Get to know How To Track Status Of Application Using KRA iTax Status Checker. Know the status of your applications at KRA using the KRA Status Checker.

When you make an application on KRA iTax Portal that generates a task that has to be approved by a Kenya Revenue Authority (KRA) Officer, tracking that application is the next thing you need to do by the use of the KRA iTax Status Checker. But this is no easy task if you are not familiar with how to use the iTax Status Checker.

In this article, I am going to share with you the steps involved on How To Use The KRA Status Checker on KRA iTax Portal to check the status of your applications at Kenya Revenue Authority (KRA). By the end of this article you should know how to use the KRA iTax Status checker to track the status of the applications you made at Kenya Revenue Authority (KRA).

READ ALSO: Frequently Asked Questions: Presumptive Tax And Turnover Tax (TOT)

Before we proceed to digging deeper into KRA Status Checker on iTax, we need to lay the ground rules by understanding what the KRA iTax Status Checker is. Kindly note that KRA Status Checker and KRA iTax Status Checker are one and the same thing.

It is always important to know the stage at which your submitted applications to Kenya Revenue Authority (KRA) are in. This will give you the peace of mind knowing that the application is being handled by the right KRA Officer or KRA Task Manager in the Tax Station that you are registered at.

Through the iTax Portal, the KRA Status Checker or simply the iTax Status Checker will enable you know the progress of your submitted applications. So, be it payments, registrations or even amendments that you have done on KRA Portal, then the Status Checker on iTax will help you check and monitor the progress of all those submitted applications at Kenya Revenue Authority (KRA).

What Is KRA Status Checker?

The KRA Status Checker is an iTax Functionality on the KRA iTax Portal that enables taxpayers to be able to check and track the status of the applications that they made using KRA iTax Portal. The KRA iTax Status Checker basically lets you get to the stage at which your application is currently in at Kenya Revenue Authority (KRA).

With the iTax Status Checker, you are in the know how of the state of your applications through the status checker functionality on KRA Website Portal. In the previous years before iTax Portal was designed and developed, to know the status of your application, you had to visit KRA Offices countrywide. You can imagine the difficulty that taxpayers used to go through back then in the old days.

