Are you a New Taxpayer with a KRA PIN and need to login to iTax Portal for the first time? Learn How To Login For The First Time To KRA Web Portal.

When you apply for a new KRA PIN for the first time in Kenya using Cyber.co.ke Portal‘s KRA PIN Registration services, normally you will receive your KRA PIN Certificate together with the Login ID and Password that a new taxpayer needs to login to KRA Portal for the first time.

Learning How To Login For The First Time To KRA Web Portal is a must for every new taxpayer in Kenya today. In this article, I am going to share with you the step by step guide on How To Login For The First Time To KRA Web Portal. The steps outlined in this article are important in helping taxpayers in Kenya.

READ ALSO: KRA PIN Recovery Process And Steps Using KRA iTax Portal

By the end of this article, as a new taxpayer with a new KRA PIN Number you will have learnt the steps that you need to follow during iTax First Time Login. You will also know how to change the default iTax Password that was sent together with your KRA PIN Certificate from Kenya Revenue Authority (KRA).

Getting to know how to login to your new iTax Account for the first time is very important for any new taxpayer who applied and got their KRA PIN Number together with their KRA PIN Certificate using Cyber.co.ke Portal‘s KRA PIN Registration services.

This article will cover important aspects such as: What Is KRA Web Portal, What Is iTax First Time Login, Importance Of iTax First Time Login On KRA Web Portal, Requirements Needed For iTax First Time Login On KRA Web Portal and How To Login For The First Time To KRA Web Portal. By the end of the article you will have learnt all the necessary steps that are involved.

By the end of the article, you will have learnt and known the steps and process that you need to follow during iTax First Time Login. Once your KRA PIN Registration order is done, we send you the KRA PIN Number, KRA PIN Certificate and iTax Password that you will need in order to access and login to iTax Portal.

What Is KRA Web Portal?

KRA Web Portal is an online tax portal by the Kenya Revenue Authority (KRA) that allows taxpayers to perform a variety of tax related applications, processes and payments online in Kenya. The KRA Web Portal is also simply referred to as the iTax Portal, that can be accessed by taxpayers by use of their KRA PIN Number and KRA iTax Password.

As a new taxpayer in Kenya, when you apply for your first KRA PIN using Cyber.co.ke Portal, once your KRA PIN Registration order has been done and processed, your KRA Web Portal account will be created together with your KRA PIN Number (Personal Identification Number) and the same will be sent to the email address that you provided during the KRA PIN Registration process at Cyber.co.ke Portal.

The email that will be sent to you from Kenya Revenue Authority (KRA) will normally contain your iTax Login Credentials i.e. KRA PIN Number as the Login Id and the KRA iTax Password. It is a major reuqirement that each new taxpayer in Kenya login to their KRA Web Portal Accounts so as to set up their new KRA Password that they will be using from now henceforth until the day they choose to change the KRA iTax Password.

Now that we have looked at what we mean by KRA Web Portal, we need to look at the other important term that this article will also be addressing and that is iTax First Time Login. We need to understand what this means in relation to both the new taxpayer in Kenya and the KRA Web Portal.

What Is iTax First Time Login?

iTax First Time Login simply refers to the process of accessing the KRA Web Portal for the first time by logging in using the Login ID (KRA PIN Number) and the KRA iTax Password. These are sometimes referred to as the iTax Login Credentials because they are the security measures of protecting a taxpayer’s KRA Web Portal Account online. Every online account requires that the user provides the login credentials so as to be able to access it. The same also applies for KRA Web Portal accounts.

Normally, when a new taxpayer applies and registers for a new KRA PIN Number using Cyber.co.ke Portal, once the KRA PIN has been created the taxpayer will receive his or her iTax Login Credentials from Kenya Revenue Authority (KRA). It is now the duty of the new taxpayer to access his or her email address to get the iTax First Time Login details and use them to access his iTax Web Portal Account for the first time and set up a new KRA Web Portal Password.

