Do you need to check and confirm whether you have filed your KRA Returns on iTax Portal? Learn How To View Filed KRA Returns Using KRA iTax Portal.

Filing of KRA Returns is a must by any taxpayer who has an active KRA PIN Number. Problem normally arises in situations whereby the taxpayer does not know how to view his or her filed KRA Returns so as to ascertain that he or does not have any pending KRA Returns either KRA Nil Returns or KRA Employment Returns.

In this article, I am going to share with you the step by step guide on How To View Filed KRA Returns Using KRA iTax Portal. By the end of this article, you would learnt and know how to view your KRA Returns on iTax Portal so as to be sure that you do not have any pending KRA Returns thus playing your role as a Tax Compliant Taxpayer in Kenya.

READ ALSO: How To Download KRA PIN Certificate PDF Format Using iTax Portal

Viewing your KRA Returns on iTax is important as it enable you ascertain that your filed KRA Returns have been received and approved by the Kenya Revenue Authority (KRA). This article will be addressing key terms related to KRA Returns including: What Is KRA Returns, Types Of KRA Returns For Individual Taxpayers, Importance Of Viewing Filed KRA Returns On iTax Portal, Requirements Needed To View Filed KRA Returns on iTax Portal and How To View Filed KRA Returns Using KRA iTax Portal.

To be able to file your KRA Returns, you need to login to your iTax Account using your KRA PIN Number and KRA Password. It is important to take note that KRA Returns for Individuals are filed yearly between 1st January to 30th June. You always need to ensure that you file your KRA Returns before the deadlines.

Sometimes it’s important to take note that you need to check whether whether or not your KRA Returns have been filed on iTax. To do that, you need to know the steps and procedures that you should follow inorder to view all your filed KRA Returns on KRA Portal. The ggod thing is that there is a functionality inside iTax Portal that you can use to view your filed KRA Returns.

What Is KRA Returns?

KRA Returns is a standard form provided by the Kenya Revenue Authority (KRA) on which a taxpayer reports taxable income with permitted deductions and exemptions and computes his or her tax liability. The KRA Returns can either be KRA Nil Returns for those who do not have a source of income and KRA Employment Returns for those who have employment as a source of income.

You file KRA Returns for the Income tax that you have generated for a period of 12 months or 1 year. Income tax is a direct tax that is imposed on income derived from Business, Employment, Rent, Dividends, Interests, Pensions among others. Individual Income Tax is charged for each year of income on all the income of a person, whether resident or non-resident, which accrued in or was derived from Kenya.

KRA Returns are filed between 1st January and 30th June of each year for the Returns of the previous year. For example, this year 2020 we are filing the KRA Tax Returns for the year 2019. And as a taxpayer in Kenya, you have between 1st January to 30th June to ensure that you have file your KRA Income Tax Returns either KRA Nil Returns or KRA Employment Returns.

The Income Tax Laws are quite clear and state that each person with an active KRA PIN Number which can be applied online at Cyber.co.ke Portal through the KRA PIN Registration Services, is supposed to file his or her KRA Returns before the 30th June Deadline. As long as you have an active KRA PIN Number which you can get here at Cyber.co.ke Portal through our KRA PIN Registration Services, you need to file your KRA Tax Returns each and every year.

Failure to file your KRA Tax Returns by the 30th June Deadline leads to automatic penalties being imposed on you by Kenya Revenue Authority (KRA) and you will have to start the process of writing KRA Waiver Letter and Apply for KRA Waiver using iTax Portal, which rarely gets Approved. The only way to avoid all this is by ensuring that you file your KRA Income Tax Returns early.

Now that we have looked at what we mean by KRA Returns above, we need to go a notch higher and look at the types of KRA Returns for Individual taxpayers in Kenya. These are the KRA Nil Returns and KRA Employment Returns. This is as discussed below.

Types Of KRA Returns For Individual Taxpayers

Just as I had mentioned above, there are two types of KRA Returns for individual taxpayers who have the Income Tax Resident Individual Tax Obligation on their KRA PIN Number i.e. KRA Nil Returns and KRA Employment Returns.

