Filing of KRA Returns is mandatory for all taxpayers in Kenya who have KRA PIN Numbers. It is a very important exercise that enhances tax compliance amongst taxpayers. Kenya Revenue Authority (KRA) has set deadlines for filing of KRA Returns for different tax obligations in Kenya.

But one common factor that they all share is that the KRA Returns need to be filed on or before the elapse of the set deadline. If you are not sure if your records in terms of KRA Returns are up to date, you can use the View Filed Returns feature that is available on iTax. To be able to view filed KRA Returns online using iTax, you need to ensure that you have with you both the KRA PIN Number and KRA Password (iTax Password) which you need to access your iTax account.

It is quite important that all taxpayers learn and get to know the main steps that they need to follow in order to check whether or not they have filed KRA Returns on iTax. In this blog post, I am going to share with you the main steps that are involved in the process of How To View Filed KRA Returns on iTax.

READ ALSO: Step-by-Step Process of Confirming Your KRA PIN Using KRA PIN Checker

How To View Filed KRA Returns

The following are the 5 main steps involved in the process of How To View Filed KRA Returns that you need to follow.

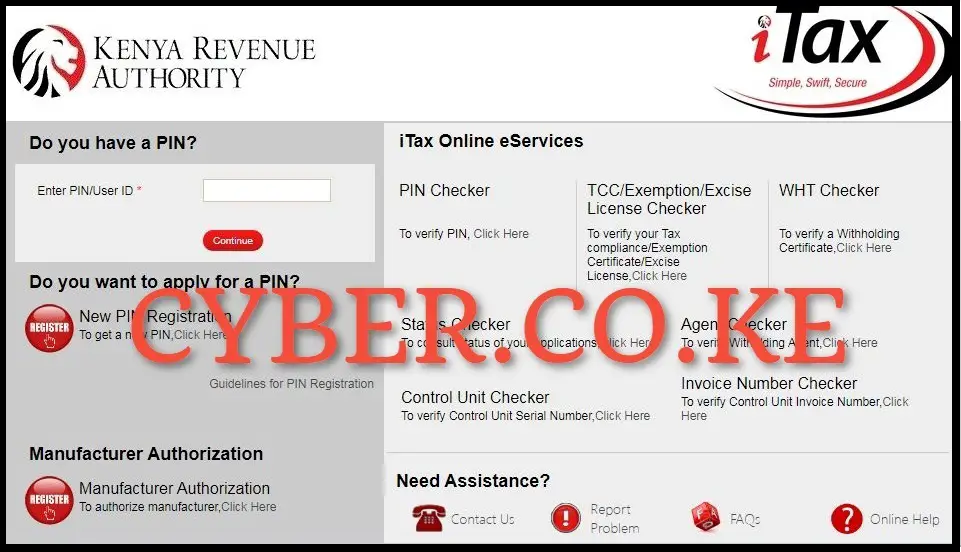

Step 1: Visit iTax

The first step in the process of viewing filed KRA Returns is to visit iTax by using https://itax.kra.go.ke/KRA-Portal/

