CYBER.CO.KE is an independent Cyber Services website and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). A service fee is charged for the assistance provided to customers in Kenya.

Get to know How To Verify KRA Tax Compliance Certificate Using iTax TCC Checker. Learn how to use KRA Portal TCC Checker today.

Do you have a Tax Compliance Certificate from Kenya Revenue Authority (KRA) that you need to verify and confirm its authenticity? This article will help you learn the steps which are involved and which you should follow when you need to verify KRA Tax Compliance Certificate (TCC) using the iTax TCC Checker.

In this article, I am going to share with you the steps involved in checking if KRA Tax Compliance Certificate is genuine or not and also whether it is active or expired. This will help you know whether or not the KRA Tax Compliance Certificate is valid.

READ ALSO: How To Login Into iTax Portal

But before we go any deeper into this article, we need to understand the most important terminology that article is focusing on and that is KRA PIN Checker. We need to understand what this is in relation to the KRA Portal and KRA PIN Number of a taxpayer.

To be able to use the iTax KRA PIN Checker, you need to ensure that you have with you the KRA PIN Number that you want to check on iTax Portal and confirm if it’s valid or not. Incase you have forgotten your KRA PIN, then you can request for KRA PIN Retrieval and have both your KRA PIN Number and KRA PIN Certificate sent to you.

Having a KRA PIN is one thing, confirming whether or not is another thing that all taxpayers in Kenya need to know how to do. The good thing is that iTax has a functionality that enables Kenyans confirm their KRA PIN Numbers with ease and convenience and that is what is called the iTax KRA PIN Checker or simply KRA PIN Checker.

What Is KRA TCC Checker?

The Tax Compliance Certificate Checker (KRA TCC Checker) on iTax allows you to confirm the validity of a KRA Tax Compliance Certificate (TCC). If you enter a genuine TCC Number, the iTax system will generate and display the KRA PIN, Name of the Holder and the TCC status.

Now, let us dive into the steps involved in verifying Tax Compliance Certificate on iTax. Before we begin, you will need the following:

-

Tax Compliance Certificate Number

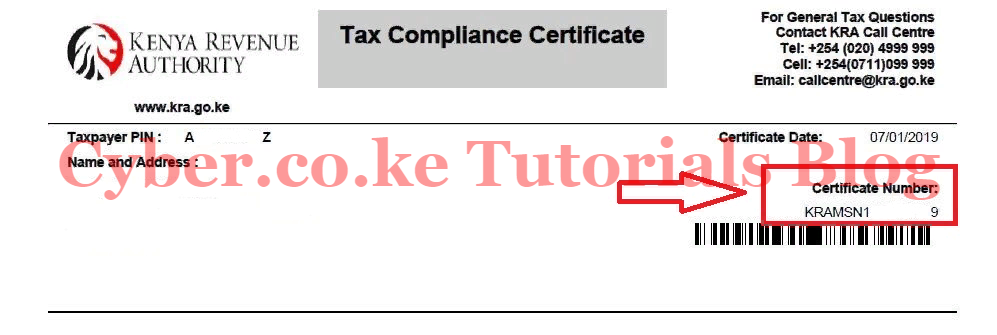

You can find your Tax Compliance Certificate Number at the top right hand side corner of the Tax Compliance Certificate. This is as illustrated below:

Assuming that you already have a TCC, if you do not have it yet, you can check our guide on How To Apply for KRA Tax Compliance Certificate using iTax. Now lets us look at the steps involved in verifying the KRA Tax Compliance Certificate.

How To Verify KRA Tax Compliance Certificate Using iTax TCC Checker

Step 1: Visit iTax Portal

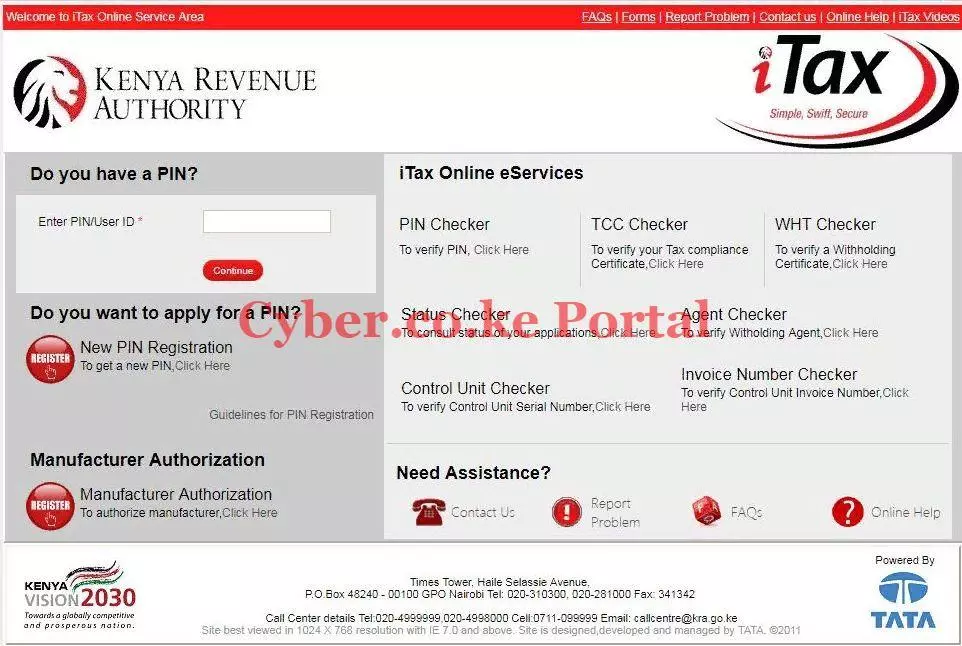

The first step involved visiting the KRA iTax Portal using the link provided in the above description.

