Are you looking to pay for your KRA Penalties on iTax Portal using KRA Paybill Number? Learn How To Pay KRA Penalties Using KRA Paybill Number 572572.

It quite obvious that when you fail to file your KRA Returns for a particular year or period, then KRA automatically imposes a Late Filing Penalty on the taxpayer. Knowing How To Pay KRA Penalties is very important especially for taxpayers who have pending Returns which inturn translates to KRA Penalties when they file all their pending KRA Returns on iTax Portal.

In this article, I am going to share with you the step by step guide on How To Pay KRA Penalties on iTax Portal. By the end of this article, you will have learnt the steps that you need to take inorder to pay for your KRA Penalties using the KRA Paybill Number. Basically you will know all the steps that are involved in paying that KRA Penalty or Penalties using the KRA Paybill Number quickly and easily.

READ ALSO: How To Check KRA Penalties Using KRA iTax Portal

To understand How To Pay KRA Penalties, a taxpayer needs to first understand some key concepts and terms in relation to the KRA Penalties. So in this article, I am going to cover the key concepts related to KRA Penalty on iTax Portal.

The key terms and concepts that we shall cover includes: What Is KRA Penalties, Reasons For KRA Penalties, Waiver Of KRA Penalties, Payment Of KRA Penalties, Modes Of Payment For KRA Penalties (KRA Penalties Payment Methods), What Is KRA Paybill Number, Requirements Needed To Pay KRA Penalties and How To Pay KRA Penalties Using KRA Paybill Number.

If by any chance a taxpayer fails to file his or her KRA Returns either KRA Nil Returns or KRA Employment Returns, then a KRA Penalty will be imposed on the taxpayer immediately after 30th June. So if the taxpayer files his or KRA Returns on 1st July or any other date and month past 30th June, the there will be a KRA Penalty of KRA Penalties depending on the number of years not filed.

What Is KRA Penalties?

I had already covered in broad explanation on What Is KRA Penalties on the previous article about How To Check KRA Penalties Using KRA iTax Portal. But just to recap the definition of KRA Penalties; refers to a penalty that is imposed on a taxpayer for failing to file his or her KRA Returns for a specified period or year. When a taxpayer fails to file his or her KRA Returns either KRA Nil Returns or KRA Employment Returns, then a penalty will be imposed on the taxpayer for what we call late filing of KRA Returns on iTax Portal.

So, from the definition above KRA Penalties are automatically imposed on taxpayers who fail to file their KRA Returns before the elapsing of the 30th June Deadline that the Kenya Revenue Authority (KRA) has set in place. To put this into an example, this year 2020 we are filing the KRA Returns for the previous year 2019. The KRA Returns period begun on 1st January and runs till 30th June.

Let me put this into a contextual illustration of How the KRA Penalties work. Assuming that we have two taxpayers by the names Mkenya Halisi and Mkenya Daima. Let’s start off with Mkenya Halisi who got his KRA PIN back in 2013 and updated the KRA PIN Number through KRA PIN Update Services at Cyber.co.ke Portal today. Mkenya Halisi needs to file his or her KRA Returns inorder to apply for a KRA Tax Compliance Certificate that is needed for a Job Application.

Since the KRA PIN for Mkenya Halisi has been updated in 2020 yet he got the KRA PIN in 2013, that means when filing the KRA Returns, he or she will have to start filing all pending KRA Returns from 2015, 2016, 2017 and 2018. When all these pending KRA Returns are filed on iTax Portal, then the system will generate Defaulter Notices that will be sent to the taxpayer iTax Registered email address.

