eTIMS, short for electronic Tax Invoice Management System, stands as a robust software solution by Kenya Revenue Authority (KRA) tailored to streamline invoicing processes for taxpayers in Kenya. Its core principles revolves around simplicity, convenience and flexibility, aiming to provide users with an intuitive platform for managing electronic invoices efficiently. By leveraging eTIMS, taxpayers gain access to a user-friendly interface across a spectrum of computing devices, from traditional desktop computers to modern smartphones and tablets, ensuring convenience and accessibility at every step of the invoicing process.

READ ALSO: How To Register for eTIMS using eCitizen (Non VAT Taxpayers)

Designed to accommodate the diverse landscape of businesses, eTIMS extends its usage beyond VAT registered taxpayers. It mandates all entities engaged in business activities to embrace electronic tax invoicing, irrespective of their VAT registration status. This inclusivity underscores the system’s commitment to regulatory compliance and accountability, ensuring that business expenses are properly documented and supported by electronic tax invoices as per legal requirements.

The adoption of eTIMS transcends mere compliance, offering tangible benefits to taxpayers across various fronts. One notable advantage is the alleviation of compliance costs, as eTIMS provides its solutions free of charge, easing financial burdens for businesses of all sizes. Moreover, the platform’s versatility shines through its diverse array of solutions, accommodating different business needs and preferences. From inventory management modules to simplified return filing mechanisms, eTIMS empowers taxpayers with tools to streamline their invoicing workflows and enhance operational efficiency.

At its core, eTIMS serves as more than just a tax invoicing platform; it embodies a paradigm shift towards digitization and automation in tax administration. By facilitating seamless invoicing processes and providing taxpayers with the necessary tools to maintain comprehensive records, eTIMS plays a pivotal role in modernizing tax compliance frameworks and fostering a more transparent and efficient business environment. In this blog post, I am going to share with you the main steps that you need to follow so as to successfully register for eTIMS using the eTIMS taxpayer portal.

How To Register for eTIMS

The following are the 12 main steps involved in the process of How To Register for eTIMS that you need to follow.

Step 1: Visit eTIMS Taxpayer Portal

The first and foremost step in the process of registering for eTIMS is to visit eTIMS Taxpayer Portal by using https://etims.kra.go.ke/basic/login/indexLogin

Step 2: Click on Sign Up Button

Once you are on eTIMS Taxpayer Portal, click on the Sign Up button, to begin the process of eTIMS registration using the eTIMS Taxpayer portal.

Step 3: Under Sign Up Type, click on the PIN button

In this step, under eTIMS sign up type, click on the “PIN” button to use your KRA PIN Number to sign up for eTIMS on the eTIMS Taxpayer portal.