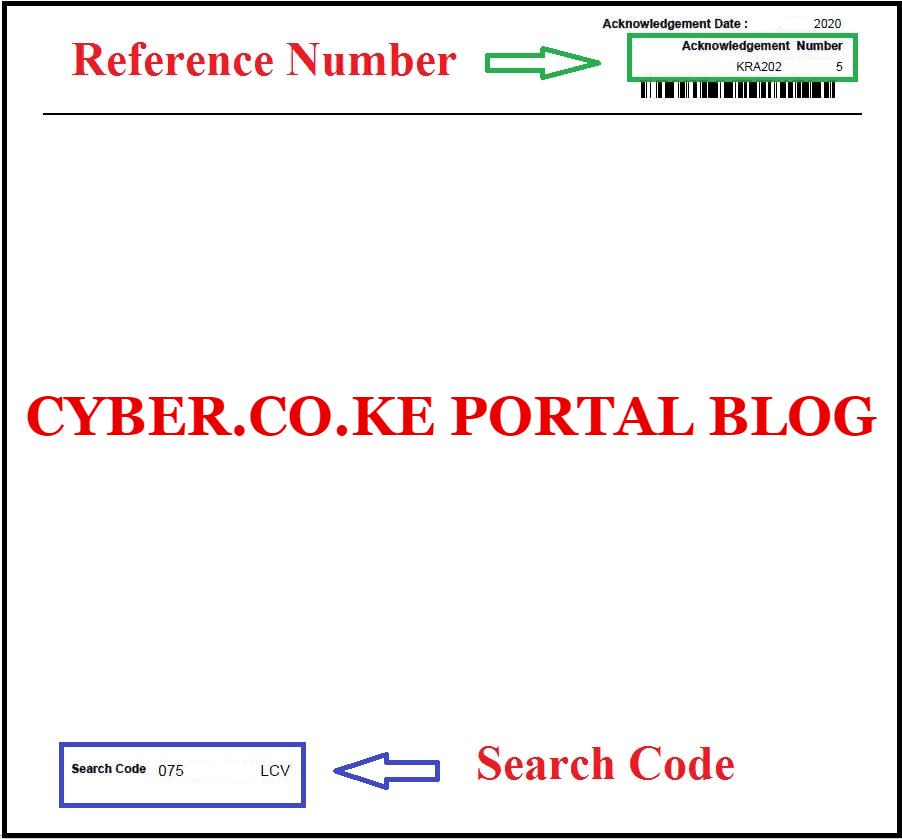

Now that we have defined what the Status Checker is in relation to KRA iTax Portal, we need to look at the requirements that you will need inorder to use the Status Checker Functionality on iTax Portal. Basically the two requirements that you are going to need for this process is the Reference Number (Acknowledgement Number) and Search Code. The Reference Number and Search Code are two important items that will help you track the status of your Applications at KRA quickly and easily. The image below is an illustration of the two;

Requirements Needed For Use of KRA Status Checker

-

Reference Number (Acknowledgement Number)

Any application that is made on KRA iTax Portal has a unique number that is generated for that application on iTax. Thuis number is what is referred to as the Reference Number (Acknowledgement Number). In most and infact all applications that are made on iTax and a task is generated for that application, a Reference Number or Acknowledgement Number will also be generated for purposes of checking and tracking that application at Kenya Revenue Authority (KRA). Below is a sample screenshot of the KRA Reference Number (Acknowledgement Number) format.

-

Search Code

The other requirement needed for using the KRA iTax Status Checker functionality on iTax Portal is the Search Code. The KRA Search Code is a unique 15 digits (characters) alphanumeric code generated together with the Reference Number (Acknowledgement Number) on an application that generates a Task for verification on the KRA iTax Portal. Below is a sample screenshot of the KRA Search Code.

The above two form the important requirements that you need to have when you need to check and track the status of application at Kenya Revenue Authority (KRA). Once you have with you the KRA Reference Number (Acknowledgement Number) and the KRA Search Code, you need to know what types of Cases (Searches) that require the above two requirements.

iTax Case Types That Require Reference Number (Acknowledgement Number) and Search Code

On KRA iTax Portal, in the iTax Status Checker Functionality, only three case types will require you to have the KRA Reference Number (Acknowledgement Number) and the KRA Search Code. These are; Registration, Payment and Return.

-

Registration

When you need to check the status of Registration on iTax, you will need to enter the KRA Reference Number (Acknowledgement Number) and the KRA Search Code. You need to note that the Registration Status Checker applies to Registration of PINs for Companies, Self Help Groups and Foreigners.

These is because the above common Registration on iTax normally generate a task that will have to go through an Approval Process at Kenya Revenue Authority (KRA). The final Status of Registration can either be “Approved” or “Rejected.”

-

Payment

The other type of Case Type search on KRA iTax Portal that will need the KRA Reference Number and KRA Search Code is Payment. Basically, payment simply refers to a payment made to Kenya Revenue Authority (KRA) and can be Income Tax Payment, Advance Tax Payment, Turnover Tax (TOT) Payment, Presumptive Tax Payment, Returns Payment and many more.

You will need to note that with Payment Case Type, you will have the Payment Registration Number instead of the Reference Number and the Search Code remains. The status of Payment when paid is “Received” and when not paid within 30 days, the status will be “Expired” and when Payment slip has just been produced, status will be “Generated.”

-

Return

The last Case Type on KRA iTax Portal that will need both the Reference Number and Search Code is the Return. You can query the status of your filed KRA Returns on iTax Portal using the KRA Status Checker on KRA Web Portal.

When you file your KRA Returns on KRA iTax Portal, then the status of the Return will be “Approved” on iTax Portal.