-

KRA Nil Returns

The first type of KRA Returns is called the KRA Nil Returns. This type of KRA Return is filed by taxpayers who do not have any source of income either Business, Rental or Employment. KRA Nil Returns just as from its definition refers to Nil or Zero (0) tax return for taxpayers who don’t have any source of income. In most cases, when a taxpayer applies for a KRA PIN on Cyber.co.ke Portal, maybe because they need the PIN to apply for a job or even get a new DL from NTSA.

Majority of taxpayers who are supposed to file KRA Nil Returns tend to forget about KRA Returns. Some end up not filing their KRA Nil Returns before the 30th June Deadline and thus end up with the Kshs. 2,000/= imposed by KRA for late filing of returns. An this consequently leads to the taxpayer being denied a Tax Compliance Certificate due to pending KRA Nil Returns which they have not Filed on iTax Portal.

To be able to file KRA Nil Returns on iTax Portal, you can check out our article on How To File KRA Nil Returns using iTax Portal or How To File KRA Returns for Students using iTax Portal. If you require any help and assistance in filing KRA Nil Returns on iTax, you can fill and submit your order online for KRA Nil Returns Filing service request here at Cyber.co.ke Portal and our support team will be able to file your KRA Nil Returns in less than 3 minutes on iTax Portal.

-

KRA Employment Returns

The other type of KRA Returns is what is referred to as the KRA Employment Returns. This is the type of KRA Return that is filed by taxpayers who have employment as their source of income. In other words, those taxpayers who have a source of income through their employment. This group of taxpayers are what is referred to as the employed.

The good thing thing about those who are in employment is that they never tend to forget to file the KRA Income Tax Returns unlike the group of taxpayers who are unemployed and use the notion that they don’t have a job so there is no need to file their Returns. For those in employment PAYE (Pay As You Earn) is deducted at source by the employer and remitted to KRA on a monthly basis before the 9th day of the month.

By using their P9 Forms that they get from their employers, these taxpayers are supposed to log into their KRA iTax Web Portal Accounts and download the KRA Returns Excel Form which they need to fill in with the data that is captured on their KRA P9 Forms. Once done, this KRA Returns Form is supposed to to validated and uploaded into KRA iTax Account of the taxpayer.

To be able also to file your KRA Employment Returns on iTax Portal, you can refer to our article on How To File KRA Returns using P9 Form. Just remember that you need to have with you the KRA P9 Form and the KRA Returns Form. If you need assistance in filing your KRA Income Tax Returns, you can fill and submit your order for KRA Employment Returns Filing here at Cyber.co.ke Portal and our support will gladly assist you in filing your KRA Returns quickly and easily today.

Now that we have looked and understood the two types of KRA Returns for individual taxpayers in Kenya, we now need to highlight briefly the importance of viewing filed KRA Returns using KRA iTax Portal.

Importance Of Viewing Filed KRA Returns On iTax Portal

The questions that is normally on most taxpayers mind is: why should I view my filed KRA Returns? Well, to answer this question, we need to look at the importance of viewing Filed KRA Returns on iTax. There exists two key importance of viewing filed KRA Returns on iTax Portal. These are: To Confirm Whether You Have Any Pending KRA Returns and To Confirm Whether Your Filed KRA Returns Was Approved By KRA.

-

To Confirm Whether You Have Any Pending Year(s) Of KRA Returns Not Filed

By viewing your Filed KRA Returns on iTax Portal, you will be to see if you have any pending returns for a year that you failed or forgot to file for. You need to take note that the KRA iTax System allows a taxpayer to file KRA Returns for the year 2015 going forward i.e. 2015, 2016, 2018, 2018 and 2019. If you did not file KRA Returns for the year 2014 going downwards, then you need to visit your KRA Tax Station and they will be able to file all the previous years Returns.

-

To Confirm Whether Your Filed KRA Returns Were Submitted And Approved By KRA

You don’t just file KRA Returns and logout from your iTax Web Portal Account. You need to view the Filed KRA Returns to ascertain that they have been successfully submitted to KRA and that they are in the Approved Status. The last step when you have filed either the KRA Nil Returns or the KRA Employment Returns is downloading the KRA Returns e-Acknowledgement Receipt, which is just a confirmation that you have filed your KRA Returns.