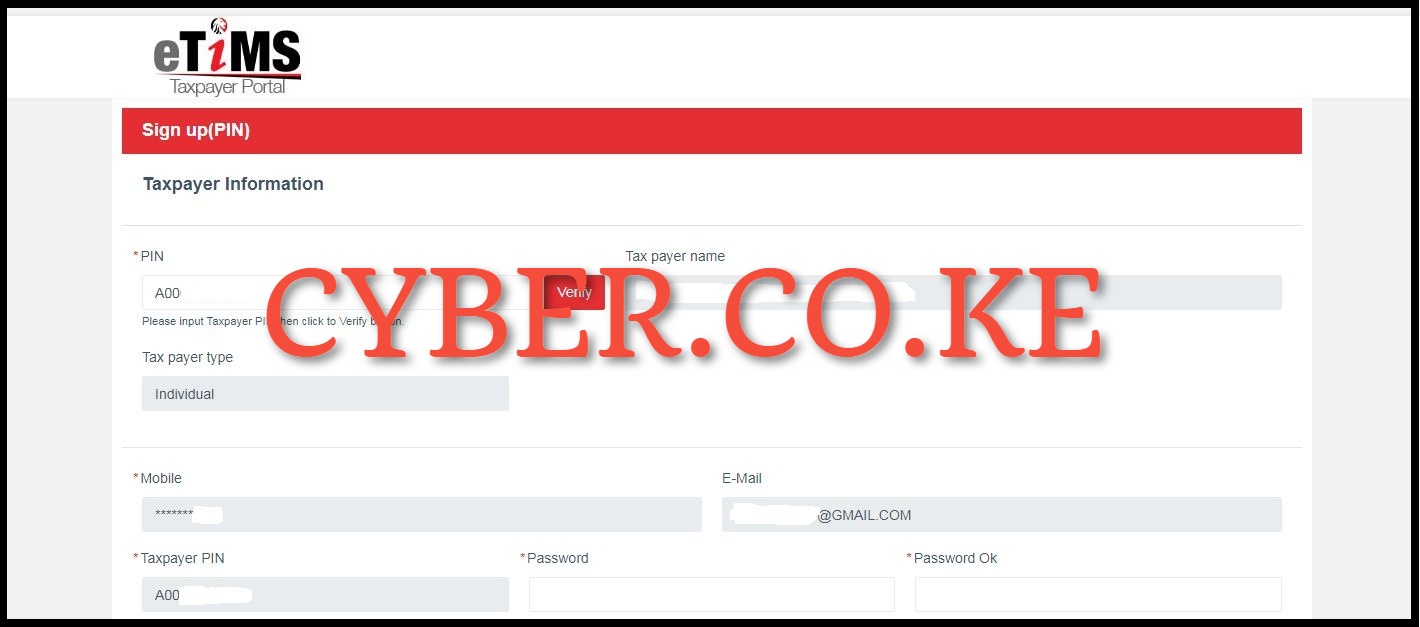

Step 4: Enter your KRA PIN Number and click on Verify button

Next, you need to enter your KRA PIN Number (Taxpayer PIN) and then click on the “Verify” button to verify the KRA PIN on the eTIMS Taxpayer portal.

Step 5: eTIMS Taxpayer Information

After clicking on the “Verify” button in step 4 above, the taxpayer details will auto-populate the eTIMS registration form. From here, you can confirm if the details being displayed on the eTIMS Taxpayer portal are accurate.

