Are you looking for a way to Download your KRA Acknowledgement Receipt on iTax? Learn How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal.

Most applications that taxpayers make using iTax Portal require that they Download the KRA Acknowledgement Receipt at the end of the process. But a problem arises in situations whereby a taxpayer forgets to Download KRA Acknowledgement Receipt, thus raising the question of How To Reprint KRA Acknowledgement Receipt on iTax.

In this article, I am going to share with you the step by step guide on How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal. By the end of this article, you will have learnt and known the step by step processes that you need to follow in order to Reprint KRA Acknowledgement Receipt using your iTax Account quickly and easily.

READ ALSO: How To Pay Presumptive Tax Using KRA Paybill Number 572572

The KRA Acknowledgement Receipt plays an important role in each and every application that taxpayers submit to Kenya Revenue Authority (KRA) for processing and approval. This article will seek to address all key terms and concepts that are related to the KRA Acknowledgement Receipt.

We shall be covering key terms including: What Is KRA Acknowledgement Receipt, Types Of KRA Acknowledgement Receipts, Importance Of KRA Acknowledgement Receipts, Requirements Needed To Reprint KRA Acknowledgement Receipt and How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal. To be able to reprint your Acknowledgement Receipt from KRA Portal, you need to login to your iTax Account using KRA PIN Number and KRA Password.

The good thing is that in case you have forgotten your KRA PIN Number or even iTax Password (KRA Password), here at Cyber.co.ke Portal we can gladly assist you with that. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you. Incase you have forgotten your iTax Password, you can request for KRA PIN Change of Email Address so that you can be able to change your KRA Password.

What Is KRA Acknowledgement Receipt?

KRA Acknowledgement Receipt is a document that is generated by the KRA iTax Portal that shows that an application, request, return, registration or amendment has been successfully submitted to Kenya Revenue Authority (KRA) for processing and approval. The receipt serves as an acknowledgement that KRA has received the application or request that a taxpayer has submitted using KRA Web Portal. Since the Receipt is issued by KRA, it acknowledges or confirms the receipt of submitted application, process or task using KRA Web Portal.

When you make an application be it for Returns, Registration or Amendment, the last step will normally involves downloading the KRA Acknowledgement Receipt. If by any chance or reason you fail to Download the KRA Acknowledgement Receipt, then you will need to Reprint the KRA Acknowledgement Receipt. But the problem out there is that many taxpayers don’t know how to about Reprinting KRA Acknowledgement Receipt. The good news is that this article will seek to answer and address the steps taxpayers should take.

There are many reasons why taxpayers might fail to Download KRA Acknowledgement Receipt and one of the main one being iTax Downtime or iTax Server Issues. When this occurs, the application might be submitted by the taxpayer was not able to download the KRA Acknowledgement Receipt. The good news is that a copy of the KRA Acknowledgement Receipt is normally sent to iTax Registered Email Address as part of confirmation that your request has been submitted and received by Kenya Revenue Authority (KRA).

Having looked at the definition of KRA Acknowledgement Receipt above, we now need to look at Types Of KRA Acknowledgement Receipts. We need to understand the various types of Acknowledgement Receipts that we have on iTax Portal. I will only be covering the most important KRA Acknowledgement Receipts on KRA Web Portal.

Types Of KRA Acknowledgement Receipts

When you make any application using the iTax Portal, the last step will normally involve you downloading the KRA Acknowledgement Receipt which basically shows that you request or application has been submitted successfully to Kenya Revenue Authority (KRA). There are actually 3 main types of KRA Acknowledgement Receipts i.e. e-Return Acknowledgement Receipt, e-Registration Acknowledgement Receipt and e-Amendment Acknowledgement Receipt.