Having looked at the importance of viewing Filed KRA Returns on iTax Portal, we now need to look at the main requirements that are needed in the process of viewing Filed KRA Returns on iTax Portal. To be able to view your Filed KRA Returns on iTax Portal, you are going to need KRA PIN Number and KRA iTax Password. This is as described below:

Requirements Needed To View Filed KRA Returns on iTax Portal

To be able to view Filed KRA Returns on iTax Portal, you need to login to iTax Account, and in this case you need to have with you KRA PIN Number and KRA iTax Password. I am going to highlight on each of these two requirements below.

-

KRA PIN Number

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

-

KRA iTax Password

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same as the one you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable you Reset KRA iTax Password.

Now that we have looked at the key requirements that are needed in the process of viewing Filed KRA Returns on iTax Portal, we can now look at the step by step guide on How To View Filed KRA Returns Using KRA iTax Portal.

How To View Filed KRA Returns Using KRA iTax Portal

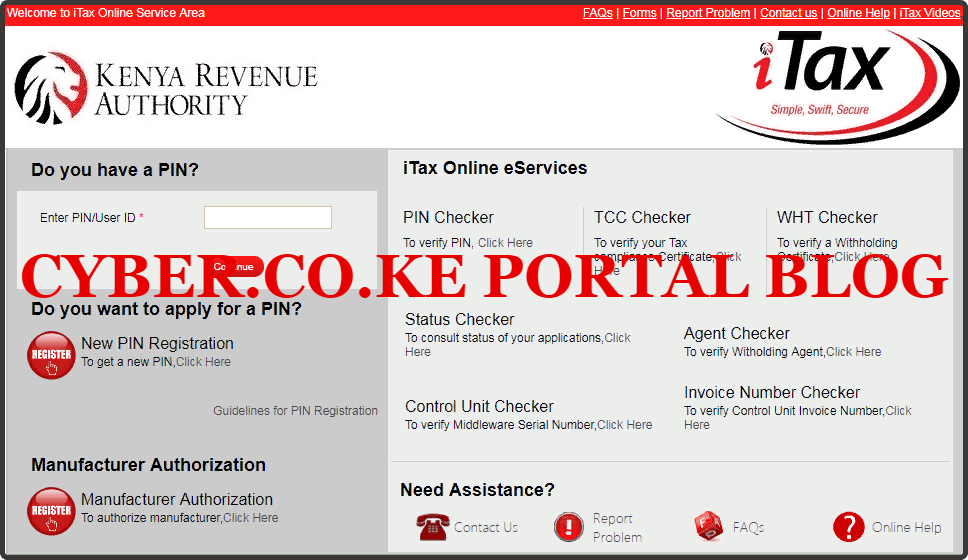

Step 1: Visit KRA Portal

The first step that you need to take in the process of How To View Filed KRA Returns Using KRA iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