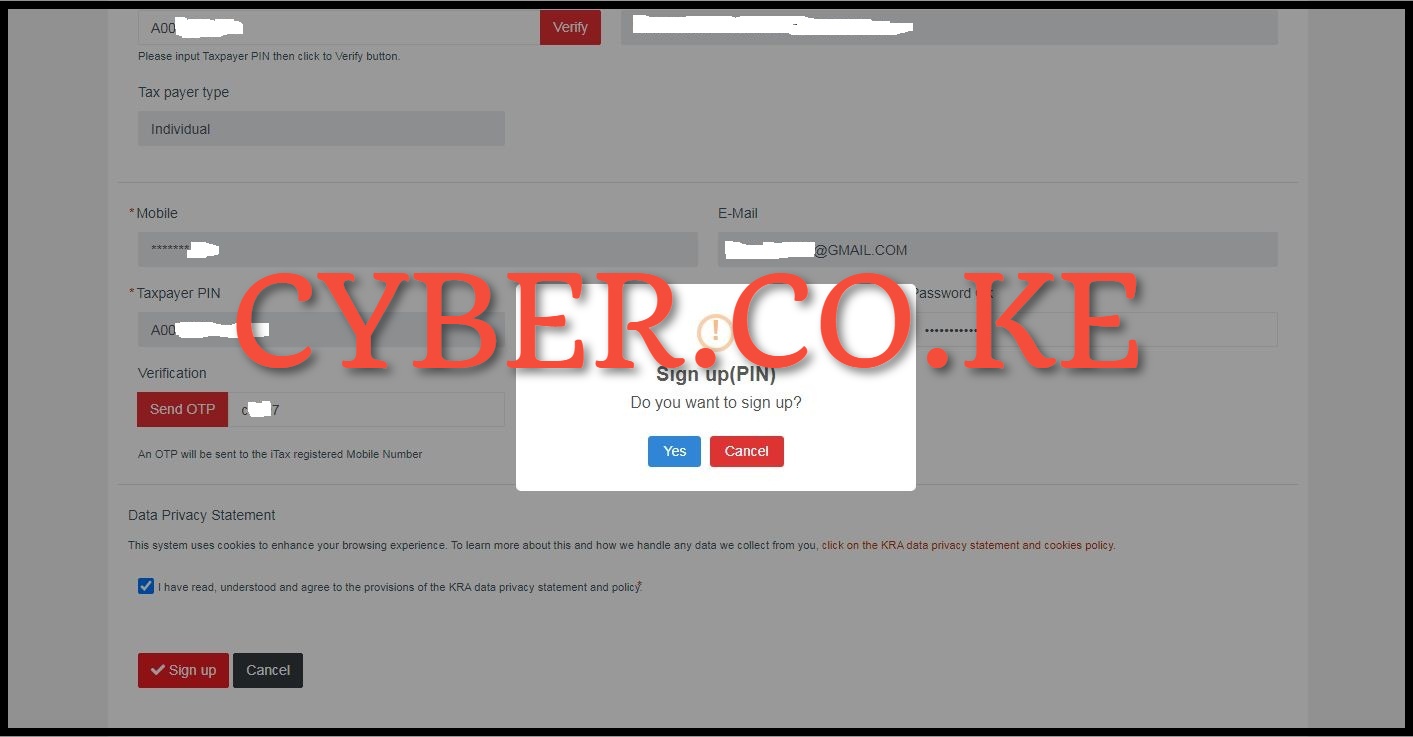

Step 6: Enter and Confirm Password then click on Send OTP button

In this step, you need to enter the password that you will be using on the eTIMS Taxpayer portal. After entering the password and confirming the same, click on the “Send OTP” button which will initiate the sending OTP to the iTax registered Mobile Number. You will receive the OTP from KRA Internal and you need to enter the eTIMS OTP verification code. After entering the OTP that was sent to your iTax registered mobile number, check the box to confirm that you have gone through the “Data Privacy Statement” and then proceed to click on the “Sign Up” button.

Step 7: Click on the Yes button on eTIMS Sign Up

In this step, a sign up confirmation message populates (appears). Click on “Yes” to complete the sign up process for eTIMS using eTIMS Taxpayer portal. You will the message “eTIMS Sign up is completed” meaning that you have successfully signed up or registered for eTIMS using the eTIMS Txpayer portal. The eTIMS sign up process using the eTIMS taxpayer portal ends in this step and the next phase continues in step 8 below.

Step 8: Login Into eTIMS Taxpayer Portal

In this step, after you have successfully signed up or registered for eTIMS and clicked on the “Yes” button you will be re-directed to the eTIMS Taxpayer Portal login page where you now need to login into eTIMS by using your User ID (KRA PIN Number) and eTIMS Password. Once you have entered your eTIMS User ID and eTIMS Password, click on the “Login” button to access your eTIMS Taxpayer Portal account.