-

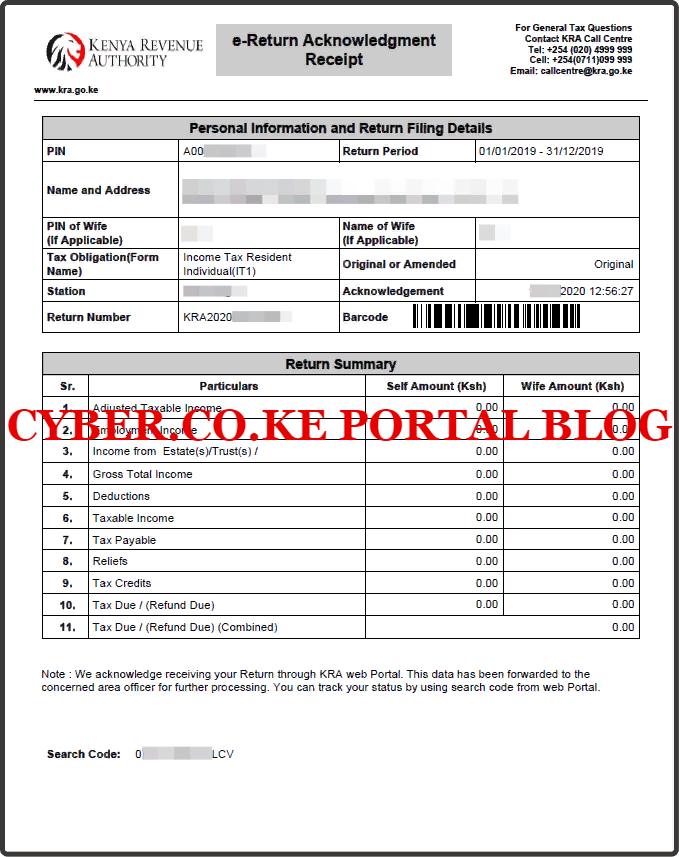

e-Return Acknowledgement Receipt

The first and most common type of KRA Acknowledgement Receipt is what is referred to as e-Return Acknowledgement Receipt. Just as the name suggests, the e-Return Acknowledgement Receipt is basically a document that a taxpayer needs to download after successfully filing his or her KRA Returns on iTax Portal. So, when you are filing Returns on iTax just remember to download the e-Return Acknowledgement Receipts.

For example, when you file either your KRA Nil Returns or KRA Employment Returns, the last step will normally involve you downloading the e-Return Acknowledgment Receipt. The e-Return Acknowledgement Receipt is not limited to the above two but it is also issued for for VAT Returns, TOT Returns, PAYE Returns, Company Returns among other types of KRA Returns that taxpayers can file on KRA Web Portal.

