Have you forgotten and need to Recover your KRA PIN and KRA PIN Certificate? Get to know the KRA PIN Recovery Process And Steps Using KRA iTax Portal. Know the steps involved in How To Recover lost or forgotten KRA PIN Number and KRA PIN Certificate in Kenya quickly and easily using CYBER.CO.KE Portal. It is a common thing that majority of taxpayers in Kenya don’t remember their KRA PIN Number that easily.

READ ALSO: How To Reset Forgotten KRA Password Online Using iTax Portal

This has in turn given rise to the rise of the KRA PIN Recovery request by the taxpayers in Kenya on a day to day basis. Many taxpayers want to recover both their KRA PIN Number and KRA PIN Certificate so as to allow them to use them where there are required. In this article, I am going to share with you the KRA PIN Recovery process and steps that if you have forgotten your KRA PIN, you should always follow so as to recover both lost or forgotten KRA PIN Number and KRA PIN Certificate quickly and easily.

By the end of this article, you will have learn and known the KRA PIN Recovery Process And Steps Using KRA iTax Portal that you ought and need to always take when you want to recover your KRA PIN in the shortest time possible. Knowing how to recover both your KRA PIN and the KRA PIN Certificate is of great value for any taxpayer who has forgotten his or her KRA PIN Number and needs it to be recovered quickly and sent to their email addresses. This article will cover the basics of the KRA PIN Recovery process and steps by addressing and looking at key aspects.

We shall be looking at key terms and concepts such as: What Is KRA PIN Recovery, Types Of KRA PIN Recovery, Importance Of KRA PIN Recovery, Requirements Needed For KRA PIN Recovery and KRA PIN Recovery Process And Steps Using KRA iTax Portal. But one of the quickest ways to recover your KRA PIN is by using the KRA PIN Retrieval services here at Cyber.co.ke Portal. Your KRA PIN Certificate will be recovered and the same will be sent to your preferred email address of choice.

What Is KRA PIN Recovery?

KRA PIN Recovery is the process that a taxpayer follows in order to recover or retrieve his or her lost KRA PIN Number and the KRA PIN Certificate using Cyber.co.ke Portal‘s KRA PIN Retrieval service. The KRA PIN Recovery process entails two key aspects i.e. recovery of the KRA PIN Number if the PIN has not yet been updated or migrated to iTax Portal and recovery of the KRA PIN Certificate if the PIN is already on iTax Portal. This process is sometimes referred to as KRA PIN Retrieval and taxpayer can easily place order for KRA PIN Retrieval using Cyber.co.ke Portal.

As a process, KRA PIN Recovery enables the taxpayer to recover and retrieve either the KRA PIN Number or the KRA PIN Certificate. This is because there are some KRA PIN Numbers of many taxpayers in Kenya which have not yet been updated or migrated to the KRA iTax Portal upto today. The same also applies to KRA PIN Numbers that are already on iTax Portal but the owners have forgotten and thus the need to retrieve and recover the KRA PIN Certificate.

So, from the definition you can note that the recovery process entails the recovery and retrieval of either the KRA PIN Number or the KRA PIN Certificate. All these depends on whether or not the KRA PIN is on iTax Portal or not yet on iTax Portal. So, a taxpayer can either choose to recover his or her KRA PIN Number that is not yet on KRA iTax Portal and have it updated on iTax Portal using the KRA PIN Update services at Cyber.co.ke Portal.

The same applies to KRA PIN Certificate recovery or retrieval. The taxpayer can choose to retrieve the KRA PIN Certificate and have the same KRA PIN Certificate sent to his or her email address using the KRA PIN Retrieval services that Cyber.co.ke Portal offers to taxpayers in Kenya on a day to day basis. Having looked at the definition of KRA PIN Recovery above, we now need to look at the types of KRA PIN Recovery can a taxpayer can choose.

Types Of KRA PIN Recovery

There are two types of KRA PIN Recovery i.e. Recovery of KRA PIN Number and Recovery of KRA PIN Certificate. We now need to look at what each one of these types of recoveries mean in relation to the taxpayer KRA PIN and the KRA iTax Portal.