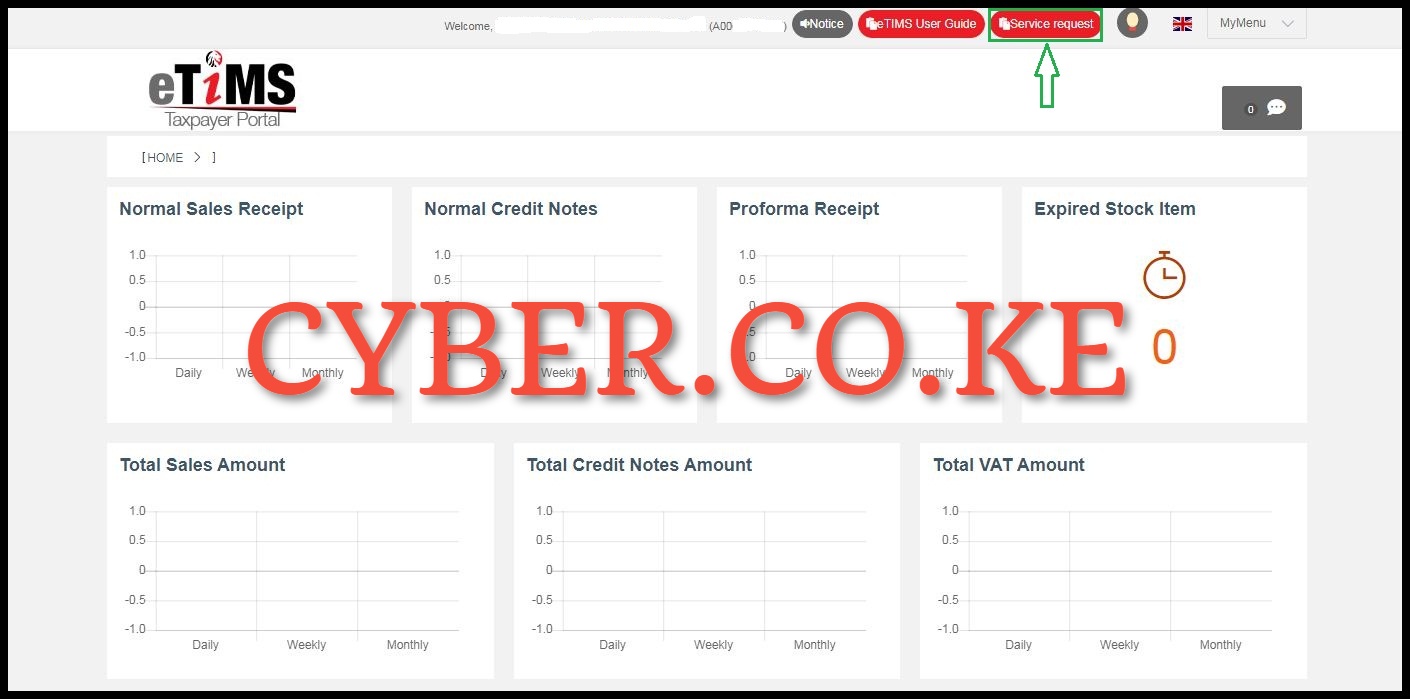

Step 9: Click the Service Request button on the top right corner

Once you have successfully logged into eTIMS Taxpayer Portal, click on the “Service Request” button located on the top right corner of the eTIMS Taxpayer portal account dashboard.

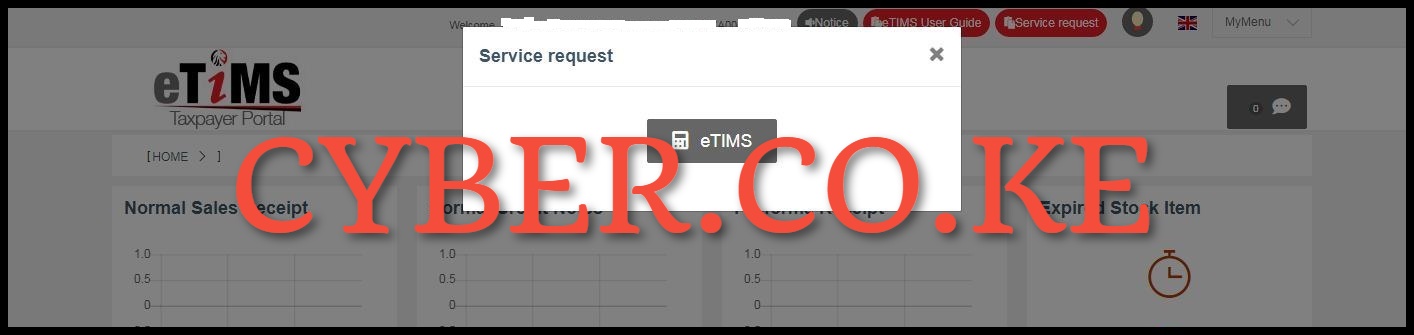

Step 10: Click the eTIMS button

In this step, you need to click on the “eTIMS” button that will appear from the pop up window on eTIMS Taxpayer portal account dashboard after you have clicked on the “Service Request” button in step 8 above.