Now that you know the Case Types that will require both the Reference Number and Search Code, we need to look at the steps involved in How To Track Status Of Application Using KRA iTax Status Checker.

How To Track Status Of Application Using KRA iTax Status Checker

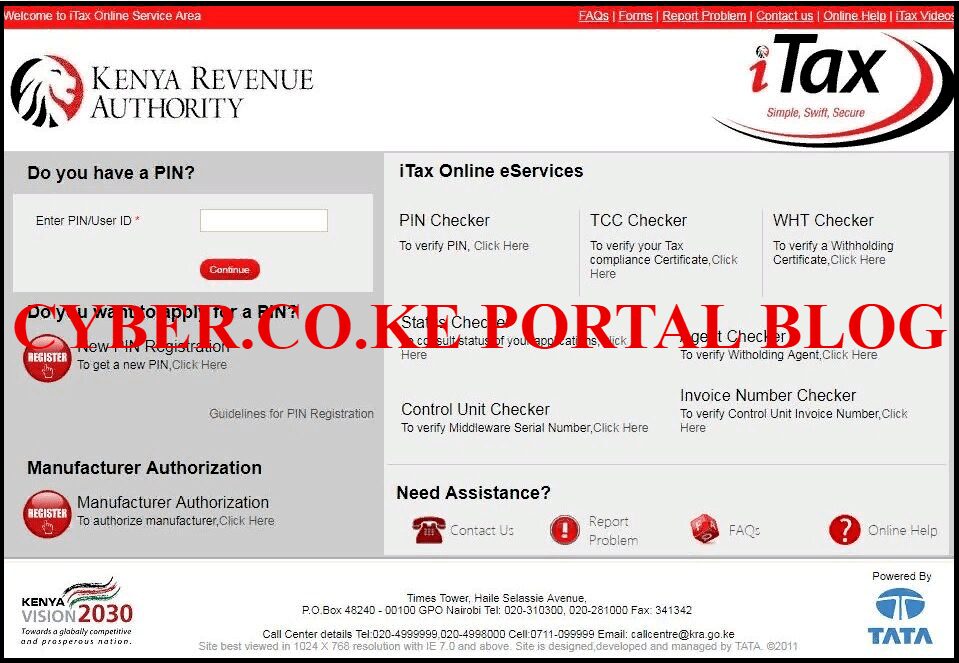

Step 1: Visit KRA Portal

The first step that you need to take is to ensure that you visit the KRA iTax Portal using the link provided above in the title.