Recovery Of KRA PIN Number

The first type of KRA PIN Recovery is what is called the Recovery of the KRA PIN Number. This is basically retrieving the lost or forgotten KRA PIN Number that has not yet been updated or migrated on iTax Portal. Once the KRA PIN Number is recovered, the taxpayer has to request for KRA PIN Update using Cyber.co.ke Portal so as to have the recovered KRA PIN Number updated on the KRA iTax Portal.

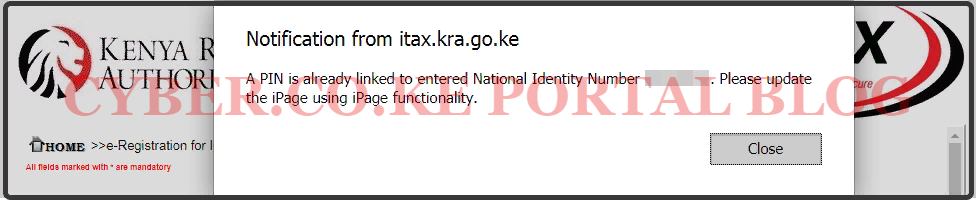

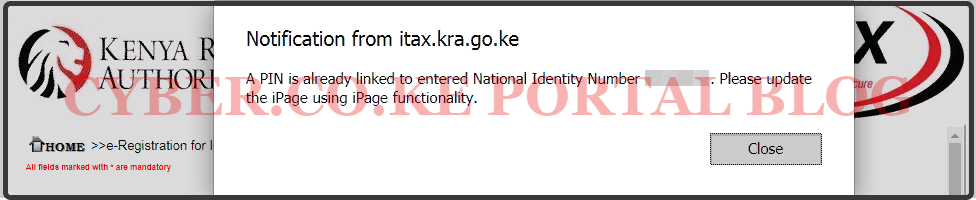

When you get the following message on iTax Portal; “A PIN is already linked to entered National Identity Number. Please update the iPage using the iPage functionality” This simply means that you already have a KRA PIN Number that is not yet updated on iTax Portal. You now need to retrieve the KRA PIN using KRA PIN Retrieval services and Update the KRA PIN using KRA PIN Update services that is offered at Cyber.co.ke Portal.

Recovery Of KRA PIN Certificate

The other type of KRA PIN Recovery is what is referred to as the Recovery of KRA PIN Certificate. Basically this entails the retrieval of a taxpayer’s KRA PIN Certificate by using the KRA PIN Retrieval services at Cyber.co.ke Portal. Normally, the lost of forgotten KRA PIN Certificate of the taxpayer will be retrieved and sent to his or her email address for printing.

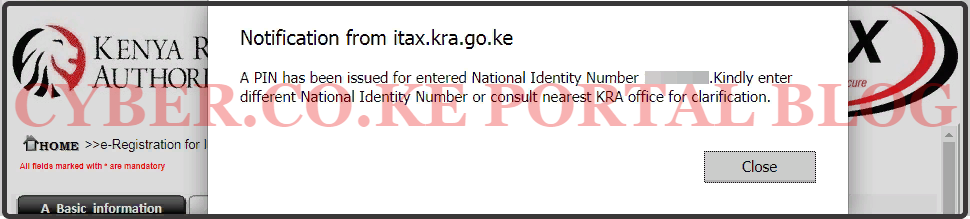

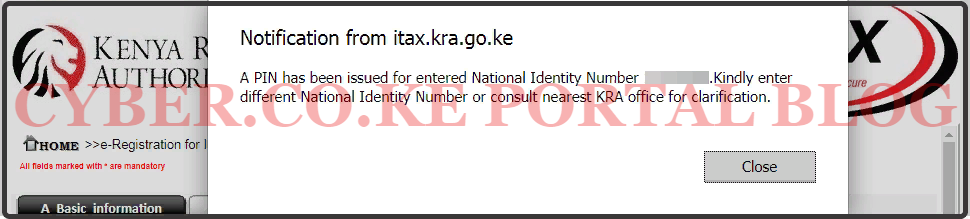

When you get the following message on iTax Portal; “A PIN has been issued for entered National Identity Number. Kindly enter a different National Identity Number or consult nearest KRA office for clarification” This simply means that your KRA is already on itax and you need to retrieve the KRA PIN Certificate online using KRA PIN Retrieval services at Cyber.co.ke Portal and have the KRA PIN Certificate sent to your email address within 30 minutes of submitting your order.

