Did you know that if you lost or forgot your KRA Clearance Certificate you can easily get it back by simply reprinting it from your KRA Portal (iTax Portal) account. Through the process of KRA Clearance Certificate Reprinting, you can easily and quickly get a copy of your KRA Clearance Certificate online. As a document, the clearance certificate is normally issued by Kenya Revenue Authority (KRA) to taxpayers who have been compliant i.e. filed KRA Returns and made payment to any taxes due.

For one to be issued with a KRA Clearance Certificate, you need to ensure that you always file your KRA Returns on time and if you have any tax due, make payment of the same on or before the elapse of the deadlines that have been set by KRA. The KRA Clearance Certificate is a very important document that comes in handy especially during job application process as it is one of the 6 documents that job seekers need to present for employment purposes in Kenya,

To be able to reprint KRA Clearance Certificate online using KRA Portal (iTax Portal), there are two key requirements that a taxpayer needs to have. This includes both the KRA PIN Number and KRA Password (iTax Password) which are needed for the purposes of logging into your account so as to be able to reprint your KRA Clearance Certificate quickly and easily.

READ ALSO: How To Check KRA PIN Certificate Online (In 5 Steps)

Requirements Needed In Reprinting KRA Clearance Certificate

As mentioned above, the process of reprinting KRA Clearance Certificate requires one to have both the KRA PIN Number and KRA Password (iTax Password). Below is brief description of what each one of the two requirements entails in relation to the process of How To Reprint KRA Clearance Certificate.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you when you want to login to iTax Portal (KRA Portal). If by any chance you have forgotten or you don’t remember your KRA PIN Number, you can submit KRA PIN Retrieval request online here at CYBER.CO.KE and our support team will be able to assist with the retrieval of your lost or forgotten KRA PIN Number.

At the same time, if you are looking for a new KRA PIN Number, you can get it here in less than 3 minutes by submitting your KRA PIN Registration request at CYBER.CO.KE. Your new KRA PIN Number and KRA PIN Certificate will be sent to your Email Address once the request for KRA PIN Registration has been done and processed by our support team.

-

KRA Password (iTax Password)

The next requirement that you need to have with you in the process of reprinting KRA Clearance Certificate online is your KRA Password (iTax Password), which you will need to access your iTax Portal account. If you don’t know or have forgotten your KRA Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for KRA Password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at CYBER.CO.KE and have your Email Address changed so as to enable your Reset KRA Password.

Did you know that you can easily apply and get your KRA PIN Number and KRA PIN Certificate online in less than 5 minutes by using CYBER.CO.KE today. Get it via email address or even WhatsApp upon submission.

Here at, CYBER.CO.KE, we offer unmatched KRA PIN Registration, KRA PIN Retrieval, KRA PIN Update and KRA PIN Change of Email Address services to Kenyans daily. Fill and submit your request online today.

How To Reprint KRA Clearance Certificate (In 5 Steps)

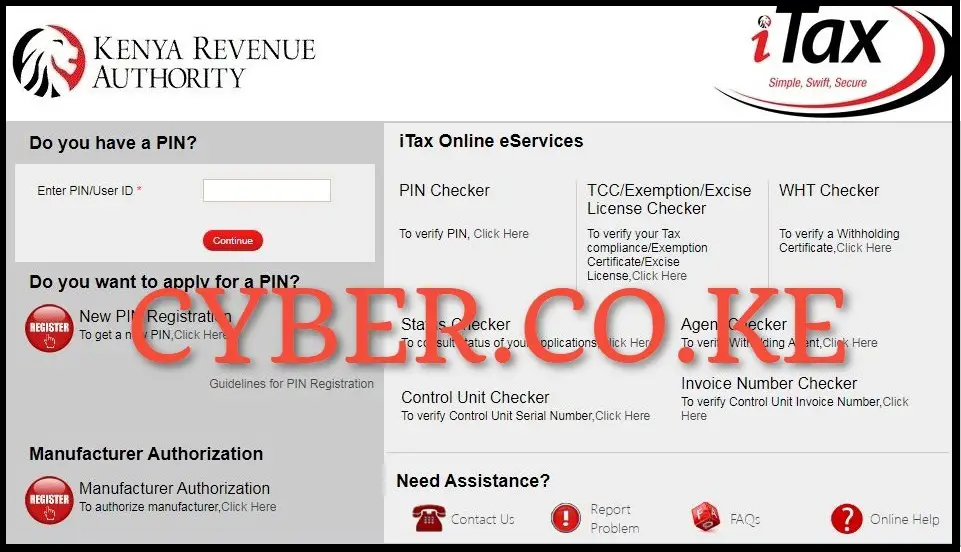

Step 1: Visit KRA Portal

The first step in the process of reprinting KRA Clearance Certificate is to visit KRA Portal using https://itax.kra.go.ke/KRA-Portal/