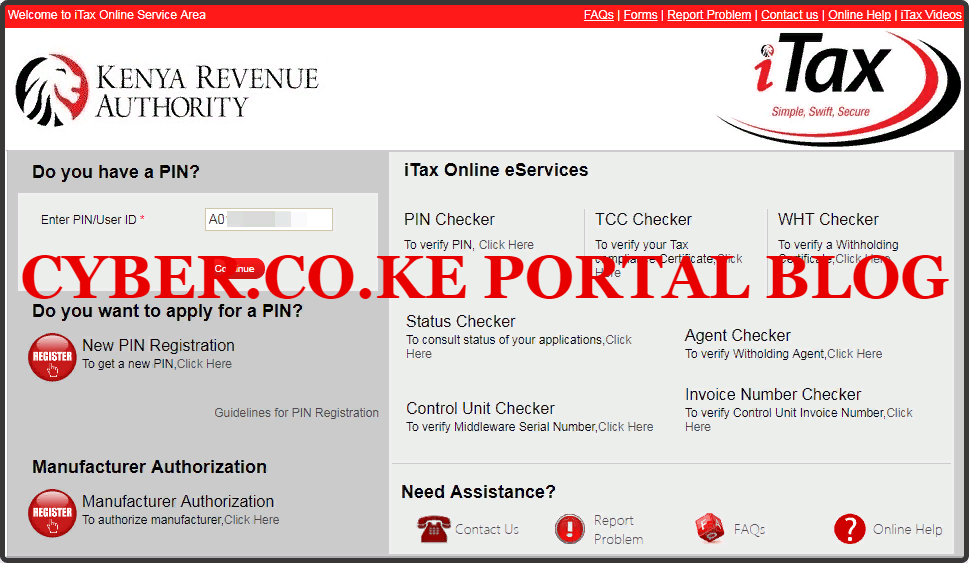

Step 2: Enter Your KRA PIN Number In the PIN/User ID Section

In this step, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

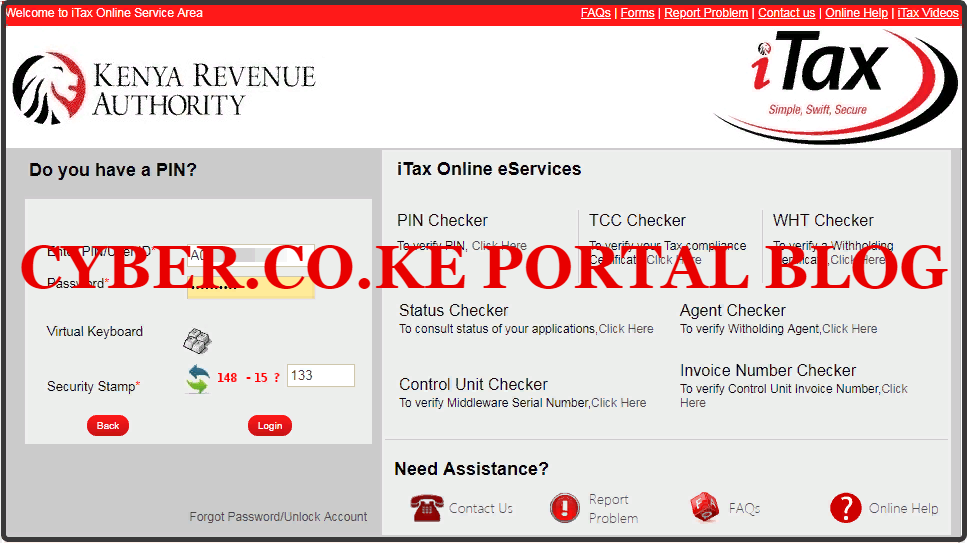

Step 3: Enter KRA iTax Password and Solve Arithmetic Question (Security Stamp)

In this step, you will be required to enter your KRA iTax Password and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA iTax Web Portal Account Dashboard

Once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA iTax Web Portal Account Dashboard. Here upon successful login process, you are able to view a wide range of iTax Portal functionalities. Since we need to view Filed KRA Returns Using iTax Portal, we proceed to Step 5 below.

Step 5: Click On Returns Followed By View Filed KRA Returns

From the menu list items, you will need to click on Returns and from the dropdown menu select View Filed Return. This is as illustrated in the screenshot below.