So, why is KRA PIN Recovery so important to a taxpayer in Kenya? Well, to answer this question we need to look at the Importance Of KRA PIN Recovery as outlined below.

Importance Of KRA PIN Recovery

KRA PIN Recovery is a very important process that helps nearly all taxpayers in Kenya to recover either their KRA PIN Numbers or KRA PIN Certificates by using the KRA PIN Retrieval services at Cyber.co.ke Portal. The recovery process is of two key importance i.e. Retrieval Of KRA PIN Numbers and Retrieval Of KRA PIN Certificate. This is as described below.

Retrieval Of KRA PIN Numbers

The KRA PIN Recovery process is of great importance in that it allows for the Retrieval of KRA PIN Numbers of taxpayers who have forgotten their KRA PIN Numbers and need them to be updated on iTax Portal using the KRA PIN Update services offered at Cyber.co.ke Portal.

Retrieval Of KRA PIN Certificate

The KRA PIN Recovery is also important in that it allows for the Retrieval of KRA PIN Certificates of taxpayers who have lost or forgotten their KRA PIN Certificates which are already on iTax Portal through the use of the KRA PIN Retrieval services offered at Cyber.co.ke Portal.

Now we need to change gears a little bit and look at the key requirements that a taxpayer needs to have in the recovery of his or her KRA PIN Number or KRA PIN Certificate using the KRA iTax Portal and Cyber.co.ke Portal.

Requirements Needed For KRA PIN Recovery

To be able to recover either your KRA PIN Number or KRA PIN Certificate using the KRA iTax Portal and Cyber.co.ke Portal, you need to ensure that you have with you the ID Number, Date of Birth and Email Address. These are the most important requirements that will make the KRA PIN Recovery process much easier and quicker for any taxpayer in Kenya.

ID Number

The first requirement that you need to ensure that you have with you in the process of KRA PIN Recovery using the KRA iTax Portal is your ID Number. Basically any Kenyan above the age of 18 years has a National ID. You are going to need that ID Number as all KRA PINs are normally linked to a taxpayer’s ID Number.

Date of Birth

The other key requirement that you are going to need in the KRA PIN Recovery process is the Date of Birth. This is normally displayed in your National ID either in full that is date/month/year or certain National IDs simply have the year only i.e. 00/00/1970.

Email Address

The last requirement that you need to have with you in the process of recovery of either your KRA PIN Number or KRA PIN Certificate is a valid and working email address. You can either have Gmail, Yahoo or Outlook. This is important as the recovered KRA PIN Number of KRA PIN Certificate will be sent to you only through a valid and working email address.

Having looked at the key requirements that are needed in the KRA PIN Recovery process above, we now need to look at the step by step guide of KRA PIN Recovery Process And Steps Using KRA iTax Portal. One thing to note is that the KRA PIN Recovery process makes use of both KRA iTax Portal to check whether you have a KRA PIN (if the it recovery of KRA PIN Number or recovery of KRA PIN Certificate) and the Cyber.co.ke Portal to Retrieve your KRA PIN Certificate and also to Retrieve your KRA PIN Number (if recovery of KRA PIN Number that is not yet on iTax Portal then KRA PIN Update or recovery of KRA PIN Certificate that is already on iTax then KRA PIN Retrieval)