Step 2: Click on the TCC Checker Section

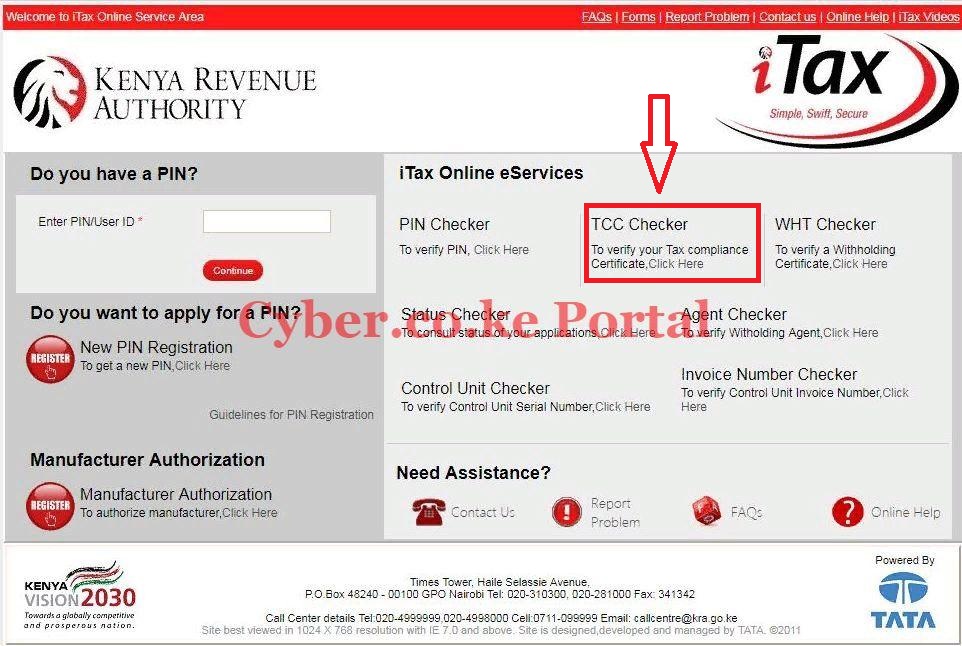

Next, you will need to click on the TCC Checker section as shown in the screenshot below.