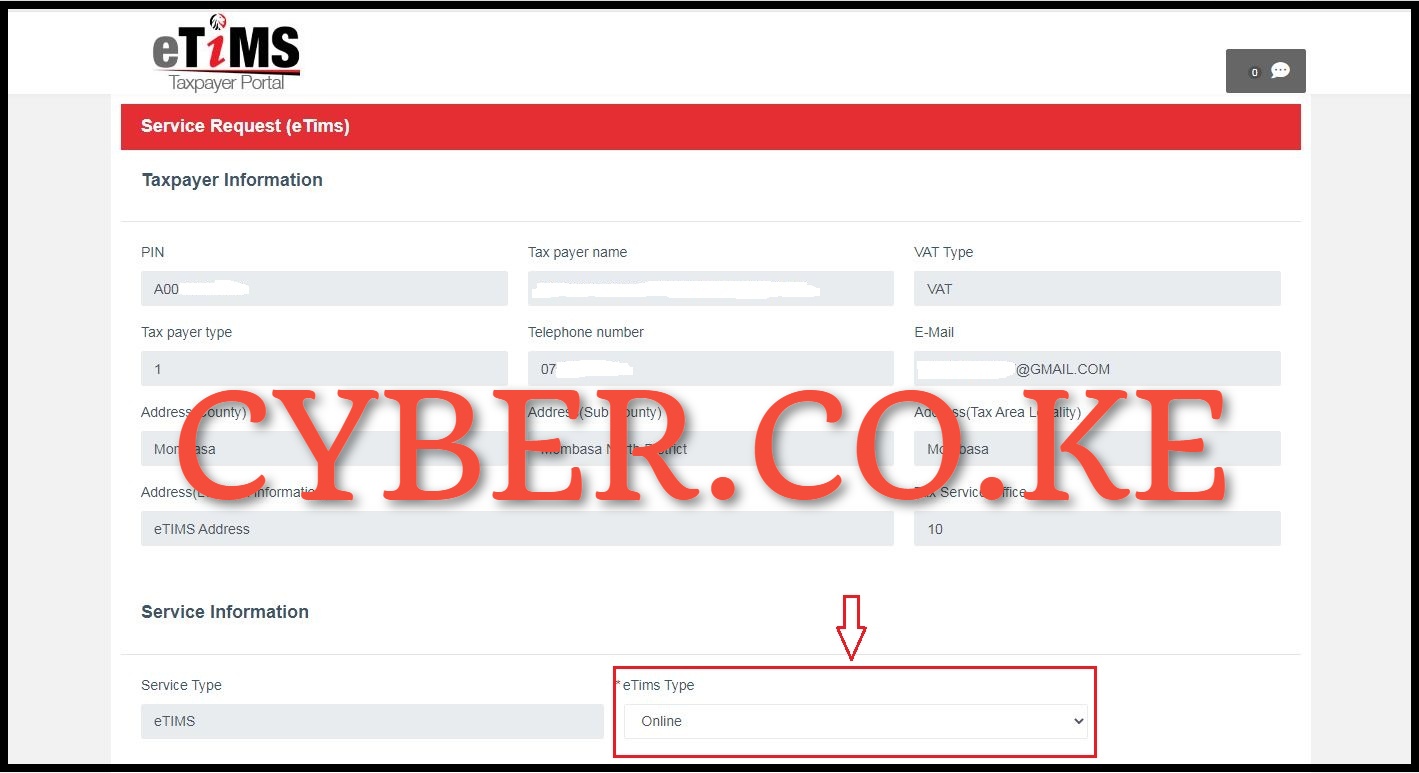

Step 11: Select eTIMS Solution Type

Next, the taxpayer’s data should be displayed as follows. Click the drop down arrow under the “eTIMS Type” and select eTIMS solution that is suitable for your business. The service type is eTIMS and the eTIMS type can either be: eTIMS Client, Online, VSCU or OSCU.

Step 12: Attach required documents and click on Send button

In this last step, you need to attach the required documents i.e. Directors(s) National ID and the Signed Commitment Letter. You need to take note that if applying for eTIMS Client you will be required to provide the serial number of the device you intend to download the software on. Once you have uploaded all the required eTIMS application documents, click on the “Send” button to submit the eTIMS application request.

Download the: eTIMS Confirmation Document (Letter)

Download the: eTIMS Acknowledgement and Commitment Form

Kindly take note that the eTIMS Confrmation Document is also known as the eTIMS Acknowledgement and Commitment Form. A pop up window will appear displaying: “Service Request – Would you like to apply?” click on the “Yes” button. At this step, that marks the end of eTIMS registration process using the eTIMS taxpayer portal. Once the eTIMS application and the submitted documents have been reviewed and approved by Kenya Revenue Authority (KRA), you will now start using the eTIMS solution that you selected.

READ ALSO: Frequently Asked Questions About eTIMS By Taxpayers in Kenya

The above 12 main steps sums up the whole process of registering for eTIMS using the eTIMS taxpayer portal. It is important to take note that the iTax registered mobile number is crucial as the OTP code will be sent to the mobile number during the process of eTIMS registration using eTIMS taxpayer portal. Also, you need to ensure that you select the correct eTIMS solution type for your business. Finally ensure that you upload your National ID and also the signed commitment letter or form. So, when you are looking to register for eTIMS in Kenya, just follow the above outlined steps to register for eTIMS using the eTIMS taxpayer portal today.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.