How To Recover KRA PIN Number

Step 1: Visit KRA Portal

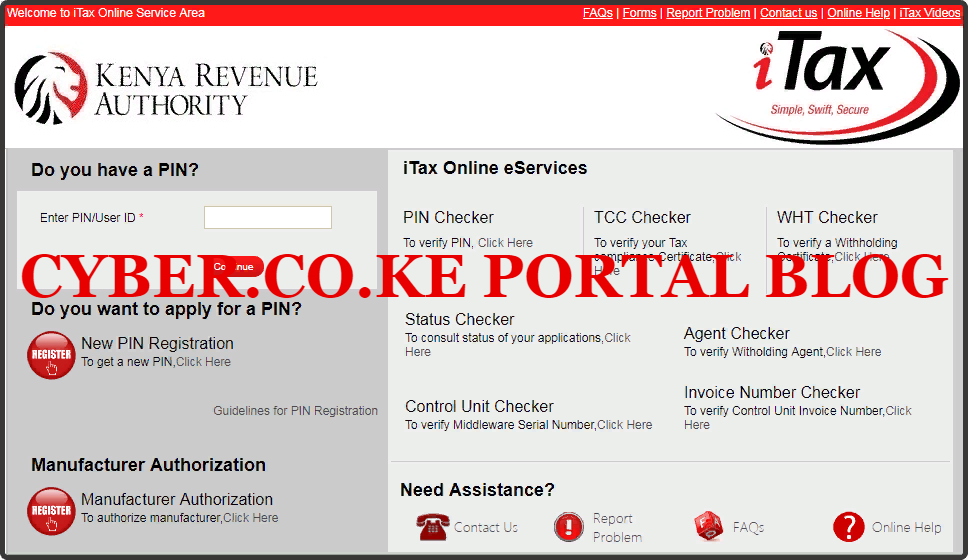

The first step that you need to take in KRA PIN Recovery Process And Steps Using KRA iTax Portal is to ensure that you visit the KRA iTax Web Portal using the link provided above in the description. Take note that the above is an external link that will take you to the KRA iTax Portal i.e. link will open in a new tab.

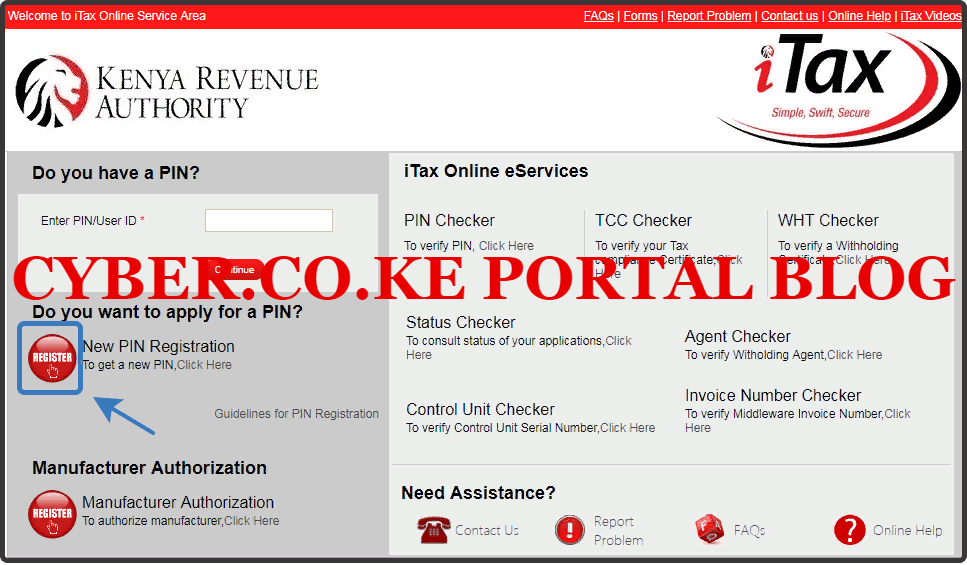

Step 2: Click on the Register Button On iTax Portal Homepage

Next, you will need to click on the “Register” button located at the left hand side of the iTax Portal. This is as illustrated in the screenshot below.