-

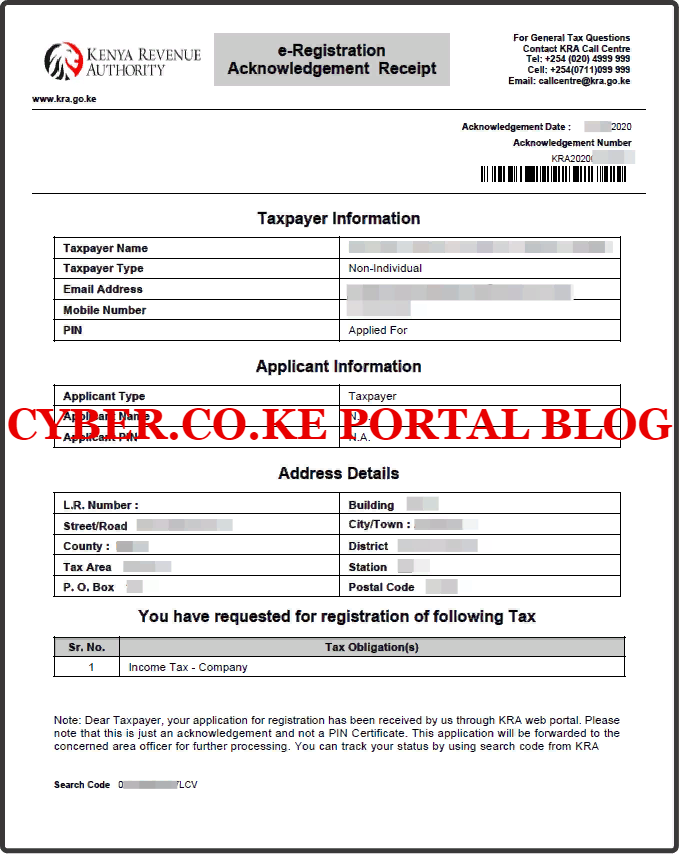

e-Registration Acknowledgement Receipt

The other type of KRA Acknowledgement Receipt is what is referred to as the e-Registration Acknowledgement Receipt. Just as the name suggests, the e-Registration Receipt is normally issued when a taxpayers submits PIN Registration requests to Kenya Revenue Authority (KRA) on iTax Portal. For Non Kenyan Non Residents, they will normally be issued with the e-Registration Acknowledgement Receipt while they wait for Approval of KRA PIN Registration. The same applies to Non Individuals i.e. Groups, Companies, Organizations and Saccos.

For example, when you apply for KRA PIN Registration services for Company KRA PIN or Self Help Group KRA PIN here at Cyber.co.ke Portal, once your request has been submitted online, we normally send the taxpayer the e-Registration Acknowledgement Receipt that shows the Company KRA PIN Registration or Self Help Group KRA PIN Registration has been submitted and received by Kenya Revenue Authority (KRA). The e-Registration Acknowledgment Receipt is important as it has the reference numbers that a taxpayer can use to track the status of Registration online.

-

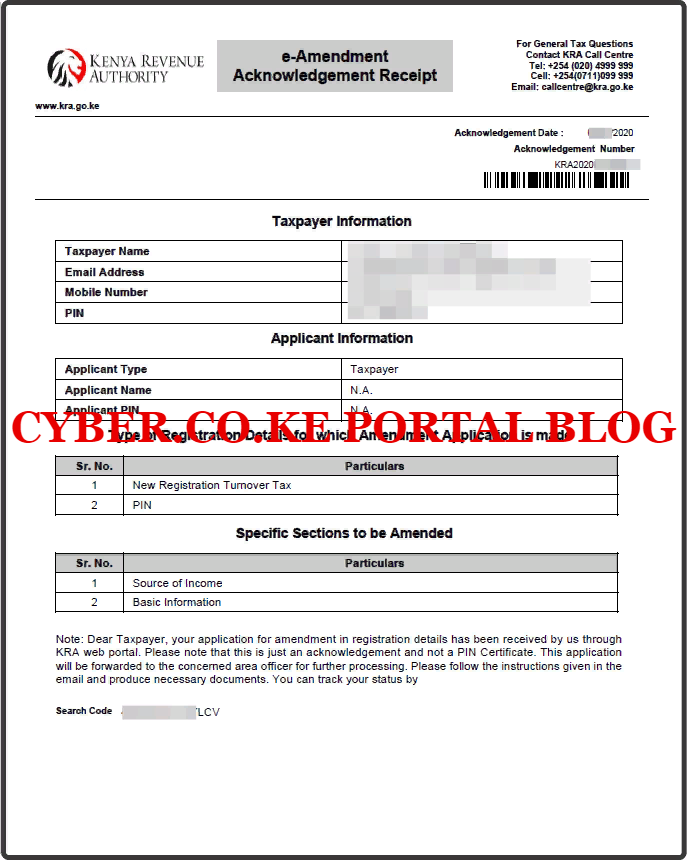

e-Amendment Acknowledgement Receipt

The last but definitely not the least type of KRA Acknowledgment Receipt is what we refer to as the e-Amendment Acknowledgement Receipt. Just as the name suggests, this is a KRA Acknowledgement Receipt that is issued to a taxpayer when they apply for Amendment of their KRA PIN on KRA Web Portal. Each and every amendment that generates a task for approval at Kenya Revenue Authority (KRA) normally has an e-Amendment Acknowledgement Receipt.

For example, when a taxpayer makes an amendment on his KRA PIN i.e. amend Tax Station, amend source of income or amend tax obligation, an e-Amendment Acknowledgement Receipt will be generated as the amendment goes through the approval process at Kenya Revenue Authority (KRA). So, that taxpayer is supposed to download the e-Amendment Acknowledgement Receipt that will enable him or her track the status of the Amendment online quickly and easily.

