to apply and get a new Tax Compliance Certificate (TCC) from KRA Portal.

Just as I have mentioned above, to be able to get Tax Compliance Certificate from KRA, you are going to need your KRA PIN Number and KRA Password as these two form the most important KRA Portal login credentials. Let’s look at each of these key requirements briefly below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA Password

The next requirement that you need to have with you is your KRA Password. You will need the KRA Password to access your KRA Portal Account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your KRA Portal Account.

You can only change or reset your KRA Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA Password.

How To Get Tax Compliance Certificate From KRA Portal

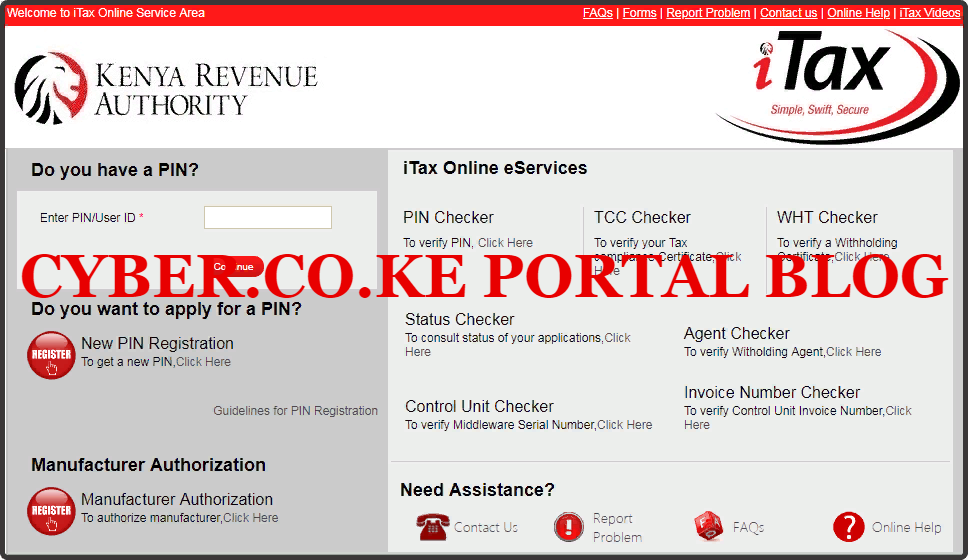

Step 1: Visit KRA Portal

The first step in the process of getting Tax Compliance Certificate from KRA is to visit KRA Portal. You can click on https://itax.kra.go.ke that will take you to the KRA Portal. Note that the link will open in a new browser tab.