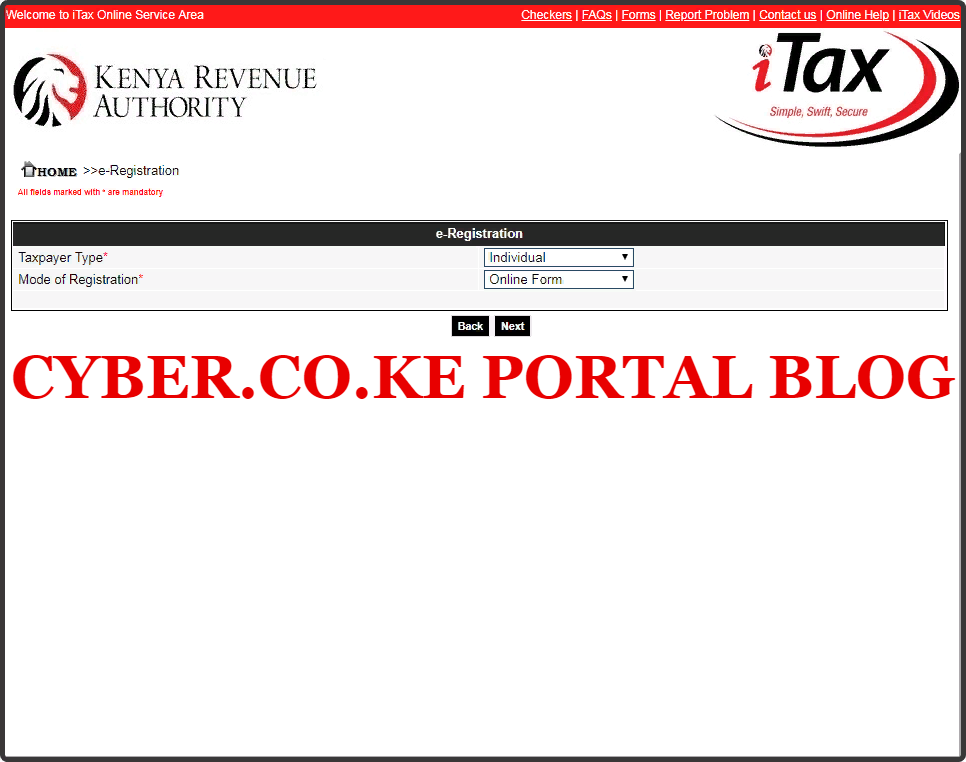

Step 3: Select Individual and Online Form in the e-Registration Part

In this step, you are going to select Individual and then Online Form in the e-Registration for. This is as illustrated below. Click on the “Next” button once you have done so.