Having looked at the main types of KRA Acknowledgement Receipts on the KRA iTax Portal, we now need to change gears and look at Importance Of KRA Acknowledgement Receipts. We need to understand why the KRA Acknowledgement Receipt is so important to taxpayers in Kenya.

Importance Of KRA Acknowledgement Receipts

So, what is the importance of this KRA Acknowledgment Receipt? Basically the KRA Acknowledgement Receipt is important is two ways i.e. Application Submission and Application Tracking. Let us look at these two important functions of the Acknowledgements Receipts by KRA.

-

Application Submission

When you submit an application online to KRA be it KRA Returns Submissions, KRA PIN Registrations or KRA PIN Amendments, you will be issued with the KRA Acknowledgment Receipt that simply simply shows you that your application was submitted successfully to Kenya Revenue Authority (KRA).

-

Application Tracking

Withe the KRA Acknowledgement Receipt, there is a reference number and a search code that a taxpayer can use to track the status of his or her application at Kenya Revenue Authority (KRA) quickly and easily and be on the know how of when the application will be approved.

Now that we have looked at the Importance of the KRA Acknowledgment Receipt above, we need to look at the Requirements Needed To Reprint KRA Acknowledgement Receipt. This is important to understand as to which key requirements we need inorder to Reprint KRA Acknowledgement Receipt using KRA iTax Portal.

Requirements Needed To Reprint KRA Acknowledgement Receipt

To be able to Reprint KRA Acknowledgement Receipt, there are a set of requirements that taxpayers need to have i.e. KRA PIN Number and KRA iTax Password. Let us look at each one of these requirements below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that you know the key requirements needed to Reprint KRA Acknowledgement Receipts, we now need to head towards the homestretch and look at How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal.