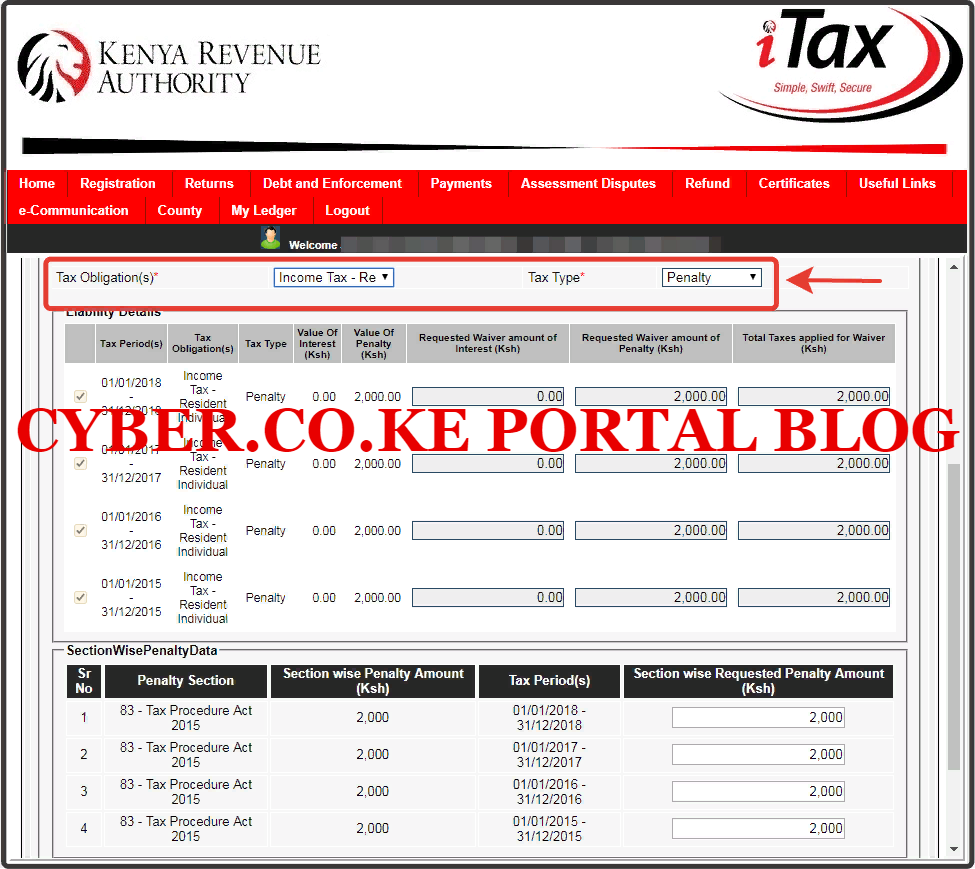

For Mkenya Halisi there will be 4 KRA Penalties from 2015 to 2018, reason being Late Filing of KRA Returns. Below is an illustration of the KRA Penalties for the said taxpayer above.

Now from the above illustration, you can see that Mkenya Halisi a total KRA Penalties of Kshs. 8,000.00 which is a huge sum of money considering that the taxpayer does not has any source of of income i.e unemployed. The taxpayer got the KRA PIN back in the days, and completely forgot to File KRA Returns.

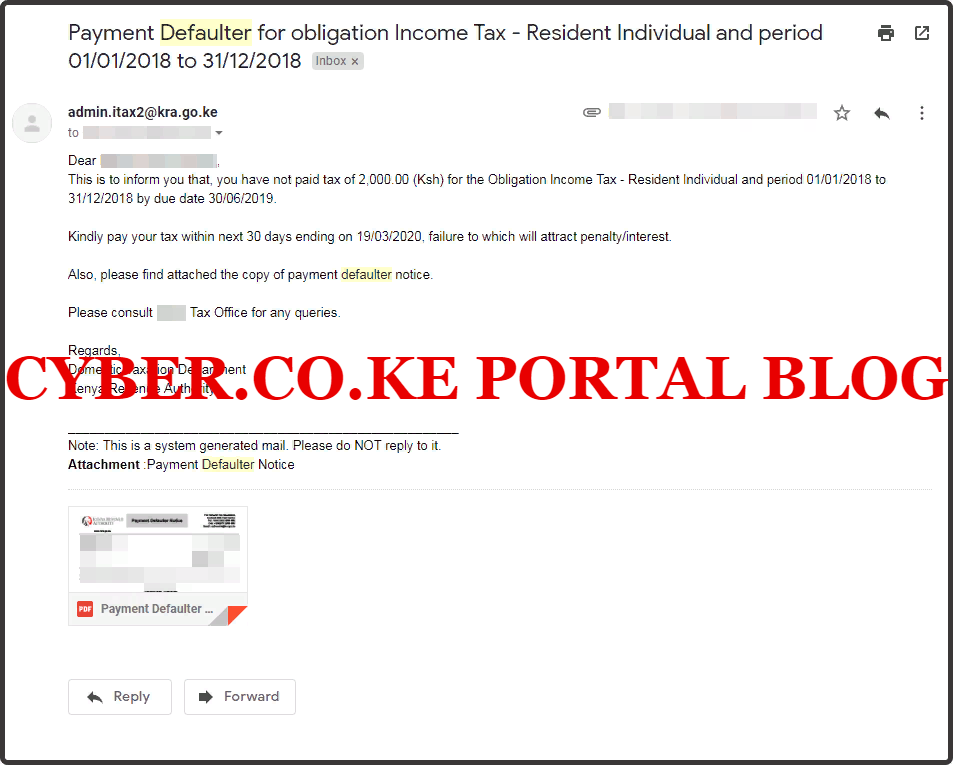

Now let’s look at a scenario of Mkenya Daima. The taxpayer got his or her KRA PIN using KRA PIN Registration Services back in 2018. In 2019 he forgot to file the KRA Returns and when he or she tried to File KRA Returns for 2019 in 2020, the iTax System prompted Mkenya Daima that he or she has a pending Return for the year 2018. This forces the taxpayer to file the pending KRA Return for 2018 before proceeding to file the current KRA Return for 2019. A Payment Defaulter notice will be generated and and email will also be sent about the same.