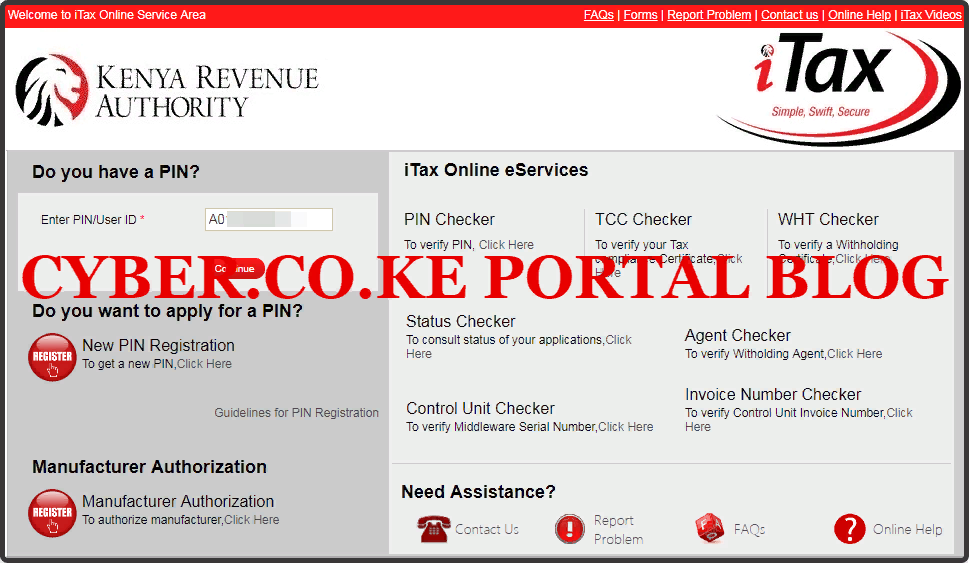

Step 2: Enter KRA PIN Number

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

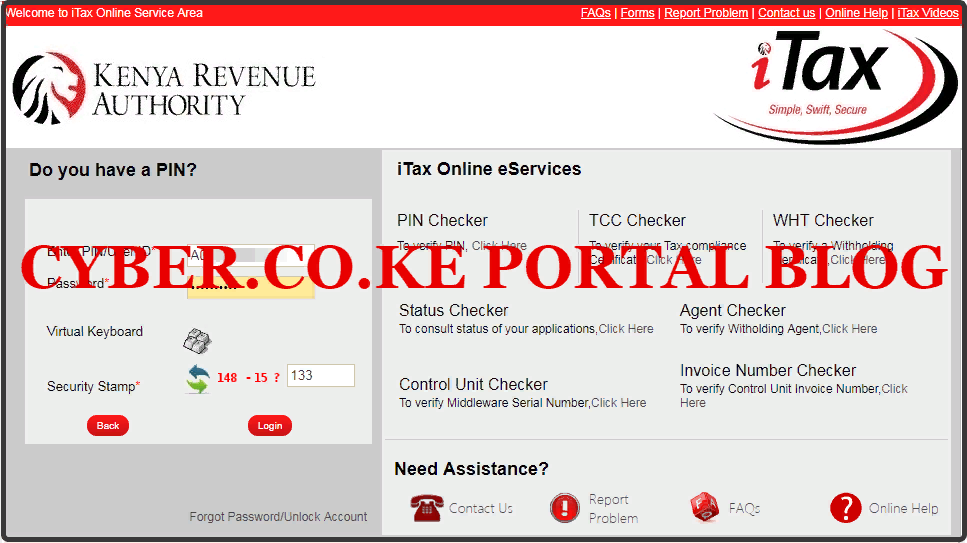

Step 3: Enter KRA Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA Password and also solve the arithmetic question (security stamp). If you have forgotten your KRA Password, you can check our article on How To Reset KRA Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your KRA Portal Account.

Step 4: KRA Portal Account Dashboard

Once you have entered the correct KRA Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA Portal Account Dashboard. Since we are looking to get Tax Compliance Certificate from KRA, we proceed to step 5 below.

Step 5: Click On Certificates Followed By Apply For Tax Compliance Certificate

In this step, you will need to click on the Certificates menu tab on iTax then from the drop down menu list click on Apply for Tax Compliance Certificate on KRA Portal. This is as outlined in the screenshot below.