How To Reprint KRA Acknowledgement Receipt

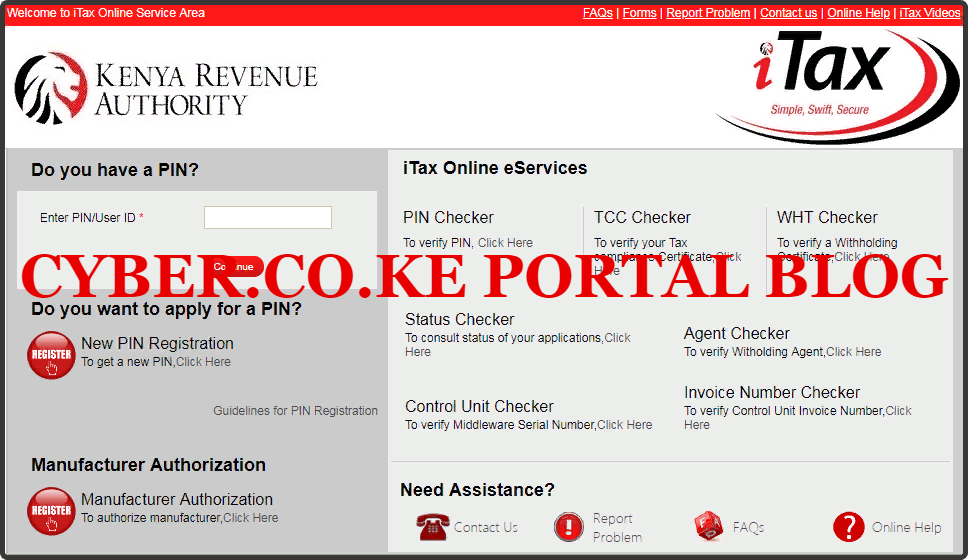

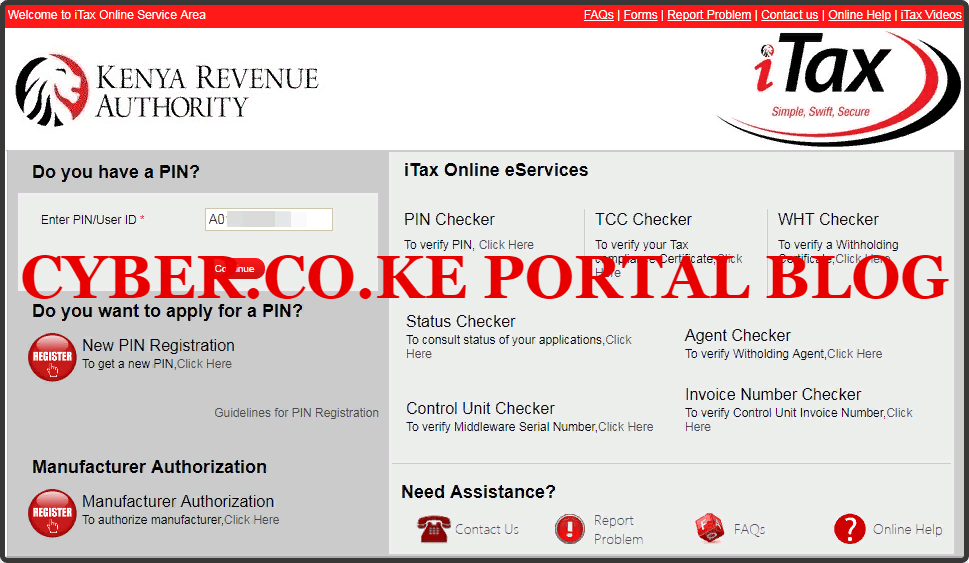

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the above description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” button to proceed to the next step.

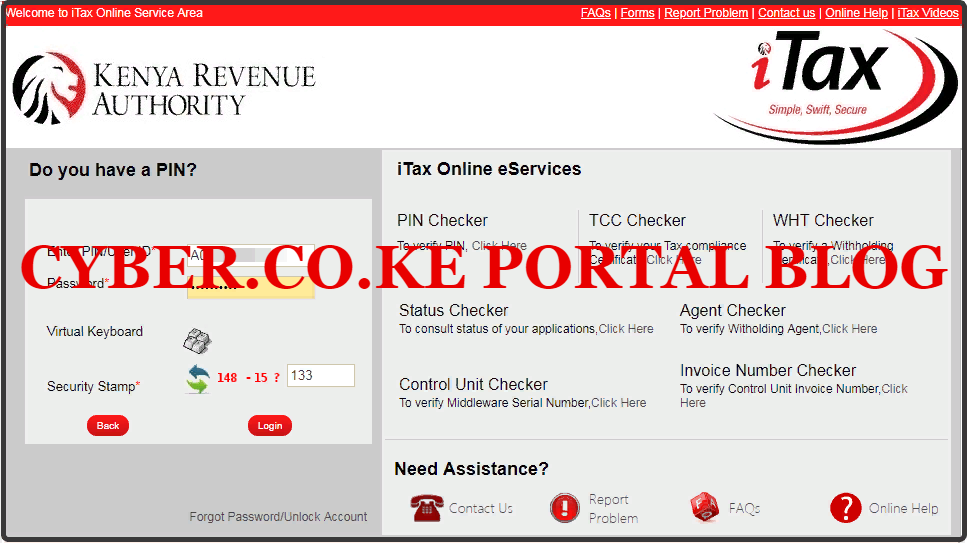

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to Reprint KRA Acknowledgement Receipt using KRA iTax Portal, we proceed to Step 5 below.

Step 5: Click On Useful Links Then Consult And Reprint Acknowledgement Receipt And Certificate

Next, you will need toc click on Link tab and from the drop down menu list click on Consult and Reprint Acknowledgement Receipt and Certificate. This is as illustrated below.