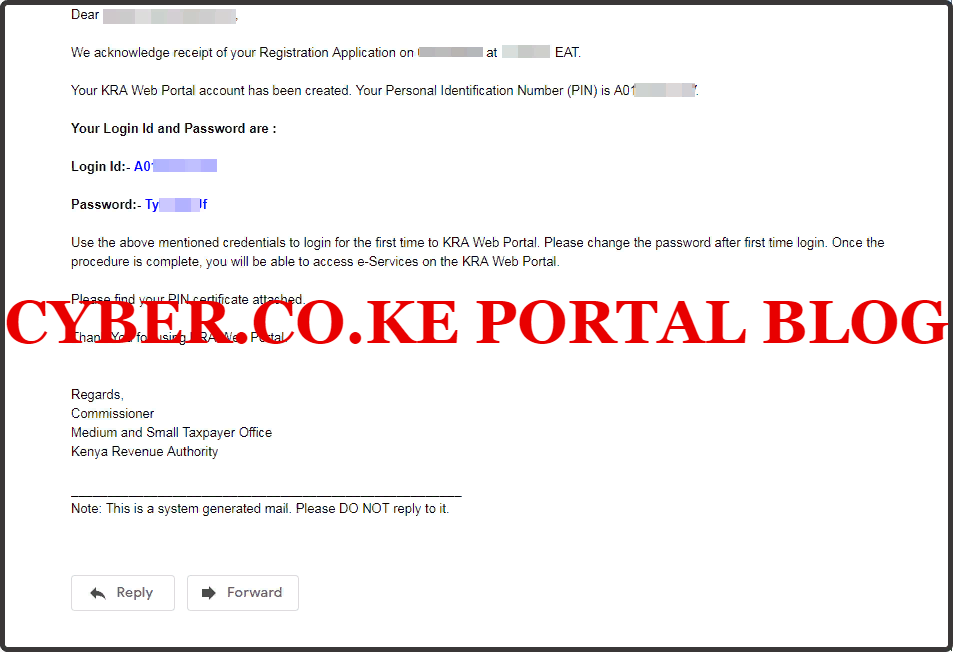

Below is the sample email from KRA titled, “Approval of PIN registration for TAXPAYERS NAMES” that serves as a final confirmation that your KRA PIN Registration order at Cyber.co.ke Portal has been completed and KRA PIN has been generated and your KRA Web Portal account has been created together with your iTax Login Credentials.

The above is what we normally refer to as the iTax First Time Login email because it is the first email that all new taxpayers receive from Kenya Revenue Authority (KRA) that contains their KRA Web Portal Account login details to gether with their KRA PIN Certificate that the taxpayer applied using Cyber.co.ke Portal‘s KRA PIN Registrations services online in Kenya.

I wont dwell much on the iTax First Time Login above, and now we need to change gears and move further to the Importance Of iTax First Time Login On KRA Web Portal. Why is this iTax First Time Login so important to new taxpayers in Kenya? The answer to this follows below.

Importance Of iTax First Time Login On KRA Web Portal

KRA iTax First Time Login on KRA Web Portal is very important for all new taxpayers who have applied and received their new KRA PIN Numbers and KRA PIN Certificates using Cyber.co.ke Portal. iTax First Time Login on KRA Web Portal is very important because of two main reasons i.e. Change Of Default Password and Access To KRA Web Portal Services.

-

Change Of Default Password

Just as I had mentioned at the beginning of this article, iTax First Time Login is important to all new taxpayers because it is a requirement that the first thing that new taxpayers must do is to change the default KRA Password that was sent by Kenya Revenue Authority (KRA) to a new password that they can easily remember so as to allow easy access through login to their KRA Web Portal Accounts. Please change the password after first time login.

-

Access To KRA Web Portal Services

Once the procedure of changing the default KRA Password is complete, you will be able to access e-Services on the KRA Web Portal. After changing the default KRA iTax Password the new taxpayers will be able to access the wide range of KRA iTax services on the KRA Web Portal much quicker and easier. With the new password that the taxpayer set during the iTax First Time Login, one can easily access the KRA iTax Portal Account.

Having looked at the importance of iTax First Time Login above, we now need to start heading for the homestretch by looking at the Requirements Needed For iTax First Time Login On KRA Web Portal. Basically these includes the KRA PIN Number and KRA iTax Password (the one sent to your email for the first time by KRA) as discussed below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that you have with you the key requirements that are needed during iTax First Time Login on the KRA Web Portal, we can now look at the step by step guide that all new taxpayers in Kenya need to follow on How To Login For The First Time To KRA Web Portal.