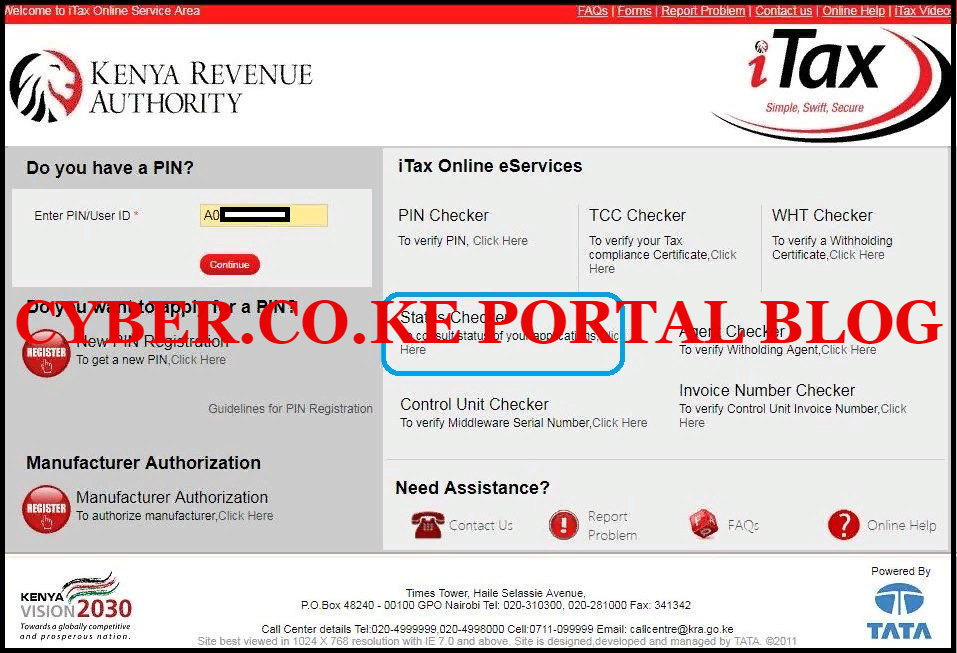

Step 2: Click On Status Checker Functionality

In this step, you will need to click on the Status Checker functionality that is just below the PIN Checker. This is as shown below;