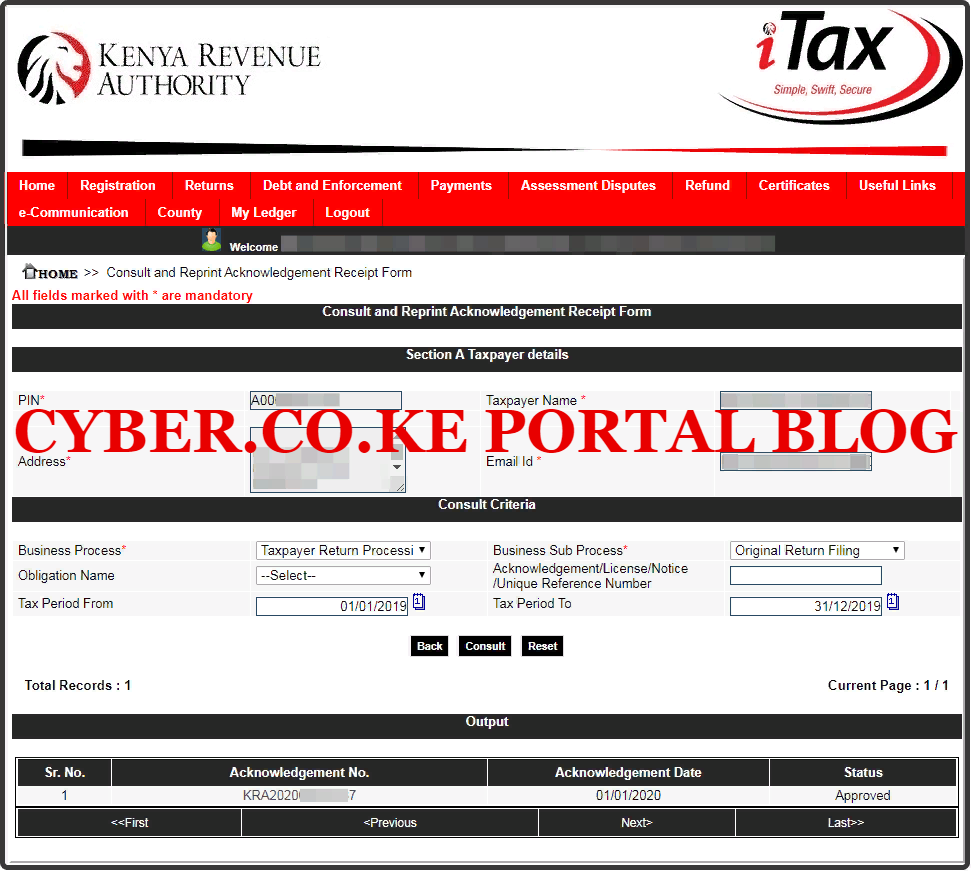

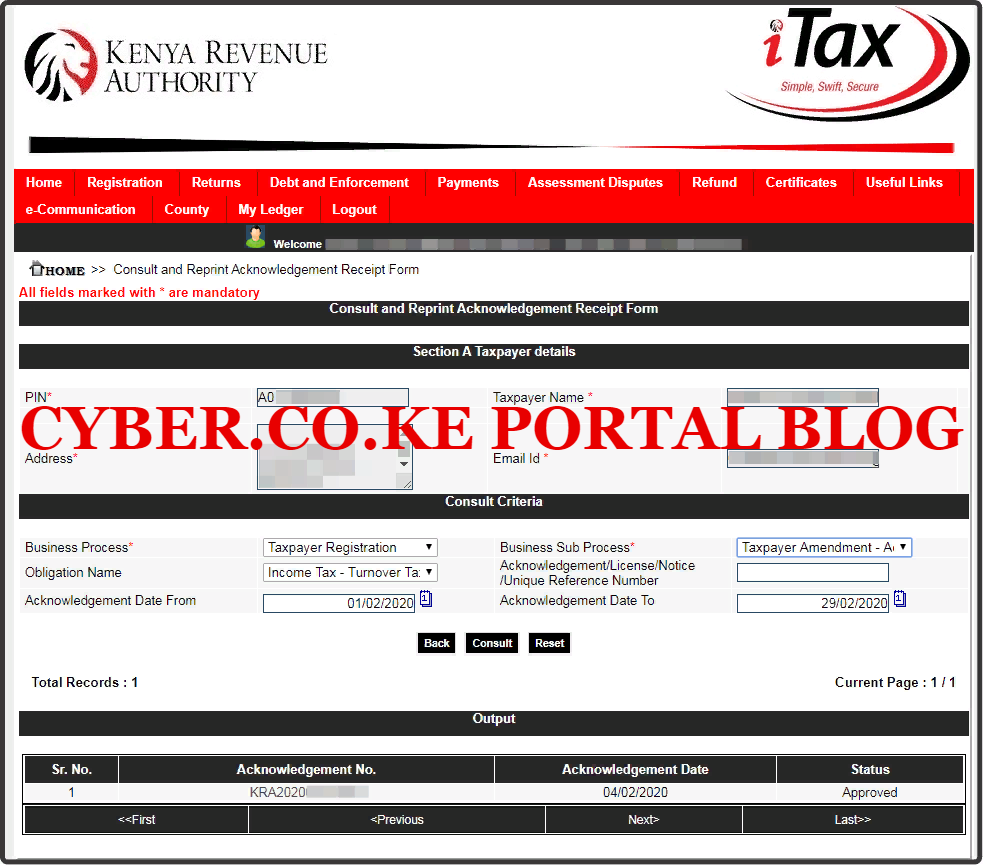

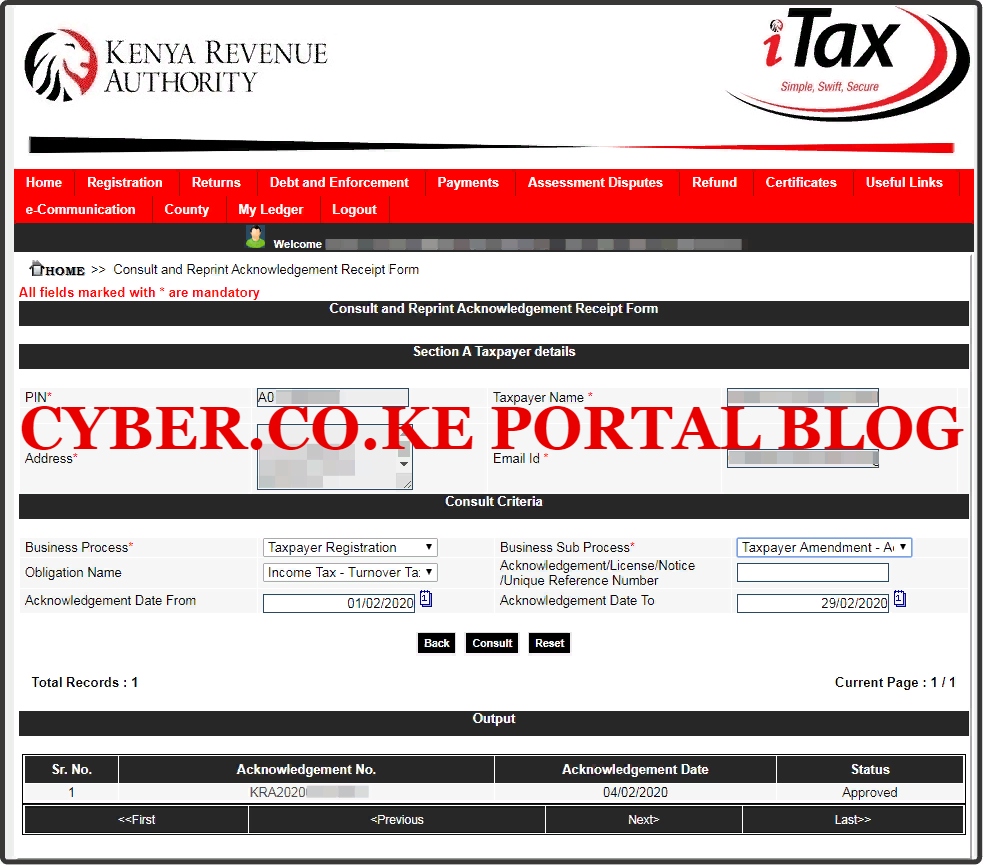

Step 6: Fill The Reprint Acknowledgement Receipt Form

This definitely the most important step in the process of How To Reprint KRA Acknowledgement Receipt. There are some fields that the taxpayer need to select and fill depending on the type of Acknowledgment Receipt that they want to download and reprint on KRA iTax Portal. You will notice that the Reprint Acknowledgment Receipt Form is made up of 3 sections i.e. Taxpayer Details, Consult Criteria and Output.The Taxpayer Details section is automatically prefilled by the iTax System i.e. the KRA PIN, Taxpayer Name, Address and Email ID parts.