New Taxpayers: How To Login For The First Time To KRA Web Portal

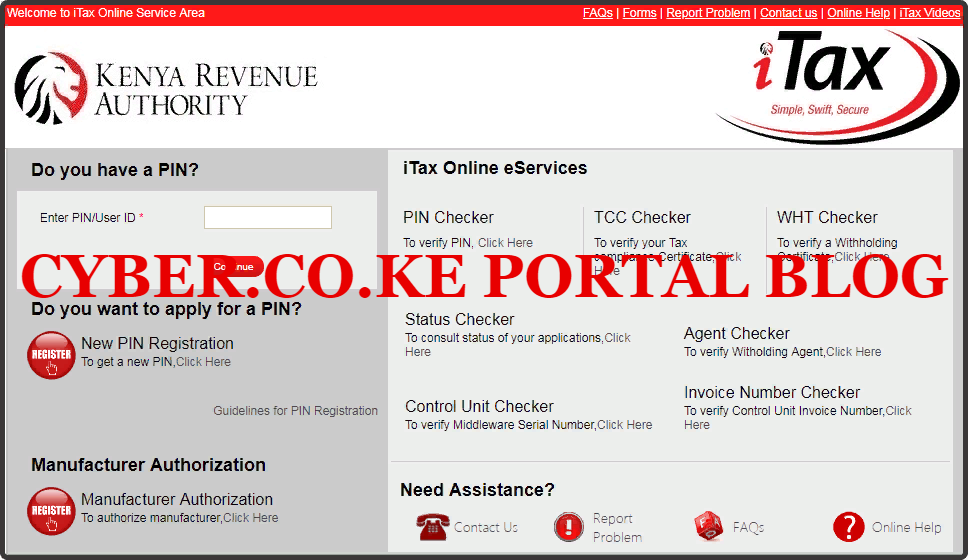

Step 1: Visit KRA Portal

The first step that you need to take on How To Login For The First Time To KRA Web Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA Web Portal i.e. link will open in a new tab.

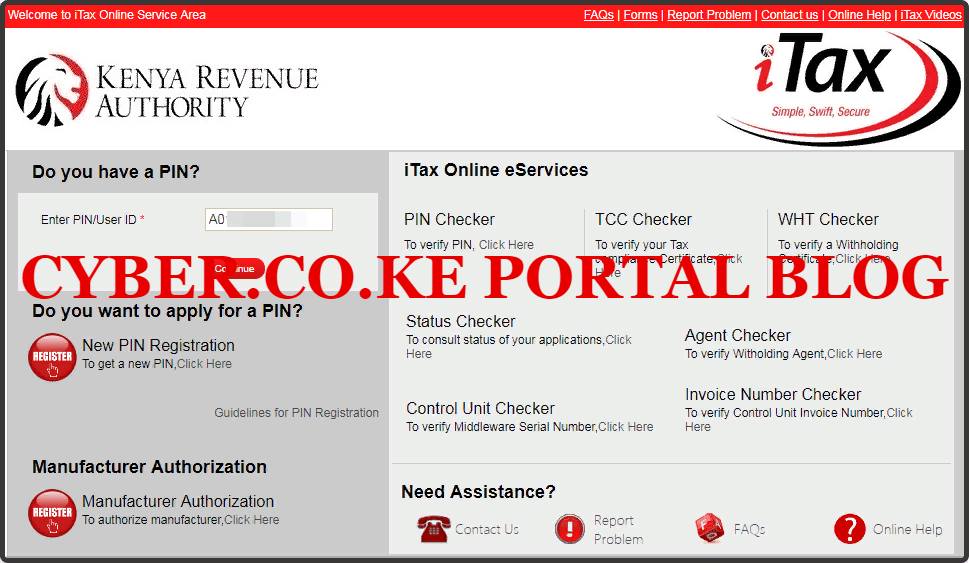

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” button to proceed to the next step.

Step 3: Enter The Default KRA Password Sent To Your Email (iTax First Time Login Email) and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your default KRA Password that was sent to your Email Address by Kenya Revenue Authority (KRA) and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