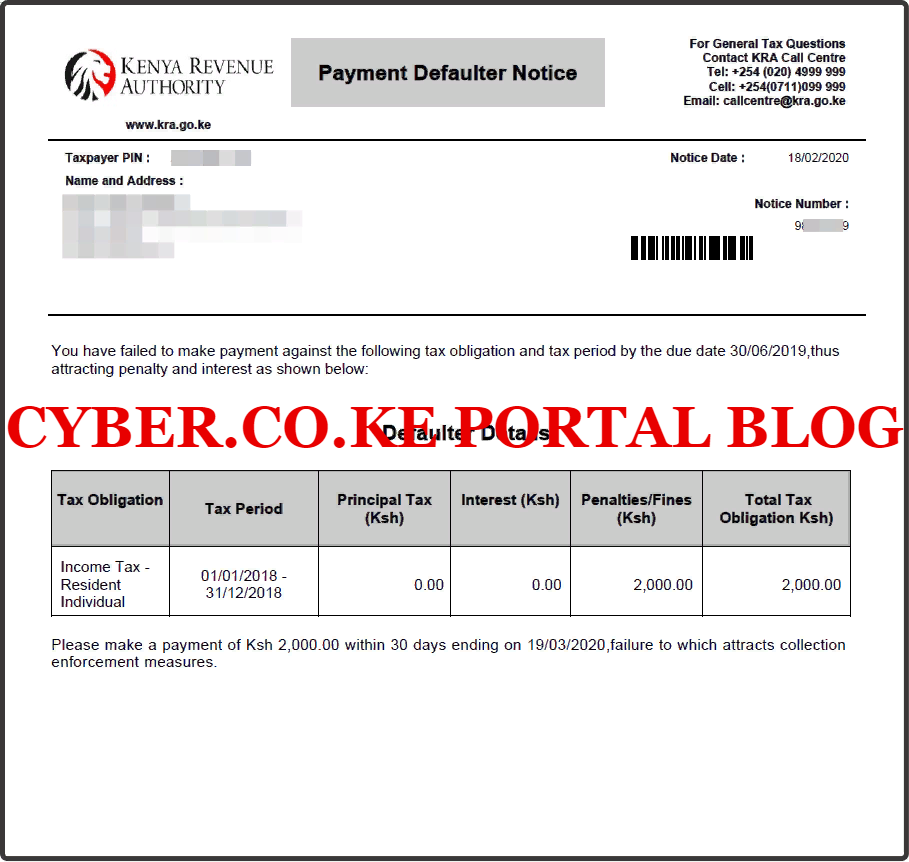

That Return for 2018 will attract a KRA Penalty of Kshs. 2,000 because of Late Filing of the KRA Returns. Now this taxpayer has to decide to Pay the KRA Penalties or to Apply for KRA Waiver. But since this article seeks to show How To Pay KRA Penalties, then we shall be focusing on the step by step guide that Mkenya Daima needs to take to Pay the KRA Penalties or Kshs. 2,000 for the year 2018 that the taxpayer failed to file KRA Returns. Below is the payment defaulter notice for failing to file KRA Returns in 2018.

As for Mkenya Halisi, the process chosen was that of applying for KRA Waiver since Kshs. 8,000 is not a small amount.You can read the articles on How To Write KRA Waiver Letter and then How To Apply For KRA Waiver Using KRA iTax Portal if you are in the same situation or a near similar one. Now that we laid down the foundation to How To Pay KRA Penalties from the concepts above, now we need to look the Reasons For KRA Penalties.

Reasons For KRA Penalties

There are not that many reasons for KRA Penalties on iTax Portal. But there exist one sole reason i.e. Late Filing Of KRA Returns. Tis is the main and definitely the only reason for those KRA Penalties that taxpayer are imposed with by the Kenya Revenue Authority (KRA).

-

Late Filing Of KRA Returns

Late Filing Of KRA Returns simply refers to a situation whereby a taxpayer fails to file his or her KRA Returns during the KRA Returns window period that runs from 1st January to 30th June of each year. To put this into an example; currently we taxpayers in Kenya are in the process of filing their KRA Returns for the year 2019. If by any chance you fail to file the KRA Returns before the 30th June deadline, then a KRA Penalty will be imposed immediately the deadline elapses.

This is now what we refer to as Late Filing of KRA Returns which inturns leads to automatically defaulter notices and where there is smoke know that there is a fire i.e. KRA Penalties on the taxpayer. So, if you did not file your KRA Returns for example for 2018, then just know immediately you file that KRA Returns a KRA Penalty will follow suit.