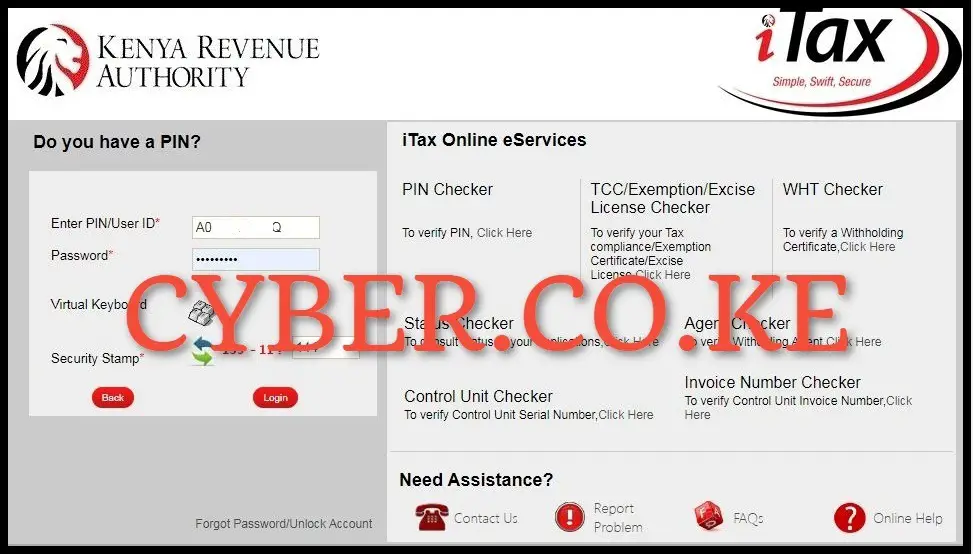

Step 2: Login to KRA Portal

Next, using both your KRA PIN Number and KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button.

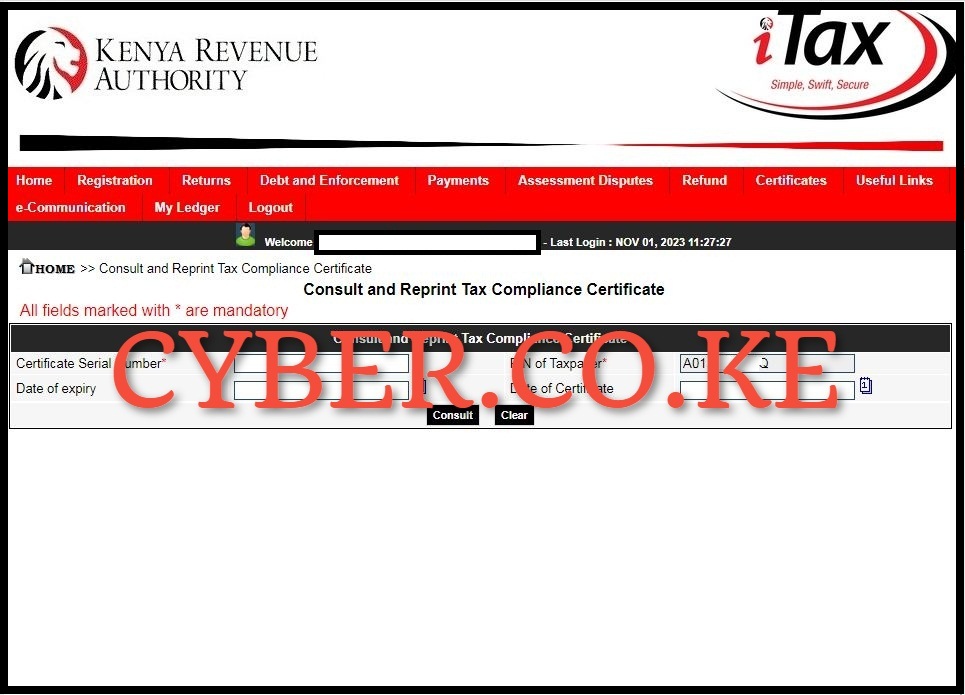

Step 3: Click on Certificates and then Consult and Reprint TCC

Once logged into KRA Portal, click on “Certificates” followed by “Consult and Reprint TCC” to be able to reprint your KRA Clearance Certificate online.

Step 4: Consult and Reprint KRA Clearance Certificate

Next, you need to consult and reprint KRA Clearance Certificate using the provided form that comprises of the following fields; Certificate Serial Number, PIN of Taxpayer, Date of Expiry and Date of Certificate. You are not required to fill any of those fields listed. You just need to click on the “Consult” button to recover your KRA Clearance Certificate online. A pop up window will appear asking “Are you sure you want to Consult?” click on the “OK” button.

Step 5: Download The Reprinted KRA Clearance Certificate

The last step involves downloading the reprinted KRA Clearance Certificate on KRA Portal. To download the reprinted KRA Clearance Certificate, on the Certificate Serial Number section, just click on the number i.e. KRABGM*********3 which will automatically download and save the KRA Clearance Certificate in PDF version to your device and at this point you can choose to either save the soft copy or make a print out of the hard copy.

READ ALSO: How To Recover KRA Clearance Certificate (In 5 Steps)

By following the above mentioned 5 steps, you will be able to reprint KRA Clearance Certificate online using KRA Portal quickly and easily. One thing to take note of is that the process of reprinting clearance certificate online requires that you have with your the KRA PIN Number and KRA Password (iTax Password). Once you have these two requirements, you can follow the above 5 main steps so as to be able to reprint your KRA Clearance Certificate on KRA Portal (iTax Portal).

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.