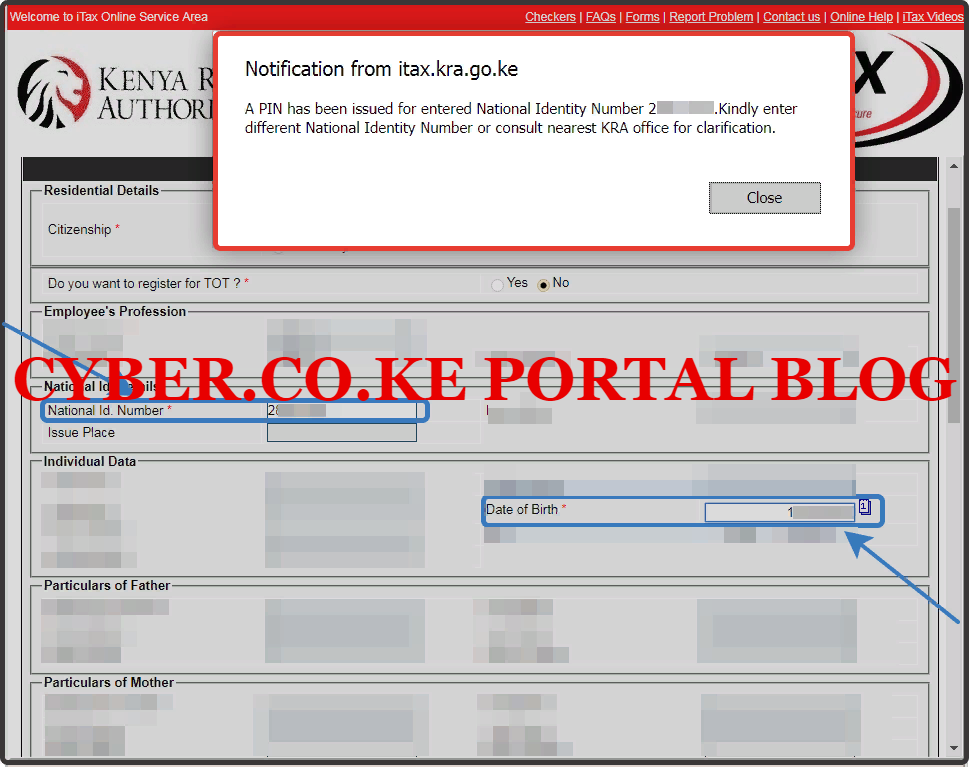

Step 4: Select Citizenship as Kenyan and then Enter National ID and Date of Birth

Here, you will need to select the citizenship under Residential Details as Kenyan, and then enter National ID Number under the national ID details sections then enter Date of Birth under the Individual Data section. Click in any part of the screen. This is as illustrated below.

KRA PIN Update

You need to take note that you can get two outcomes. First, the ID Number has a KRA PIN that is linked to it and you need to retrieve the KRA PIN Number and Update it using KRA PIN Update services at Cyber.co.ke Portal.

KRA PIN Retrieval

The other outcome is that the ID Number has already been used to register a KRA PIN that is already on iTax Portal. In this case you will have to retrieve and recover the KRA PIN Certificate using KRA PIN Retrieval services at Cyber.co.ke Portal.

Step 5: Fill KRA PIN Recovery Form at CYBER.CO.KE

Now that you have found out that you already have a KRA PIN Number on iTax, you need to start the KRA PIN Retrieval process here at Cyber.co.ke Portal, by just simply filling the KRA PIN Retrieval form below. You need to fill in the National ID Number and Valid Email Address only. Below is the form that you need to fill inorder to recover and retrieve both your KRA PIN Number and KRA PIN Certificate.

Step 6: Pay For KRA PIN Recovery Using Lipa Na M-Pesa Till Number 4288558

Once you have successfully filled in the KRA PIN Retrieval Form above, you will head over to M-Pesa and pay for KRA PIN Retrieval service request at Cyber.co.ke Portal using Lipa na M-Pesa Till Number 4288558.

Step 1: Go to Lipa na M-Pesa

Step 2: Select Buy Goods and Services

Step 3: Enter Till Number: 4288558

Step 4: Enter the amount: Kshs. 200

Step 5: Enter your M-PESA PIN and confirm the details

You will get an SMS notification from M-PESA upon successful payment of Kshs. 200 to CYBER SERVICES for your online order. Also you will receive another SMS notification from CYBER PORTAL confirming successful payment and receipt of your KRA PIN Retrieval online order service request.

Once your online order has been submitted successfully to Cyber.co.ke Portal, our support team shall process your KRA PIN Retrieval order and send the Retrieved KRA PIN Number and KRA PIN Certificate to your email address once the order has been marked as done and processed i.e. your lost or forgotten KRA PIN Number and KRA PIN Certificate will be Retrieved and sent to your Email Address.