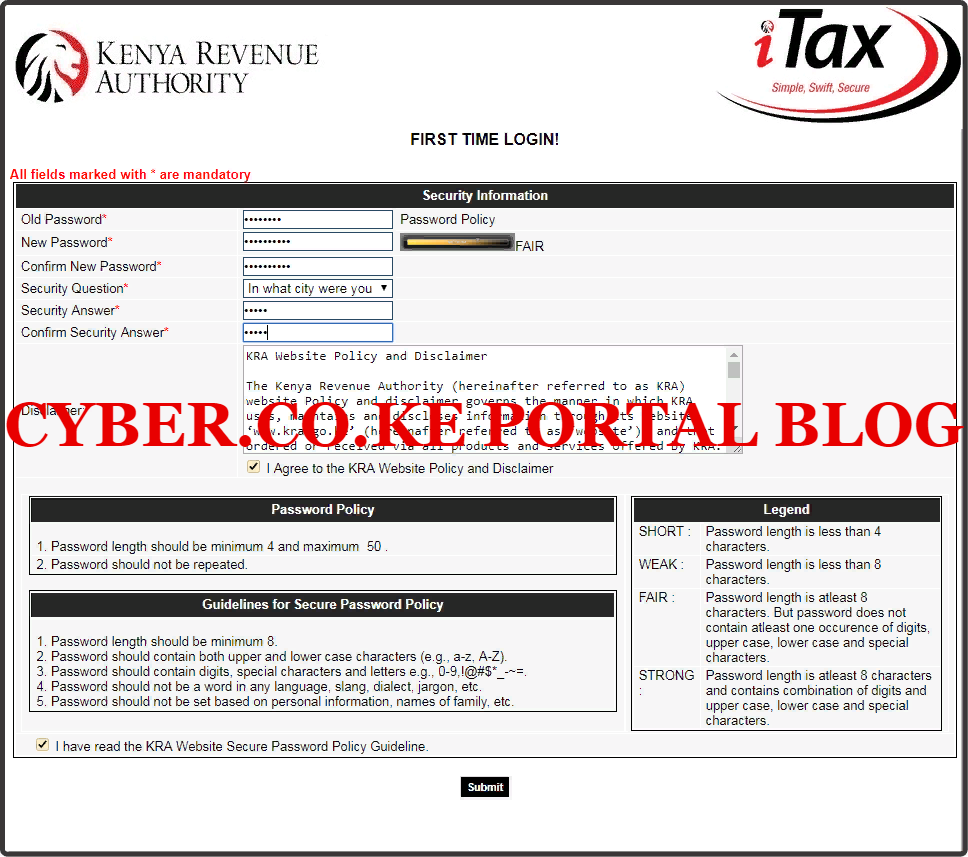

Step 4: Create A New KRA Password For Your KRA Web Portal Account

In this step, you will need to set up your new KRA Password for your KRA Web Portal account. But before you do that, you will need to enter the default KRA Password that serves as your old KRA Password. Once you have done that, then type in your new KRA Password and confirm the same. Also you need to remember to tick on the “I Agree to the KRA Website Policy and Disclaimer” and the “I have Read the KRA Secure Password Policy Guideline.” Once you have ticked the two checkboxes, click on the “Submit” button. This is as illustrated below.

Step 5: KRA Web Portal Dashboard For New Taxpayers In Kenya

Once you have setup your new KRA Web Portal Password during the iTax First Time Login, you will be successfully logged into your KRA Web Portal dashboard. ere upon successful login process, you are able to view a wide range of iTax Portal functionalities such as: File KRA Returns (both KRA Nil Returns and KRA Employment Returns), Reprint and Download KRA PIN Certificate, Apply for KRA Tax Compliance Certificate and Generate KRA Payment Slips among many other iTax Portal functionalities that have become available at your disposal. This is as illustrated in the screenshot below.

The above serves as the last step in the process of first time login to KRA Web Portal account by new taxpayers in Kenya. You need to take note that you wont be able to access the KRA Web Portal account if you don’t change and setup a new KRA iTax Password during the iTax First Time Login process on iTax Portal.

READ ALSO: How To Reset Forgotten KRA Password Online Using iTax Portal

You need to ensure that you have with you the Login ID (KRA PIN Number) and iTax Password so as to set up a new one. So next time you apply and get your KRA PIN at Cyber.co.ke Portal, just follow the above steps on How To Login For The First Time To KRA Web Portal and you will be able to start using your new KRA Web Portal account.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator on the YouTube Channel Cyber Services Kenya, specializing in crafting insightful and informative Blog Posts and Video Tutorials that empower Kenyans with practical skills and knowledge. Holding a Bachelor’s Degree in Business Information Technology (BBIT) from JKUAT, he blends technical expertise with a passion for clear and impactful communication. Do you need his help? Email Address: [email protected]

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Change of Email Address services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.