Step 3: Authenticate Tax Compliance Certificate (TCC) Number

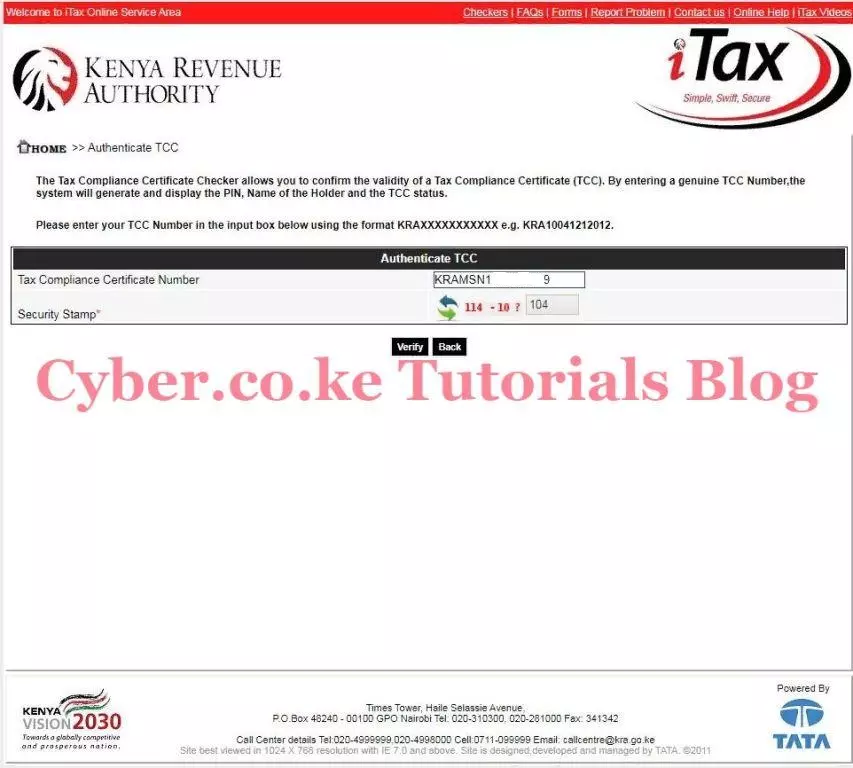

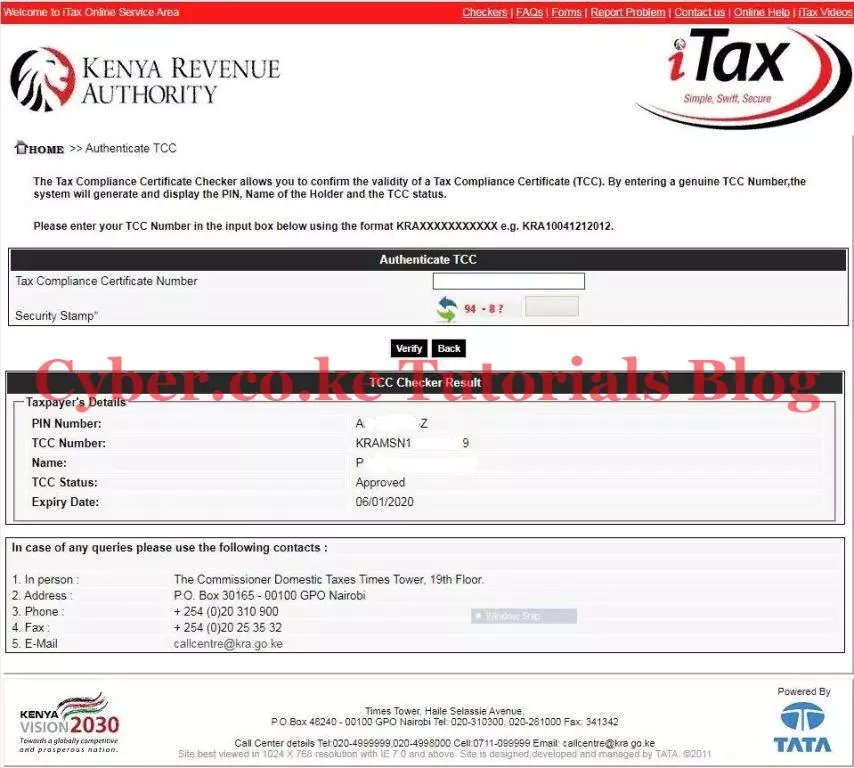

In this step, you need to enter your TCC Number in the input box using the format KRAMSNXXXXXXXXXX i.e KRAMSN1201254578. You will also need to solve the arithmetic question (security stamp). Once done, click on the “Verify” button.

Step 4: TCC Checker Result

This is the last step whereby the TCC Checker results will be displayed. This is as shown below.

You will need to note the following TCC Checker results in the taxpayer details column:

- PIN Number — the KRA PIN Number of the taxpayer will be displayed.

- TCC Number — the Tax Compliance Number

- Names — the names of the taxpayer

- TCC Status — the status of the TCC i.e Approved. (Note: if the TCC has expired it will also be shown here)

- Expiry Date — the date of expiry of the TCC i.e TCC are valid for a period of twelve months.

READ ALSO: How To Apply For Removal of KRA Tax Obligation

The above sums up the steps that are involved in verifying KRA Tax Compliance on iTax using the TCC Checker functionality.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.

ADVERTISEMENT

Check Out Our Popular Blog Posts

Check Out Our KRA Individual Services

Register KRA PIN Number

Submit Service Request →Retrieve KRA PIN Certificate

Submit Service Request →Update KRA PIN Number

Submit Service Request →Change KRA PIN Email Address

Submit Service Request →Check Out Our KRA Returns Services

File KRA Nil Returns

Submit Service Request →File KRA Employment Returns

Submit Service Request →File KRA Amended Returns

Submit Service Request →File KRA Withholding Tax Returns

Submit Service Request →Check Out Our KRA Tax Calculators

Calculate Turnover Tax (TOT)

TOT Calculator →Calculate Monthly Rental Income (MRI)

MRI Calculator →Calculate Value Added Tax (VAT)

VAT Calculator →Calculate Pay As You Earn (PAYE)

PAYE Calculator →CYBER.CO.KE

Get KRA Services Online Today

CYBER.CO.KE is a trusted online cyber services website dedicated to providing KRA Individual Services and KRA Returns Services to customers in Kenya on a day to day basis.

The KRA Individual Services that we offer to customers includes: Registration of KRA PIN Number, Retrieval of KRA PIN Certificate, Updating of KRA PIN Number and Changing of KRA PIN Email Address.

The KRA Returns Services that we offer to customers includes: Filing of KRA Nil Returns, Filing of KRA Employment Returns, Filing of KRA Amended Returns and Filing of KRA Withholding Tax Returns.

If you are looking for dependable, fast and reliable KRA Services in Kenya, we are ready and available to support you at every step of the way.

We prioritize customer convenience, clear communication and prompt service delivery, making sure that your submitted service request is completed in the shortest time possible.

ADVERTISEMENT