The Consult Criteria is the section that you need to select the type of business process that you need to Reprint KRA Acknowledgement Receipt for i.e. Business Process, Business Sub Process, Obligation Name, Acknowledgement/Licence/Notice/Unique Reference Number, Acknowledgment Date From, Acknowledgement Date To, Tax Period From and Tax Period To. The last section which is Output will basically display the link which you need click on to Download and Reprint KRA Acknowledgement Receipt.

In this process, we are going to Reprint KRA Acknowledgement Receipt for Return, Registration and Amendment. This is as described below.

-

e-Return Acknowledgement Receipt (KRA Acknowledgement Receipt For Returns)

To be able to Reprint and download the KRA Acknowledgement Receipt for Returns (e-Return Acknowledgement Receipt), we shall fill in the following fields under Consult Criteria in the Reprint Acknowledgement Receipt Form. This is as follows: Business Process (Taxpayer Return Processing), Business Sub Process (Original Return Filing), Obligation Name (Income Tax Resident – Individual), Tax Period From (01/01/2019) and Tax Period To (31/12/2019). This simply means I am downloading the e-Return Acknowledgment Receipt for KRA Returns that was filed using iTax Portal. Once you have filled in the above parts, click on the “Consult” button. This is as shown below.

In the output section, once you click on the link under the Acknowledgement Number, you will be able to download and reprint your KRA e-Return Acknowledgment Receipt.

-

e-Amendment Acknowledgement Receipt (KRA Acknowledgement Receipt For Amendment)

To be able to Reprint and download the KRA Acknowledgement Receipt for Amendment (e-Amendment Acknowledgement Receipt), we shall fill in the following fields under Consult Criteria in the Reprint Acknowledgement Receipt Form. This is as follows: Business Process (Taxpayer Registration), Business Sub Process (Taxpayer Amendment – Acknowledgement), Obligation Name (Income Tax – Turnover Tax), Acknowledgement Date From (01/02/2020) and Acknowledgement Date To (29/02/2020). This simply means I am downloading the e-Amendment Acknowledgment Receipt for KRA PIN Amendment that was filed using iTax Portal. Once you have filled in the above parts, click on the “Consult” button. This is as shown below.

In the output section, once you click on the link under the Acknowledgement Number, you will be able to download and reprint your KRA e-Amendment Acknowledgment Receipt.

-

e-Registration Acknowledgement Receipt (KRA Acknowledgement Receipt For KRA PIN Registration)

To be able to Reprint and download the KRA Acknowledgement Receipt for Registration (e-Registration Acknowledgement Receipt), we shall fill in the following fields under Consult Criteria in the Reprint Acknowledgement Receipt Form. This is as follows: Business Process (Taxpayer Registration), Business Sub Process (Taxpayer New Registration – Approval), Obligation Name (Income Tax Company), Acknowledgement Date From (01/02/2020) and Acknowledgement Date To (29/12/2020). This simply means I am downloading the e-Registration Acknowledgment Receipt for KRA PIN Registration for Company or Group that was filed using iTax Portal. Once you have filled in the above parts, click on the “Consult” button. This is as shown below.

In the output section, once you click on the link under the Acknowledgement Number, you will be able to download and reprint your KRA e-Registration Acknowledgment Receipt.

READ ALSO: How To Download Latest KRA Returns Template From KRA Portal

The above steps sum up the process of How To Reprint KRA Acknowledgement Receipt on iTax Portal. So, next time you need to download and reprint your KRA Acknowledgement Receipts quickly and easily, just follow the above outline step by step guide on How To Reprint KRA Acknowledgement Receipt Using KRA iTax Portal.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.