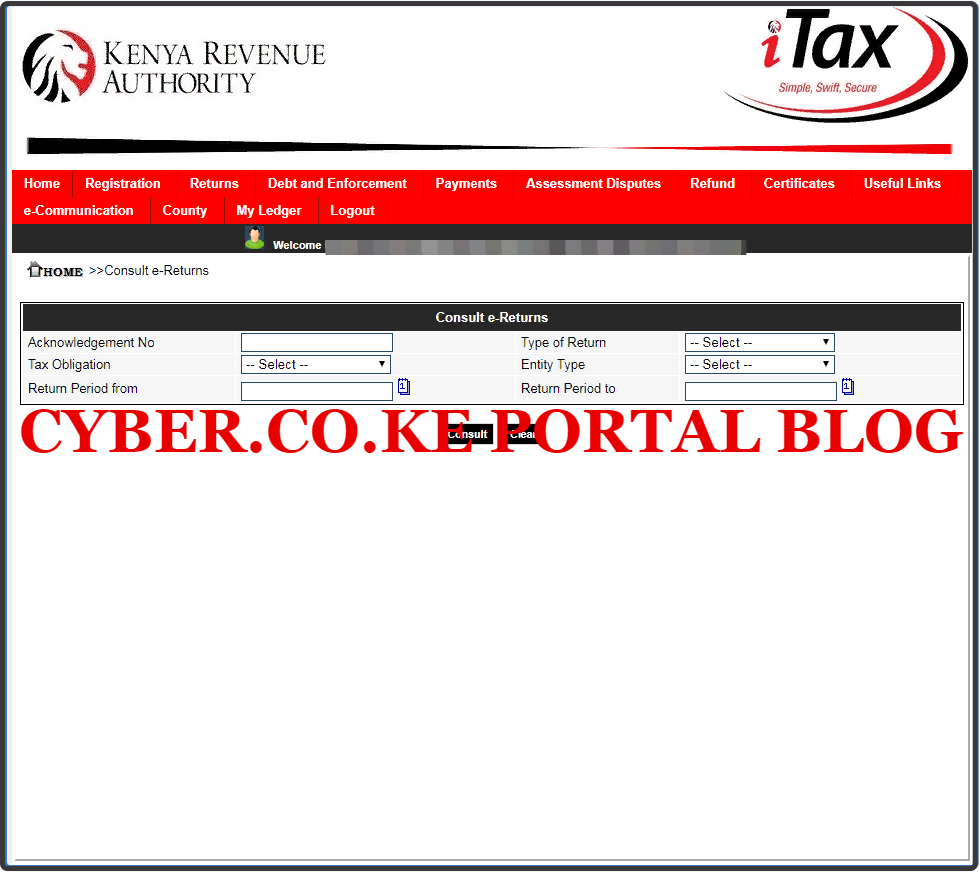

Step 6: Consult Filed e-Returns

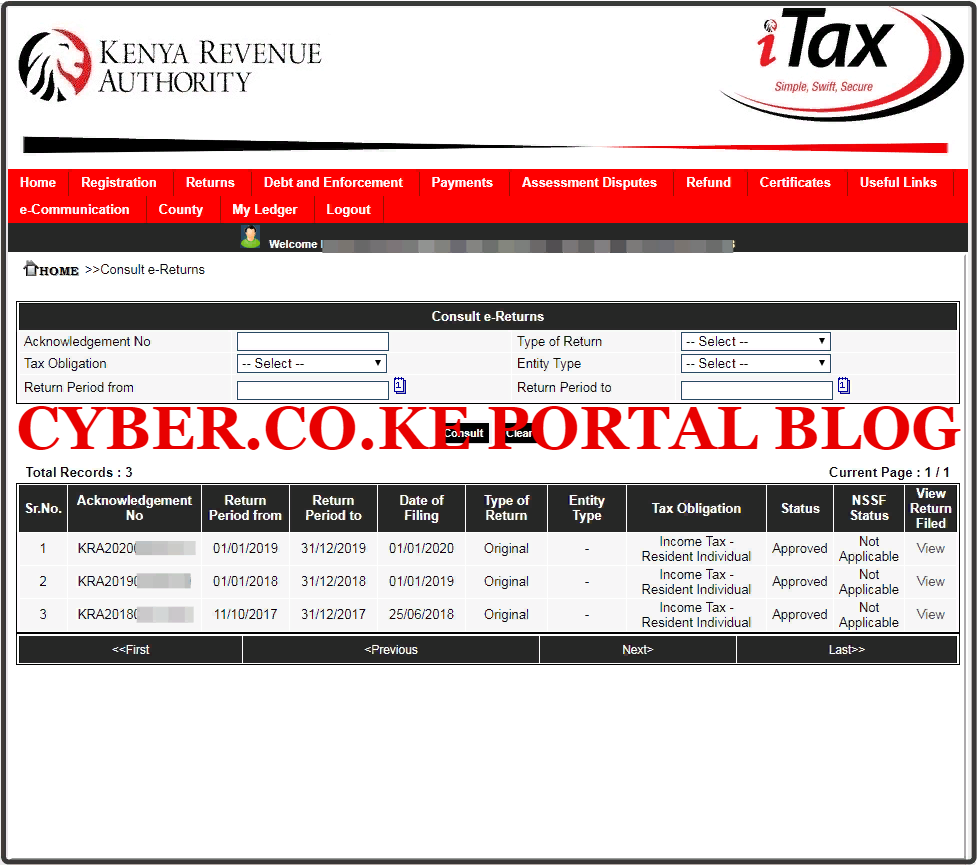

In this step, you will need to consult the filed e-Returns on KRA iTax Portal. You will notice many field items such as: Acknowledgement Number, Type of Return, Tax Obligation, Entity Type, Return Period From and Return Period To. The good news is that you don’t need to select and fill any of those fields. You are just required to consult and view Filed KRA Returns on your iTax Web Portal Account. You can do this by just clicking on the “Consult” button as illustrated in the screenshot below.

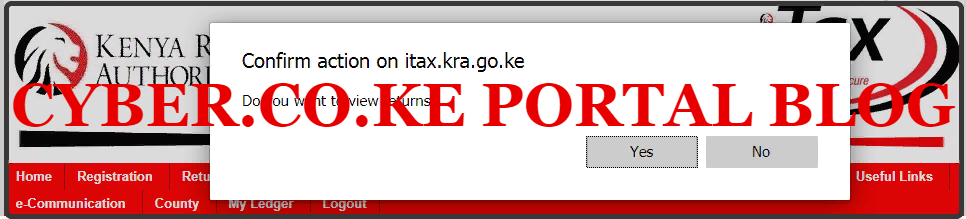

You will see a pop up notification from itax.kra.go.ke asking you to confirm the ation i.e. Do You Want To View Filed KRA Returns? At this point, you will need to click on the “Yes” button. This is as illustrated in the screenshot below.

Step 7: Results Of All Filed KRA Returns On iTax Portal

In this last step, you will be presented with all the KRA Returns that you have filed on iTax Portal. This is what we call the KRA Returns Results, as it shows you the Returns that you have been filing on iTax since the date you got the KRA PIN Number. You need to take note that there are different fields that are shown on the KRA Returns Results i.e. Serial Number (Sr.No.), Acknowledgement Number, Return Period From, Return Period To, Date of Filing, Type of Return, Entity Type, Tax Obligation, Status, NSSF Status and View Filed Return. This is as illustrated in the screenshot below.