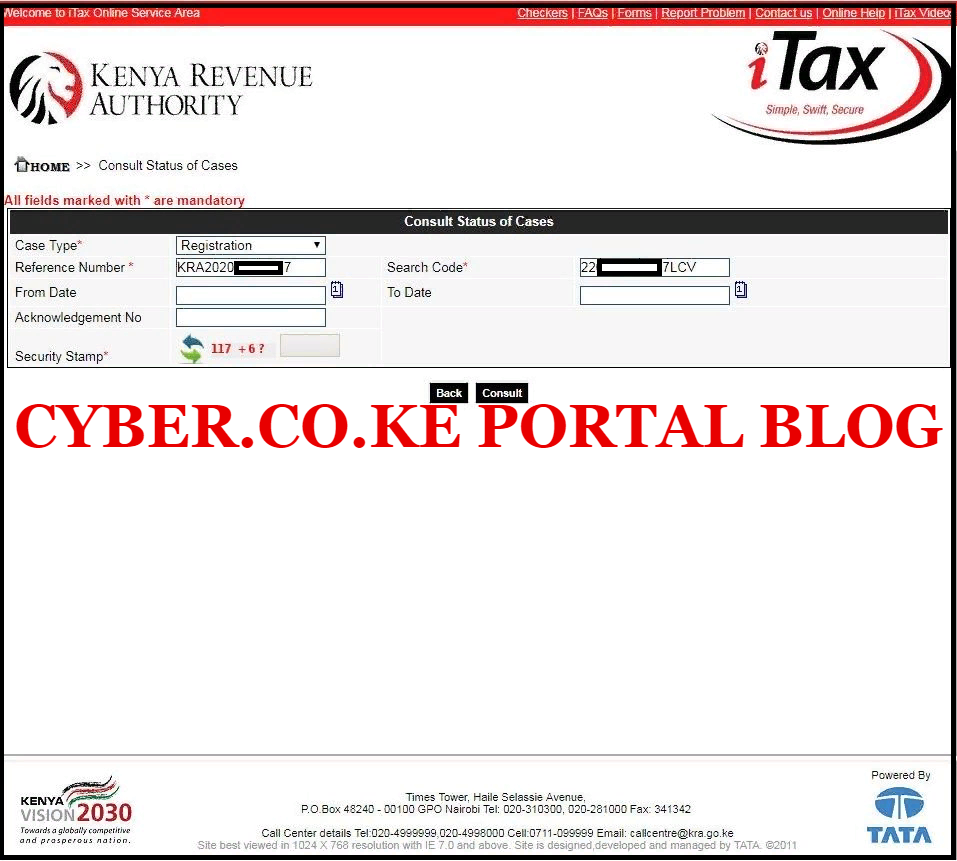

Step 3: Select Case Type and Enter Reference Number and Search Code

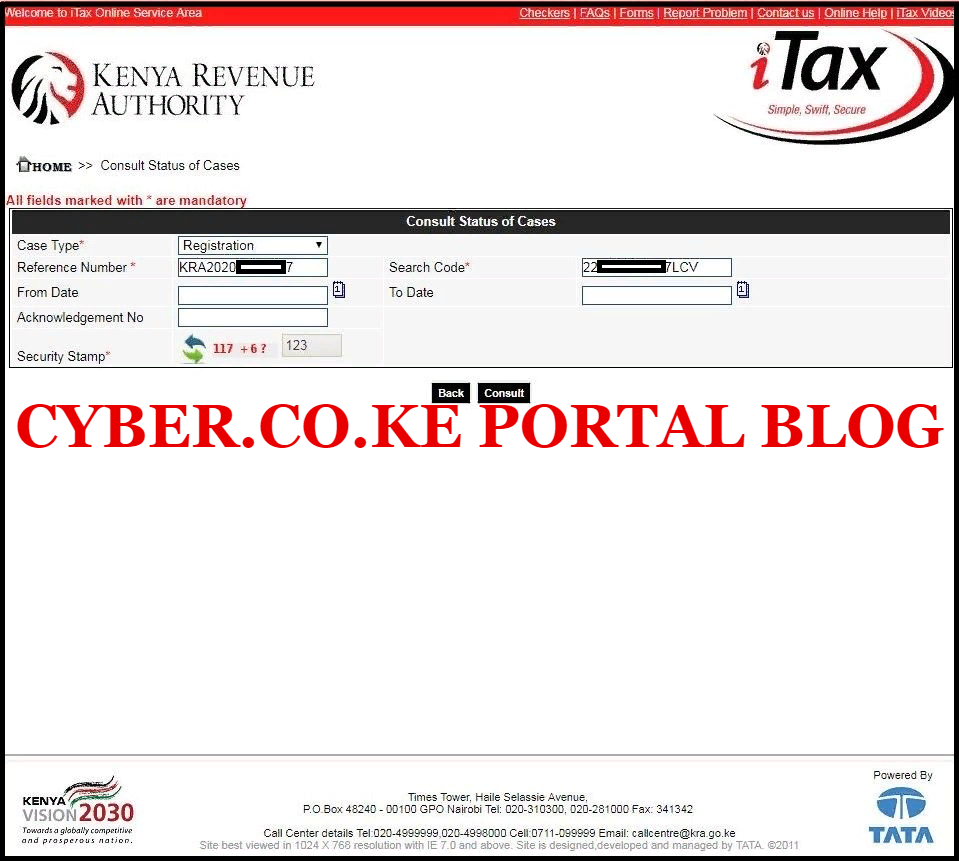

This is the most important step. In this step, you will need to choose the Case Type that you are tracking. This can either be Registration, Payment or Return. At this point you will need to ensure that you have with you the Reference Number (Acknowledgement Number) and Search Code. Refer to the example of the two below:

Reference Number/Acknowledgement Number: KRA2020*******7

Search Code: 22*********7LCV

In this example, we shall be tracking the status of Registration of a KRA PIN for a Company/Selef Help Group/Foreigner. You will fill in the details as shown in the screenshot below.

Step 4: Solve The Arithmetic Question (Security Stamp)

In this step, you will need to solve the arithmetic question (security stamp). Once you have done so, click on the “Consult” button.

