Get to know How To Write KRA Waiver Letter that you will use to apply for KRA Penalties and Interests accrued in your iTax account.

In this blog article, I am going to share with you the process that you need to follows when you are applying for KRA Waiver either on the penalties or interests accrued.

Every year, many Kenyans come face to face with the tax man’s wrath for failure of filing their returns on time. Failure to file returns, including nil returns for those who did not earn taxable income during the year, now attracts a fine of Ksh 2,000. The same applies to late filing i.e. submissions / filings made after June 30th.

The consequence of not filing your returns on time whether employment income returns or nil returns is that KRA will slap you with a penalty of Kshs. 2,000 for late filing. Unless you have Kshs. 2,000 to dish out, then you are fine. But what about the millions of Kenyans who have active KRA PINs and fail to even file nil returns?

READ ALSO: How To Apply For KRA Waiver Using iTax Portal

What is KRA Waiver Letter?

Please take note that KRA Waiver processing is a structured process which needs to be validated by an officer before the waiver is approved or rejected. Besides, it is not guaranteed. It can be rejected. Processing of KRA Waiver takes 90 days.

When are you Required to Write KRA Waiver Letter?

The necessity of writing KRA Waiver Letter arises when you know you did not file for KRA Returns on time. So, the penalty was automatically imposed for late filing. So, if you know you did not have a source of income at that time, then you should go ahead and start drafting the letter.

How do you Know if you have KRA Penalties?

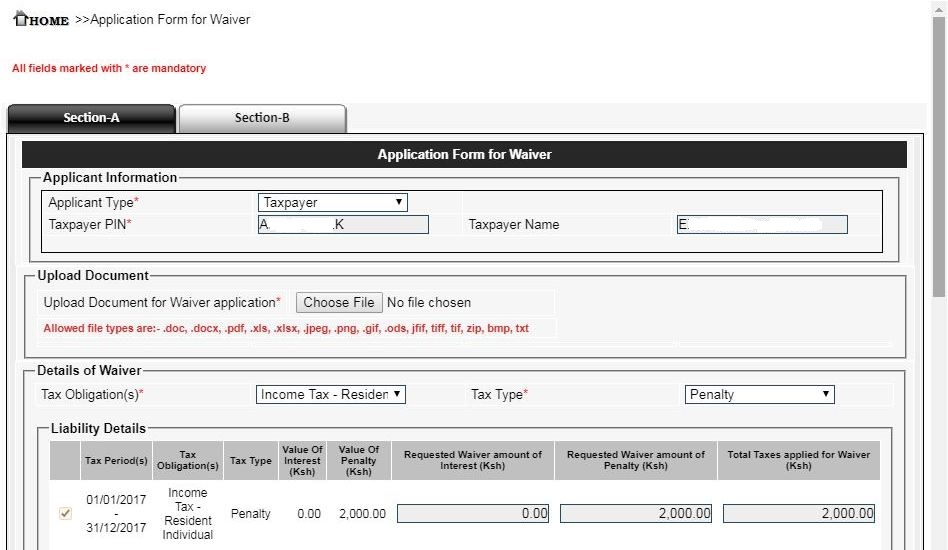

It is quite simple to know whether you have KRA Penalties. You can do this using your iTax account. Just log into your KRA iTax account; under Debt and Enforcement, click on Request for Waiver of Penalties and Interests; under details of waiver, click on tax obligation (Income Tax Resident Individual) and then tax type select penalty. You can have a look at the screenshot below to give you an idea.

So, from the image above you can see that the taxpayer has a penalty of Kshs. 2,000 for late filing of the returns for the year 2017. Now, this person needs to know How To Write KRA Waiver Letter so as to have the penalty waived off. You also need to note that the same waiver letter needs to be uploaded on the iTax portal.

How To Write KRA Waiver Letter

Writing KRA Waiver Letter is quite simple. There is no specific format for writing the Waiver letter. You just need to write explaining the reasons why the penalties occurred and justify why you requesting for a waiver.

The contents of a KRA Waiver Letter are basically not that many. You need to know that the Waiver Letter is normally addressed to the station manager. The KRA Station is normally written on the pin certificate, so when writing this letter, address it to you station manager.

Kindly note that the waiver application is approved at your station. You can also follow up with your tax station on the progress of the task. In our case, this KRA Waiver Letter is for a student who was still in College/University and was unable to file the Returns on time.

Your Names,

Postal Address,

Mobile Number,

Date.

The Station Manager,

Kenya Revenue Authority,

“Your Tax Station”

Domestic Tax Department (DTD)

RE: APPLICATION FOR WAIVER ON PENALTY FOR THE YEAR “2017” ON PIN NUMBER A000000000B

I am hereby writing this letter to request for waiver for my KRA PIN number A001000000B under the Income Tax Resident Individual obligation. I was unable to file my returns for the year “2017” as I was still in University pursuing my studies.

At the time I got the KRA PIN number I did not a source of Income and was still in University. I have also attached my academic transcripts to confirm the same.

“” {Give more reasons why you require waiver on the penalty accrued. Explain your reasons well so as to get the waiver application approved.} “”

I am hereby writing this letter requesting your humble office for waiver on the above penalty. I look forward to your response to this urgent matter .

Yours faithfully,

“Your Name”

“Signature”

“Your KRA PIN Number”

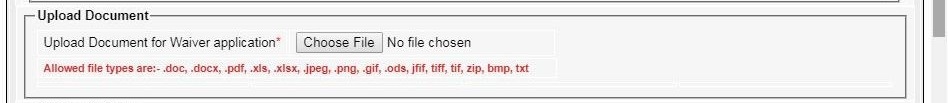

The success of any KRA Waiver application letter depends on your reasons for application of your waiver. Also attached evidence to support your waiver request will come in handy. Once you have drafted your KRA Waiver Application Letter, you have to upload it on the iTax account. Below is the screenshot where you need to upload the letter.

And that is how you write your KRA Waiver Application Letter. You can download the KRA Waiver Letter template using the links below.

Download>>KRA WAIVER APPLICATION LETTER SAMPLE TEMPLATE (MS Word Version)

Download >>KRA WAIVER APPLICATION LETTER SAMPLE TEMPLATE (PDF Version)

Once you have known How to Write KRA Waiver Letter, you can then proceed to the process of How to Apply for KRA Waiver using iTax.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator on the YouTube Channel Cyber Services Kenya, specializing in crafting insightful and informative Blog Posts and Video Tutorials that empower Kenyans with practical skills and knowledge. Holding a Bachelor’s Degree in Business Information Technology (BBIT) from JKUAT, he blends technical expertise with a passion for clear and impactful communication. Do you need his help? Email Address: [email protected]

Get KRA Services Online Today

KRA PIN REGISTRATIONAre you looking for KRA PIN Registration services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Change of Email Address services?

We are here and ready to assist you today.

Submit your service request online now and let us handle everything for you.

Receive your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.