From the above, you will be able to see all the Returns that you have filed and also their status. This is important in ensuring that you don’t have any pending KRA Returns that you have not filed yet. If you don’t see any results when you follow the above steps on How To View Filed KRA Returns, then that simply means that you haven’t filed any KRA Returns on iTax Portal. This is with exception if you applied and got your KRA PIN this year through KRA PIN Registration services at Cyber.co.ke Portal. If this is the case i.e. you are a new taxpayer, you will start filing Returns from next year.

To sum up the above, before viewing your Filed KRA Returns on iTax Portal, always ensure that you have with you KRA PIN Number and KRA iTax Portal which form part of the KRA Login Credentials. Once you have the above two requirements, you will be able to login into your KRA iTax Portal and view all your Filed KRA Returns. You can follow the above steps on How To View Filed KRA Returns Using KRA iTax Portal.

READ ALSO: How To Download KRA Returns Form Using KRA iTax Portal

If you need help and assistance with filing KRA Returns either KRA Nil Returns or KRA Employment Returns, feel free to submit your order online at Cyber.co.ke Portal for KRA Nil Returns Filing and KRA Employment Returns Filing. Our support team once in receipt of your KRA Returns Filing order will work on it and send you the KRA Returns Acknowledgment Receipt to your email address. Avoid the last minute rush and file Your KRA Returns today.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.