Having looked at the main reason for KRA Penalties above, let’s now look briefly at Waiver Of KRA Penalties. This is as discussed below.

Waiver Of KRA Penalties

You can think of KRA Waiver Application as the remedy to KRA Penalties on iTax but not the cure. Why? This is because when you apply for KRA Waiver for the KRA Penalties on iTax, the Waiver Application “will” only be approved by Kenya Revenue Authority (KRA) provided that there is sufficient and substantial grounds of evidence submitted during the Waiver Application to support your KRA Waiver Application on KRA iTax Portal for any of the KRA Penalties.

Many taxpayers just think or are of the notion that Waiver Application is the cure to KRA Penalties, but the answer to this is “No”. Especially in situation whereby a taxpayer does not provide sufficient evidence to KRA to warrant for the Approval of his or her KRA Penalties Waiver on iTax. Some of the reasons taxpayers give in the waiver application are disheartening are the main reason for the bulk Rejection of most Waiver Applications by taxpayers in Kenya. For example, most taxpayers give the reason; I did not know that I was supposed to file KRA Returns or I don’t have a job so I did not have any Returns to File. These are just but a few of the reasons for KRA Waiver Application that KRA gets daily.

Having looked at the Waiver of KRA Penalties as the remedy, we now need to start looking at the cure to KRA Penalties. This is through Payment For KRA Penalties. This is as discussed below.

Payment For KRA Penalties

When your KRA Waiver Application for the KRA Penalties gets Rejected by KRA, as a taxpayer you are left with only 1 thing to do and that is pay the KRA Penalties. Payment of KRA Penalties is the only cure to the KRA Penalties that a taxpayer might have. So, payment of the KRA Penalties serves as the last option that a taxpayer should take. There is no other option apart from deciding to just pay any pending KRA Penalties that KRA might have imposed on you as a reuslt of Late Filing of KRA Returns.

Just as I had highlighted above, applying for a KRA Waiver on iTax Portal is not a guarantee that it will be approved and all the KRA Penalties will be removed. Nope, that’s not the case. There is no need to re-apply for KRA Waiver when the first application gets rejected. The noble thing to do is just pay the KRA Penalties using the different modes of payments that are available in Kenya today. I am going to discuss the modes of payment of KRA Penalties that a taxpayer can use below.

Modes Of Payment For KRA Penalties (KRA Penalties Payment Methods)

KRA Penalties can be paid easily using the two payment methods that are available. There exists two modes of payments that a taxpayer can use to pay KRA Penalties with. This includes: Mobile Money Payment and Bank Payment.

-

Mobile Money Payment

A taxpayer can decide to use the Mobile Money Payment option inorder to pay for KRA Penalties. Mobile Money Payment simply refers to M-Pesa Payment through the KRA Paybill Number 572572. Once a taxpayer has generated a KRA Payment Slip on iTax Portal, then he or she can use the Mobile Money Payment option to pay for the KRA Penalties.

-

Bank Payment

The other option that a taxpayer can use to pay KRA Penalties is the Bank Payment option. Once a taxpayer generates the KRA Payment Slip on iTax Portal, he or she can choose to pay the KRA Penalties at any of the KRA Partner banks that are available in Kenya.

I do recommend the Mobile Money Payment option due to the flexibility and can be done on your phone quickly and easily. But if you are fond of and used to queuing, then paying the KRA Penalties at the Banks will be suitable for you.

In this article, the main focus is on How To Pay KRA Penalties Using KRA Paybill Number. To be able to pay the KRA Penalties using the Mobile Money Option i.e. M-Pesa, we first need to understand and know What Is KRA Paybill Number.

What Is KRA Paybill Number?

The KRA Paybill Number is a Mobile Money Payment options that taxpayers in Kenya can use to pay their KRA Taxes and even KRA Payments together with all other payments after generating the KRA Payment Slip on iTax Portal. The KRA Paybill Number is normally 572572, and taxpayers can use this KRA Paybill Number to make payments to the Kenya Revenue Authority (KRA).

Kenya Revenue Authority (KRA) choose to have a Paybill Number so as to make the process of paying for Taxes and other KRA Payments by taxpayers in Kenya easy and flexible at the palm of the taxpayers hands. Now that’s a plus for the KRA Paybill Number which makes paying of taxes efficient and seamless thanks to M-Pesa.

Having addressed all that pertains to KRA Penalties above, we now need to start heading to the homestretch of this article and look at the Requirements Needed To Pay KRA Penalties. To be able to pay KRA Penalties using the KRA Paybill Number above, a taxpayer will need to have KRA PIN Number, iTax Password and Safaricom M-Pesa Number.