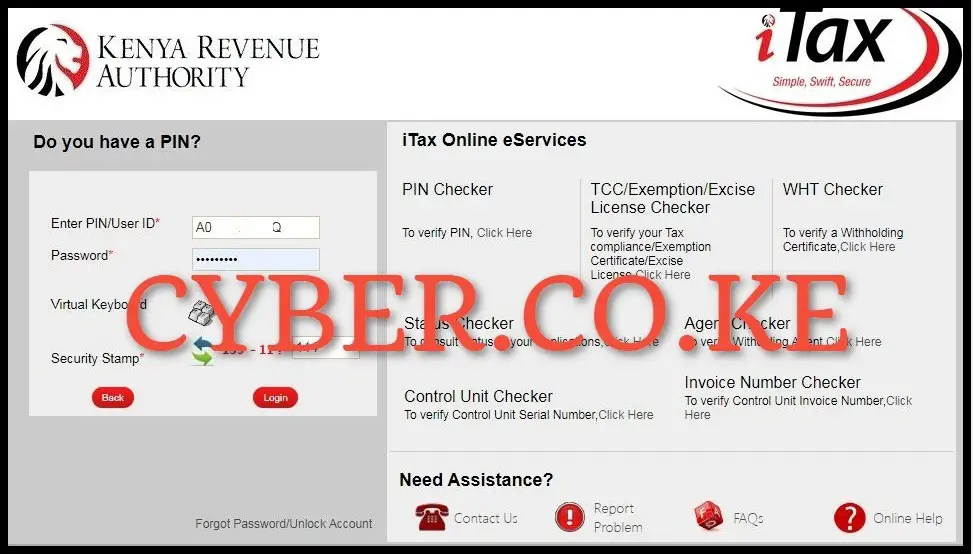

Step 2: Login Into iTax

In this step, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and click on the “Login” button to access your iTax account.

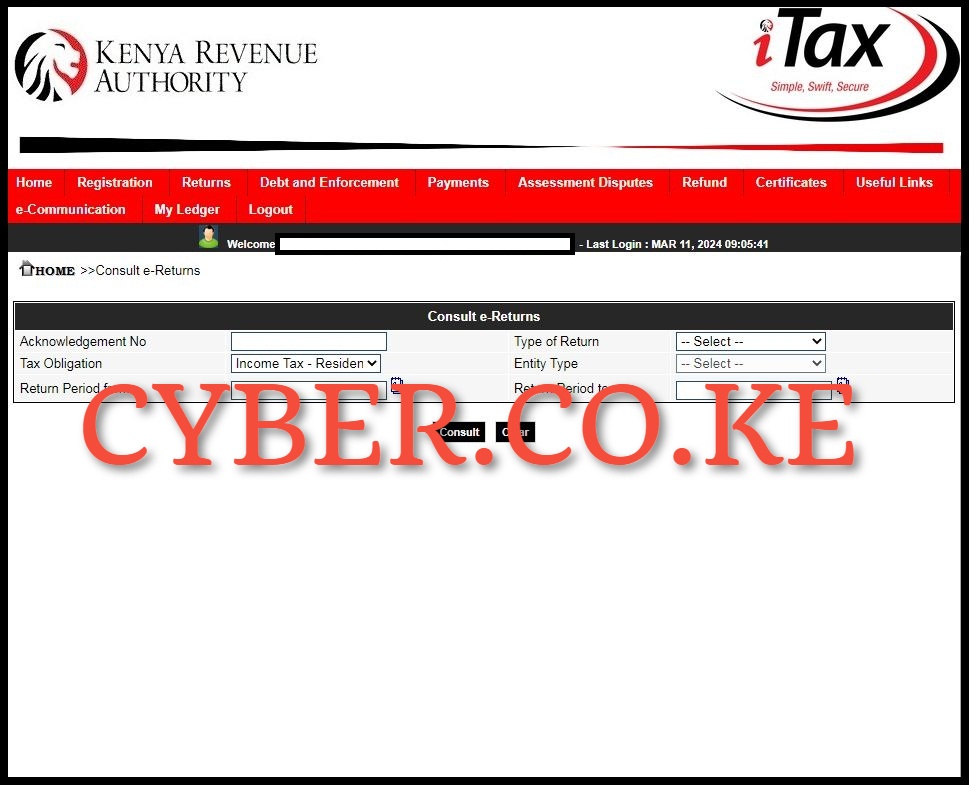

Step 3: Click on Returns followed by View Filed Return

Next, on the top menu click on “Returns” followed by “View Filed Returns” from the drop down menu items list to initiate the viewing of your filed KRA Returns on iTax.