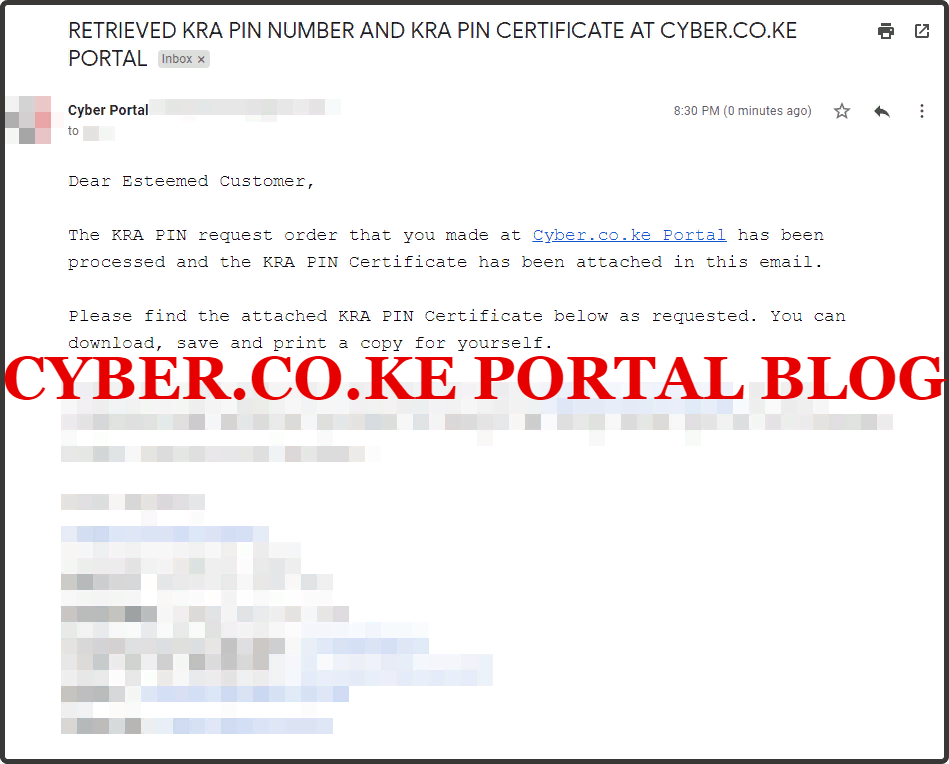

Step 7: Receive Your Recovered KRA PIN Number and KRA PIN Certificate In Your Email Address

The last step after submission and payment of the KRA PIN Retrieval charges at Cyber.co.ke Portal., our Support Team will work and process your PIN Retrieval request within 5 minutes of receipt of the online order. Your Retrieved KRA PIN Number and KRA PIN Certificate will be sent to your email address so as to enable you download and print the Retrieved KRA PIN Certificate that has your KRA PIN Number. This is as shown in the screen shot below.

READ ALSO: How To Download Turnover Tax Form Using KRA iTax Portal

The above steps sum up the process of KRA PIN Recovery that a taxpayer needs to follow in order to recover either the KRA PIN Number or KRA PIN Certificate using Cyber.co.ke Portal. Once you submit your KRA PIN Recovery order online at Cyber.co.ke Portal, our support team will recover and retrieve either your KRA PIN Number or KRA PIN Certificate depending on the type of order submitted. So next time you need to recover your KRA PIN Number or KRA PIN Certificate, just follow the KRA PIN Recovery Process And Steps Using KRA iTax Portal.

Matthews Ohotto is an Article Writer at CYBER.CO.KE and a Video Creator at Video Tutorials Kenya (YouTube). He specializes in crafting insightful Blog Posts and Video Tutorials that empower Kenyans with practical digital skills. He is a holder of Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT).

KRA INDIVIDUAL SERVICES

SUBMIT SERVICE REQUEST

KRA PIN REGISTRATION

Are you looking for KRA PIN Registration services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN RETRIEVAL

Are you looking for KRA PIN Retrieval services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN UPDATE

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA PIN CHANGE OF EMAIL ADDRESS

Are you looking for KRA PIN Update services in Kenya?

Submit your service request and let us handle everything for you.

Get your KRA PIN Certificate via Email Address and WhatsApp in a few minutes.

KRA RETURNS SERVICES

SUBMIT SERVICE REQUEST

KRA NIL RETURNS

Are you looking for KRA Nil Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA EMPLOYMENT RETURNS

Are you looking for KRA Employment Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA AMENDED RETURNS

Are you looking for KRA Amended Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.

KRA WITHHOLDING TAX RETURNS

Are you looking for KRA Withholding Tax Returns services in Kenya?

Submit your service request and let us handle everything for you.

Get your e-Return Acknowledgement Receipt via Email Address and WhatsApp in a few minutes.