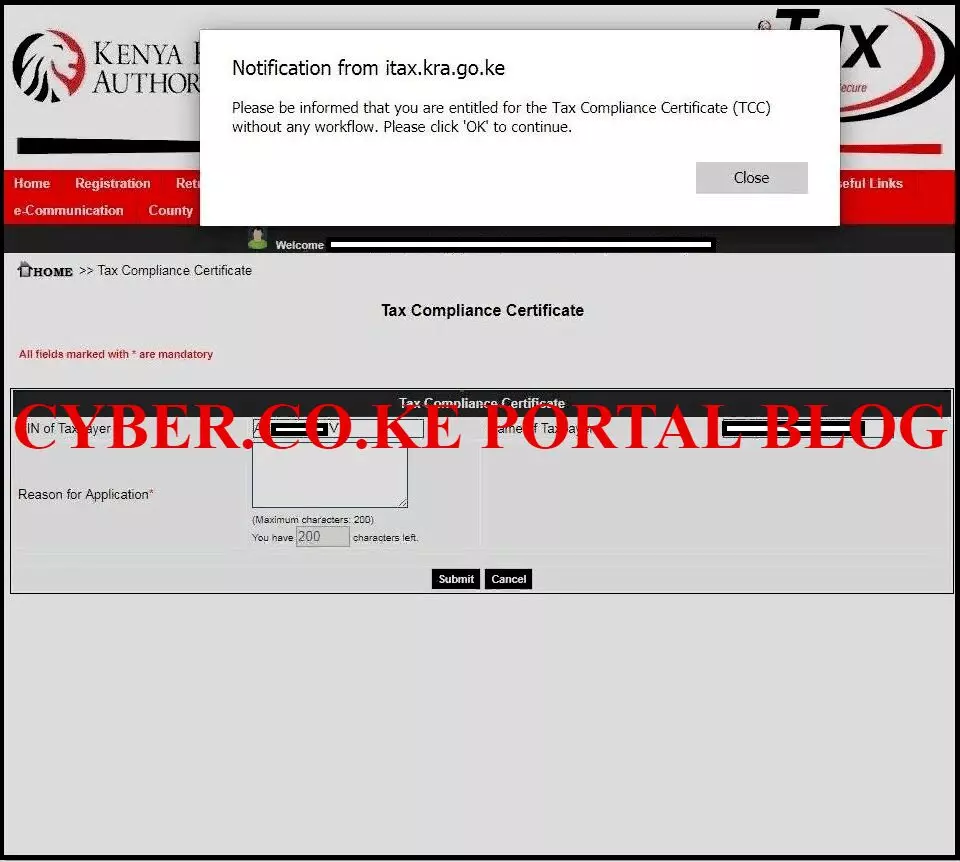

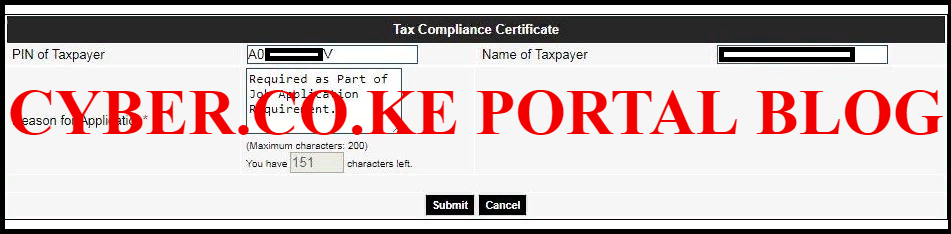

Step 6: Fill In The Tax Compliance Certificate Form

In this step, you will have to fill in the reason for your application for Tax Compliance Certificate by Kenya Revenue Authority (KRA). This can either be Job Application requirement or even Tender Application Requirement amongst other myriad or reasons on why you want to get the Tax Compliance Certificate from KRA. The reason you give here here depend on what you need the KRA Tax Compliance Certificate for.

In this you need to take note that if you have filed all your KRA Tax Returns on iTax and have no pending liabilities a pop up notifications from itax.kra.go.ke that you will get when applying for the Tax Compliance Certificate from KRA. You will take note that with this new enhancement, a popup window will be display as shown in the image above saying: “Please be informed that you are entitled for the Tax Compliance Certificate (TCC) without any workflow. Please click OK to continue.”

What the above message simply means is that when you choose to apply for the Tax Compliance Certificate on iTax, it will be issued to you immediately upon application i.e you will get the Tax Compliance Certificate immediately. You can go ahead and fill the KRA Tax Compliance Certificate form as illustrated below.