Requirements Needed To Pay KRA Penalties

Just as I have mentioned above, to be able to pay KRA Penalties, a taxpayer will need to have the following with them: KRA PIN Number, KRA iTax Password and Safaricom M-Pesa Number. Now let’s look at each one of these KRA Penalties payment requirements below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

-

Safaricom M-Pesa Number

At the moment, you can only pay for the KRA Penalties on iTax using the KRA Paybill Number 572572. This requires that the taxpayer have a Safaricom M-Pesa Number so as to enable them use the KRA Paybill Number to make payments of their KRA Penalties quickly and easily to Kenya Revenue Authority (KRA).

Shifting gears now by having addressed the requirements that are needed to pay KRA Penalties on KRA iTax Portal using the KRA Paybill Number, we can now look at the step by step guide on the process of How To Pay KRA Penalties Using KRA Paybill Number. One thing to note that in this article we are going to pay KRA Penalties using KRA Paybill Number, and you can choose to use the other payment option i.e. Bank after you have generated the KRA Penalties Payment Slip on iTax Portal.

How To Pay KRA Penalties Using KRA Paybill Number

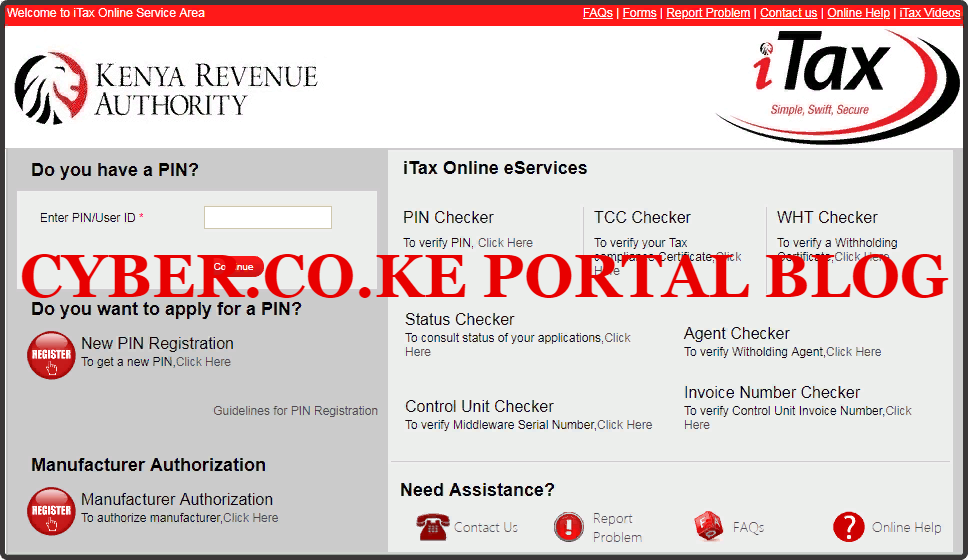

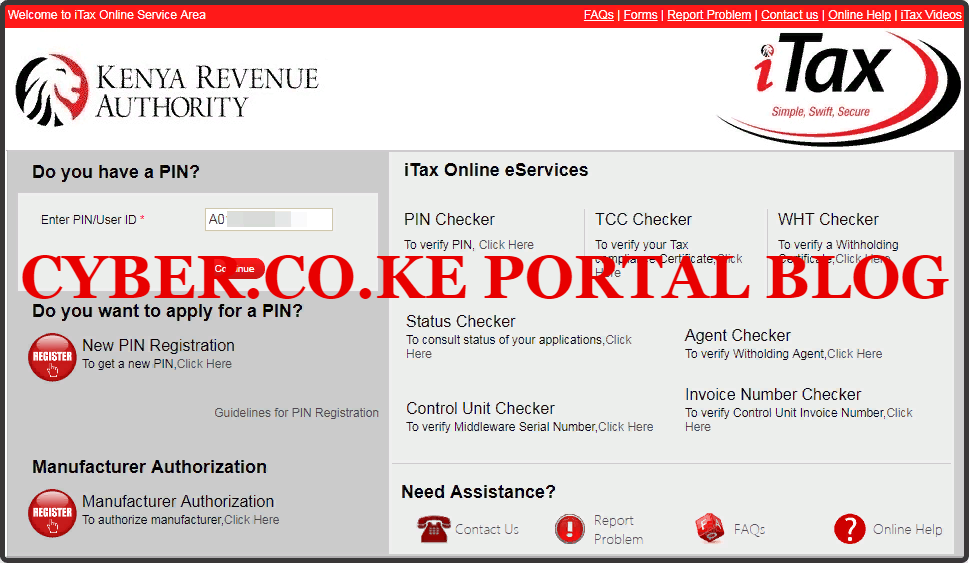

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Pay KRA Penalties is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