Step 5: KRA Status Checker Results

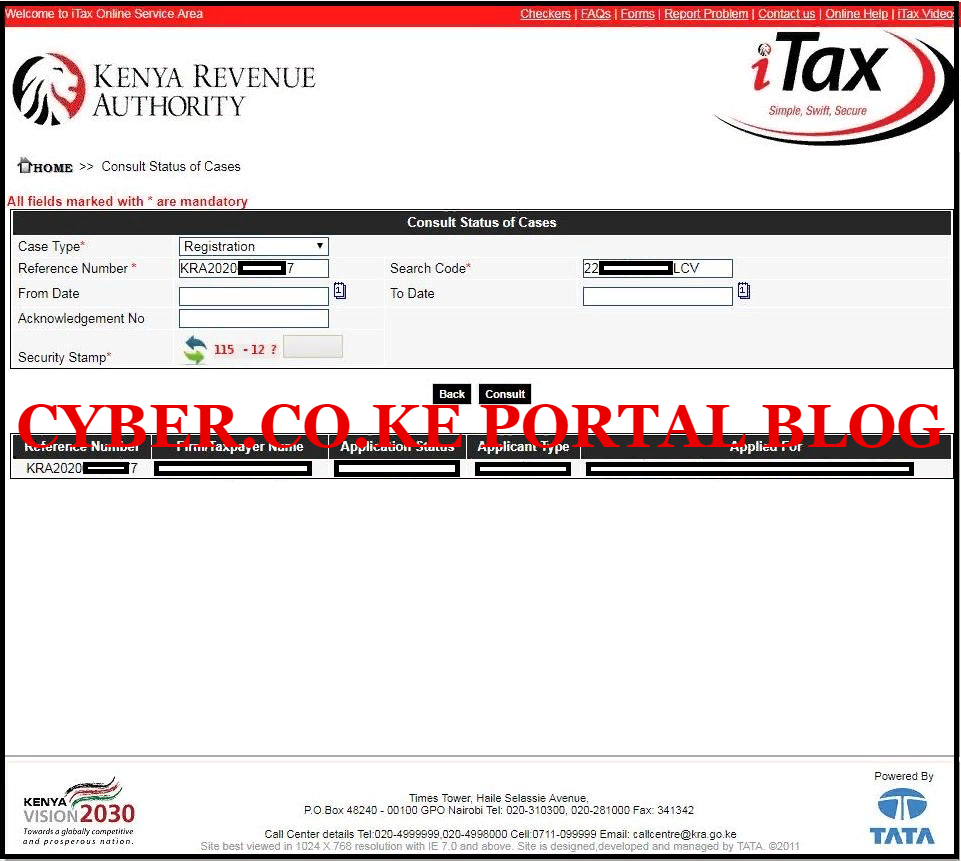

Once you have successfully clicked on the “Submit” button, you will get the KRA Status Checker Results. The KRA iTax Status Checker Results basically tell you the status of your application at Kenya Revenue Authority. In our case, we had selected the Case Type to be Registration as we were looking to know the status of the Application that we had made on KRA iTax Portal.

The Status Checker Results basically have Five columns. This includes; Reference Number, Firm/Taxpayer Name, Application Status, Applicant Type and Applied For. Let me breakdown what each of the column of the KRA Status Checker Results page means in brief.

-

Reference Number

The first column of the KRA Status Checker results is the Reference Number. This is also referred to as the Acknowledgment Number. This is the number generated for your application at Kenya Revenue Authority (KRA).

-

Firm/Taxpayer Name

The second column comprises of the Firm/Taxpayer Name. This is the name of the person or company applying for something i.e Registration on KRA iTax Portal.

-

Application Status

The third column is for the Application Status. Basically in this column the result of your Application will be displayed whether Approved (APVED) or Rejected (REJCT).

-

Applicant Type

The fourth column is for the type of applicant i.e Individual or Non Individual. Individual refers to a person while Non-Individual refers to a Company.

-

Applied For

The fifth and last column shows what the taxpayer applied for whether it was Registration or whichever application that they made on KRA iTax Portal that generated a task that was to be verified by KRA Officer.

You will follow the same process when tracking the status of Payment Status of a Return at Kenya Revenue Authority (KRA). All you need to track the status of these applications is the Reference Number and the Search Code.

READ ALSO: How To Add Sole Proprietorship Business On KRA iTax Portal

To sum everything up, next time you need to know the status of your applications at KRA, just remember you will need only the Reference Number and Search Code so as to know the status of those applications. This guide forms the basis of the steps that you need to follow when tracking status of applications at KRA using the KRA Status Checker or KRA iTax Status Checker.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CHANGE EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.

Our dedicated team is ready to assist you immediately you fill and submit your service request online. Whether you need help with Registering KRA PIN Number, Retrieving KRA PIN Certificate, Updating KRA PIN Number or Changing KRA PIN Email Address, we are here to assist you.

Get in touch with us today and experience professional online customer support.