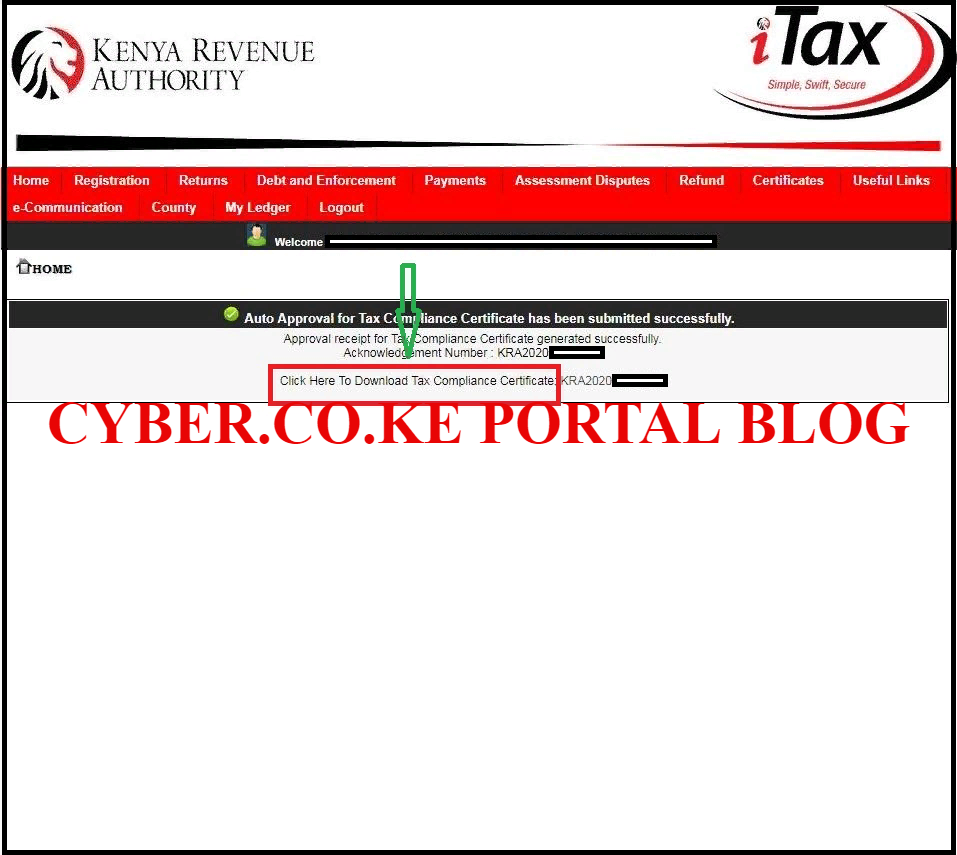

Step 7: Download Tax Compliance Certificate From KRA

This is the last step whereby you will need to download the Approved Tax Compliance Certificate from Kenya Revenue Authority (KRA). You will also need to take note of the approval receipt for the Tax Compliance Certificate that also has an acknowledgement number associated with it. To download and get the Tax Compliance Certificate from KRA, just click on the link starting with KRA20*******. This is as shown below:

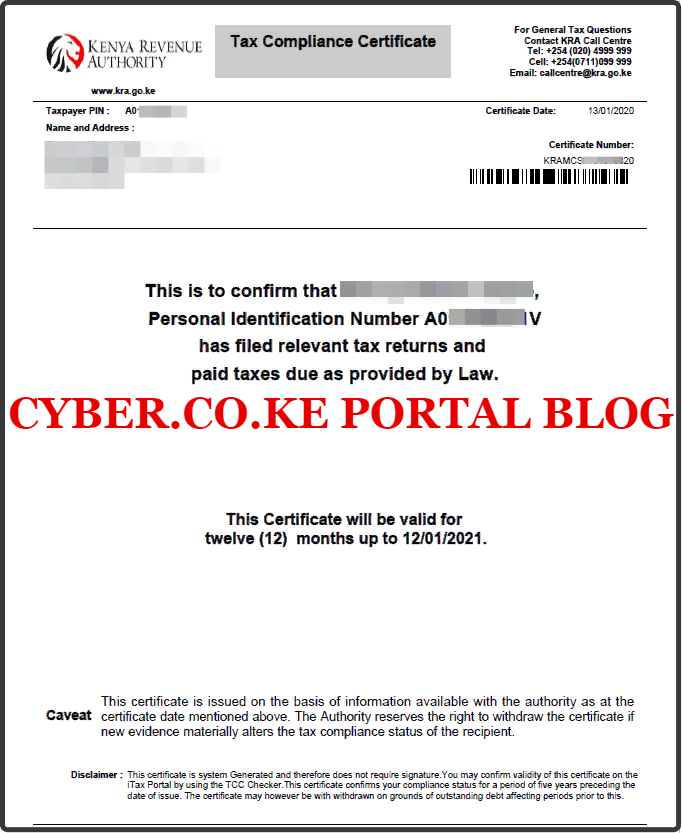

After downloading the KRA Tax Compliance Certificate on KRA Portal, you will be able to make copies for future uses when it will be needed. Also you need to take note that the Tax Compliance Certificate is only valid for a period of twelve (12) months from that date it was issued e.g. if you applied and were issued with the Tax Compliance Certificate on 27/05/2021, it will expire on 26/05/2022.

At that point, you need to apply and get another Tax Compliance Certificate from Kenya Revenue Authority. The only thing you need to keep in mind is that the KRA Tax Compliance Certificate is only issued to taxpayers who are compliant with that Tax Laws in Kenya. Below is a screenshot of the Tax Compliance Certificate (TCC) that you can get from KRA Portal.

The above steps sums up the whole process in which a taxpayer needs to follow in order to get his or her Tax Compliance Certificate from KRA. The most important thing to remember is that Kenya Revenue Authority (KRA) only issued Tax Compliant Certificates to compliant taxpayers in Kenya i.e those who file KRA Returns and pay any taxes due before the set KRA Returns Deadlines in Kenya.

READ ALSO: How To Get KRA Clearance Certificate Using KRA Portal

This simply means that your KRA Returns records needs to be upto date and at the same time you should not have any tax liabilities and penalties. Once you have ensured that you meet these two important conditions, then you can login to iTax using both the KRA PIN Number and KRA Password, and follow the step by step guide highlighted above on How To Get Tax Compliance Certificate From KRA Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.