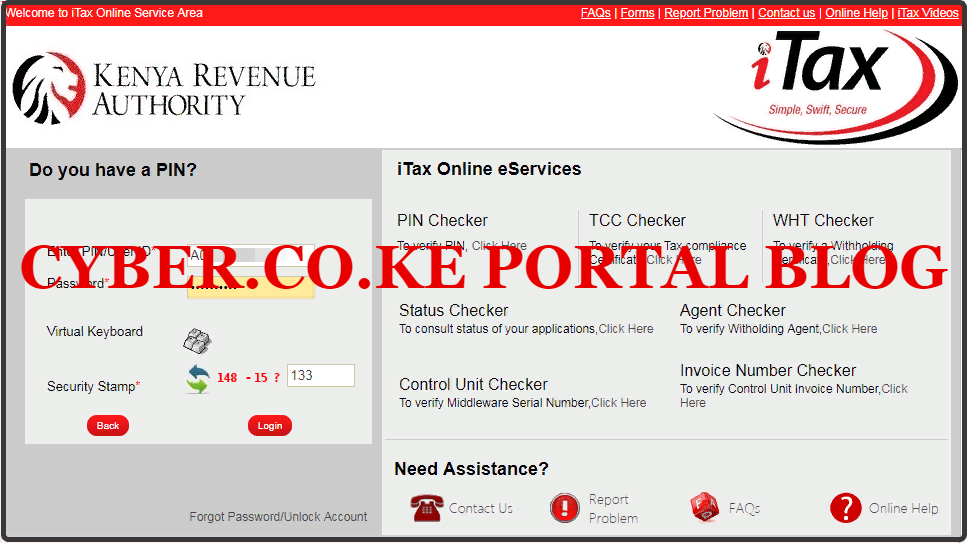

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to know How To Pay KRA Penalties on iTax Portal using KRA Paybill Number, we proceed to Step 5 below.

Step 5: Click On Payments Menu Followed By Payment Registration

In this step, on the menu list items in the KRA Web Portal Account, click on Payments then Payment Registration. This is as illustrated in the screenshot below.

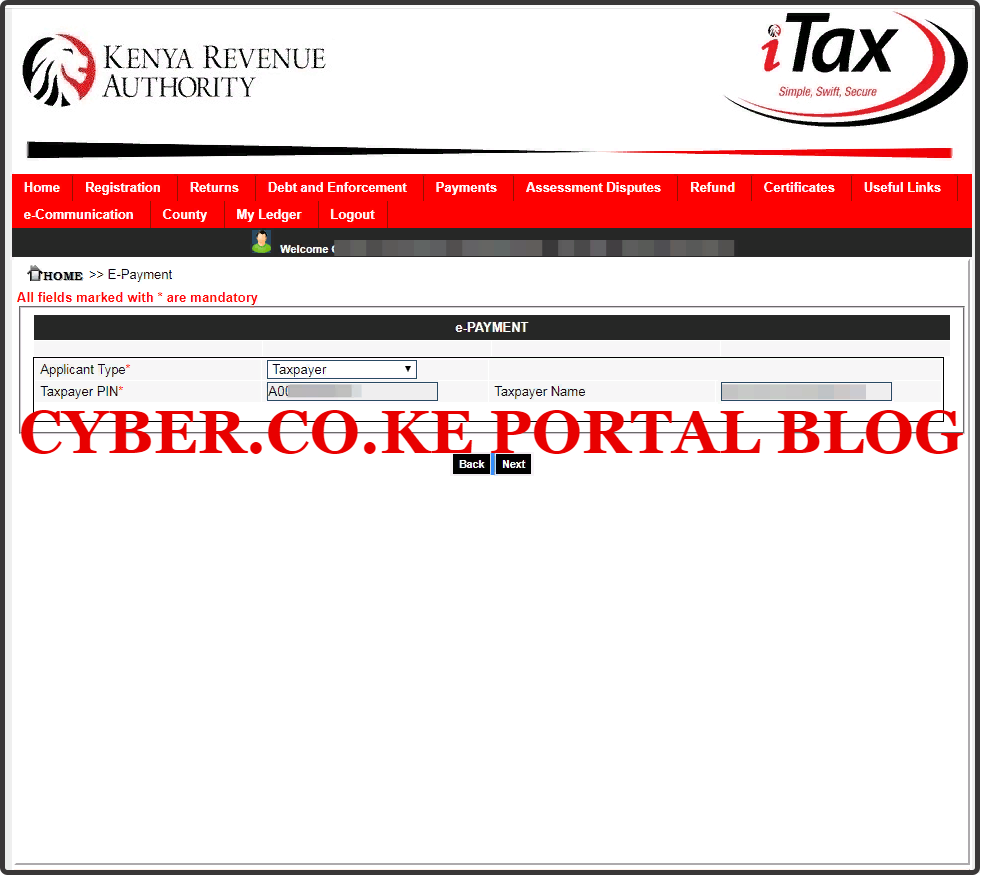

Step 6: KRA Penalties e-Payment Form

Once you have successfully clicked on Payment Registration in step 5 above, you will be taken to the KRA Penalties e-Payment form. Here you will see the Applicant Type, Taxpayer PIN and Taxpayer Name fields. All these sections are automatically pr-filled, so you proceed ahead by clicking on the “Next” button as illustrated below. Note: There will be a pop up from itax.kra.go.ke asking if you want to proceed, click on Yes.