Step 4: Consult e-Returns

In this step, you need to select the KRA Tax Obligation that you want to view the KRA Returns for. In this example, we shall select “Income Tax – Resident Individual” as the tax obligation and proceed to click on the “Consult” button to view the filed KRA Returns under that tax obligation on iTax. A pop up window will appear with the message “Do you want to view returns?” You need to click on the “OK” button to be able to view filed KRA Returns on iTax.

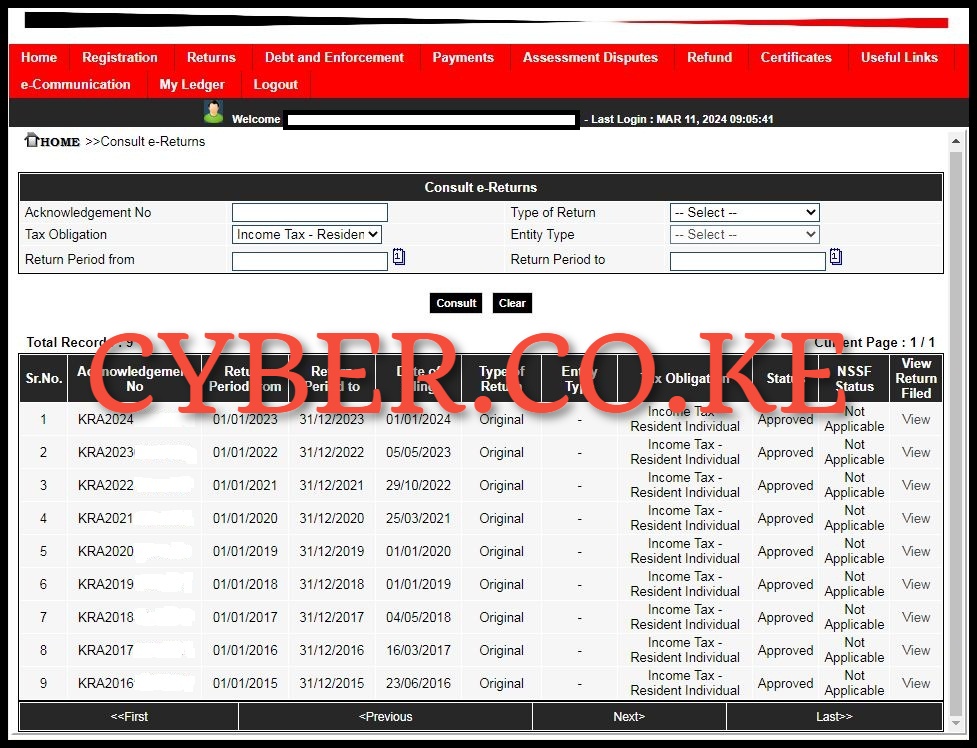

Step 5: View Filed KRA Returns on iTax

The last step involves viewing the filed KRA Returns on iTax under the tax obligation that you selected on the Consult e-Returns form. You will see the records of all the KRA Returns that you have filed on iTax. In this example, the taxpayer returns records start for the return period of 01/01/2015 to 31/12/2015 being the first return filed and the last/current return filed being 01/01/2023 to 31/12/2023.

READ ALSO: Step-by-Step Process of Reprinting PIN Certificate

The above 5 steps sums up the process of How To View Filed KRA Returns on iTax. As mentioned at the beginning of this blog post, for you to view filed KRA Returns online, you need to have with you both the KRA PIN Number and KRA Password (iTax Password) needed to login into iTax account. Once you are logged in successfully, you can follow the above outlined steps to check, view and confirm all your Filed KRA Returns online using iTax.

TRENDING BLOG POSTS IN KENYA

CYBER.CO.KE

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

CLICK HERE TO REGISTER KRA PIN NUMBER

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

CLICK HERE TO RETRIEVE KRA PIN CERTIFICATE

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

CLICK HERE TO UPDATE KRA PIN NUMBER

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

CLICK HERE TO CHANGE KRA PIN EMAIL ADDRESS