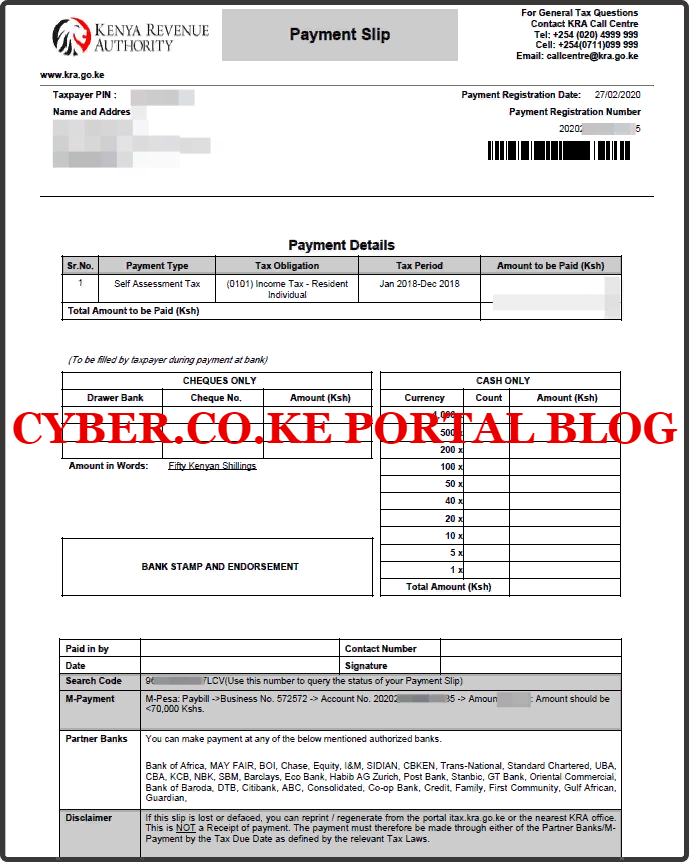

Step 7: KRA Penalties e-Registration Form

In this step, you will have to select and fill in the following fields: Tax Head (Income Tax), Tax Sub Head (0101 – Income Tax Resident Individual), Payment Type (Self Assessment Tax) and Tax Period (Jan 2018 – Dec 2018). We have selected the tax period for 2018 because the taxpayer failed to file the KRA Returns in 2018 and a KRA Penalty of Kshs. 2,000.00 was imposed on the taxpayer as a result of Late Filing of Returns. This is as illustrated below.

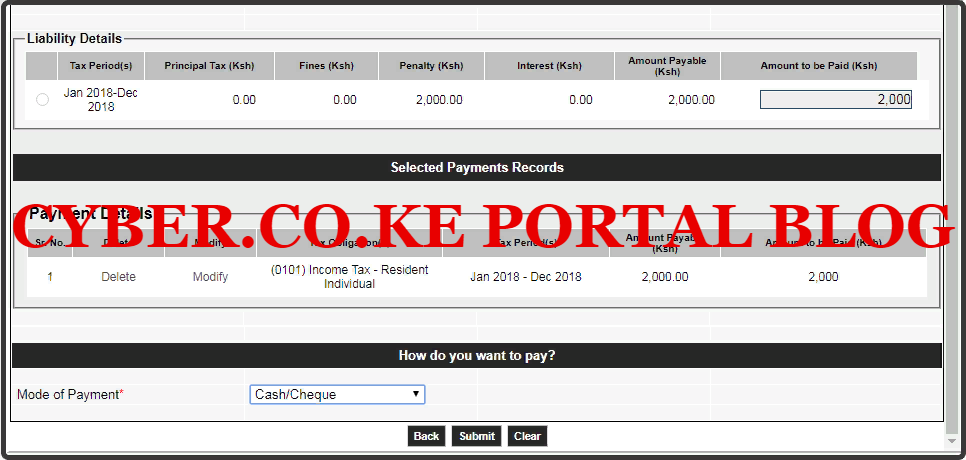

Step 8: Select The Mode Of Payment For The KRA Penalties

In this, you will need to first click on the “Add” button in the Liability Details sections. A pop up from itax.kra.go.ke will appear asking you to confirm action. Click on “Yes”. Since we are going to pay the KRA Penalty using KRA Paybill Number, the Mode of Payment we need to select will be “Cash/Cheque” Once you have done that, click on “Submit”button. This is as illustrated below.

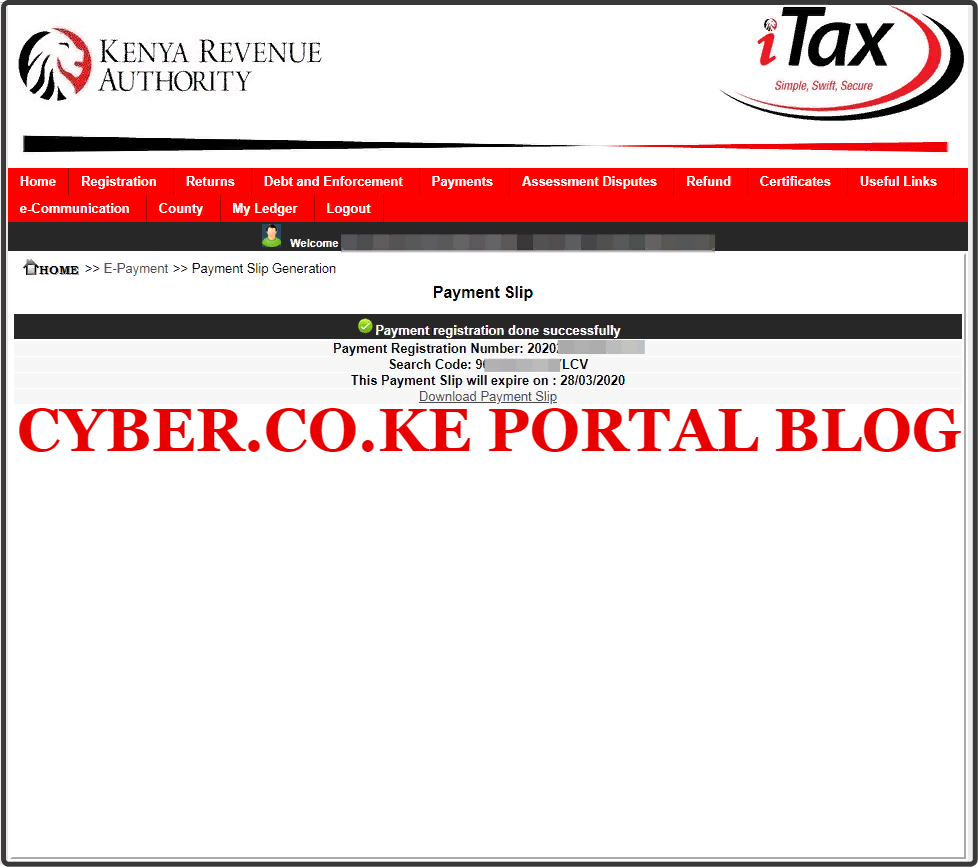

Step 9: Download KRA Penalties Payment Slip

In this step, you will need to download the KRA Penalties Payment Slip. You do this by clicking on the “Download Payment Slip” link. This is as shown below.

On the downloaded KRA Penalties Payment Slip, you need to take note of the Payment Registration Number that will as serve as the Account number since we are going to pay the KRA Penalty using KRA Paybill Number 572572.

Step 10: Pay KRA Penalties Using KRA Paybill Number

In this last step, you need to proceed and pay the KRA Penalty for that period. In our case, we are going to pay the penalty for the year 2018 which is Kshs. 2,000.00 using the KRA Paybill Number 572572.

a.: Go to Lipa na M-Pesa

b.: Select Paybill

c.: Enter Business Number: 572572

d.: Enter Account Number: 202020***********5 (Payment Registration Number is the Account Number)

e.: Enter the amount: Kshs. 2,000

f.: Enter your M-PESA PIN and confirm the details

Once you paid the Kshs. 2,000 penalty to KRA, you will get a notification from -M-PESA and KRA confirming payment for the same. That will serve as the final confirmation that you have paid the KRA Penalty using KRA Paybill Number. You should be able to receive two messages i.e. from M-Pesa and from KRA through ELMA.

- M-Pesa Message

OB******YZ Confirmed. Kshs. 2,000.00 sent to Kenya Revenue Authority for account 20202*********35 on 27/2/20 at 8:00 PM.

- KRA Message (ELMA)

Dear customer, we confirm your payment Ref OB******YZ for E-Slip No. 20202*********35 of KES 2,000.00 has been received on 27/02 20:00 by KRA.

READ ALSO: How To Verify KRA Withholding Certificate Using WHT Checker

The above two messages serve as a confirmation that your Payment for KRA Penalties has been successfully received by KRA. So, next next time you need to know How To Pay KRA Penalties using KRA Paybill Number, you can just follow our in depth step by step guide on How To Pay KRA Penalties using the KRA iTax Portal.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.