The KRA Returns Portal plays an important and integral role when it comes to KRA Returns. This is because, all Kenyans who have active KRA PIN Numbers which you can easily get using Cyber.co.ke Portal’s KRA PIN Registration services, need to login there so as to file KRA Returns before the deadline.

Not that many Kenyans are able to beat the KRA Returns Deadline of 30th June due to various circumstances or challenges that they may face. One of the biggest one being that they are not able to login to KRA Returns Portal as they do not know the steps that they should follow.

What Is KRA Returns Portal?

KRA Returns Portal is an online system that enables taxpayers in Kenya file their KRA Returns either KRA Nil Returns or KRA Employment Returns on or before the Returns Deadline of 30th June of each year. It is also simply referred to as iTax or iTax Portal and to some extent just KRA Portal.

In order for a taxpayer to file his or her returns on KRA Returns Portal, first they have to ensure that the KRA PIN Number is ion iTax. Next, they will be required to login and use the KRA Returns functionality that is found in each individual taxpayer KRA Portal account dashboard. Once logged into the Returns Portal, then you can file either KRA Nil Returns or KRA Employment Returns.

Filing of KRA Returns on iTax is no easy task especially if you are not familiar with Returns filing process. That is why it is highly recommended and advisable that you use a trusted KRA iTax Services provider such as Cyber.co.ke Portal so as to be able to file your KRA Returns for you in the shortest time possible in Kenya.

If you don’t want to go through the hectic process of Filing KRA Returns, you can always use Cyber.co.ke Portal by submitting your order online for either KRA Nil Returns Filing or KRA Employment Returns Filing requests and our support team will gladly file for you your KRA Returns on iTax quickly and easily saving you much time.

Functions Of KRA Returns Portal

There are not that many functions of the KRA Returns Portal in Kenya. But it serves one most important function of them all i.e. Filing of KRA Returns. As a taxpayer who has an active KRA PIN, you always need to ensure that you file your KRA Returns on time using the Returns Portal or iTax.

As one of the most important function of the KRA Returns Portal, filing of KRA Returns each year is very important and every taxpayer in Kenya knows that and if you don’t know, then now you know. So whether you are a student, employed or unemployed, you need to ensure that you file your KRA Returns on the Returns Portal.

You don’t need to struggle that much nowadays since you have Cyber.co.ke Portal where you can easily place your order online for KRA Returns Filing on iTax and have your Returns done for you quickly and easily.

Requirements Needed To Login To KRA Returns Portal

Just like any other online system, the KRA Returns Portal requires that you have with you a set of requirements. This includes the KRA PIN Number and KRA Password (iTax Password). I am going to highlight briefly on each of the KRA Returns Portal login requirements.

KRA PIN Number is the most important requirement that you need to have with you. If by any chance you have forgotten or you don’t remember your KRA PIN, you can submit KRA PIN Retrieval order online here at Cyber.co.ke Portal and our team of experts will be able to assist with with PIN Retrieval request.

At the same time, if you are looking for a new KRA PIN, you can get it here in 3 minutes by submitting your KRA PIN Registration order today at Cyber.co.ke Portal. Your KRA PIN Certificate will be sent to your Email Address once the Request for PIN Registration has been done and processed from our Support team.

The next requirement that you need to have with you is your KRA iTax Password. You will need the iTax Password to access your KRA iTax Account. If you don’t know or have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. Once you have requested for password reset, a new password will be emailed to you and you can use it to log into your iTax Account.

You can only change or reset your iTax Password if the email used in KRA iTax Portal is the same that you currently have. If you don’t remember or need to change your KRA Email Address, you can submit KRA PIN Change of Email Address order online at Cyber.co.ke Portal and have your Email Address changed so as to enable your Reset KRA iTax Password.

Having looked at the amin requirements for logging into KRA Returns Portal above, we now need to look at the step by step procedure that all Kenyans need to follow on KRA Returns Portal Login Steps.

KRA Returns Portal Login Steps

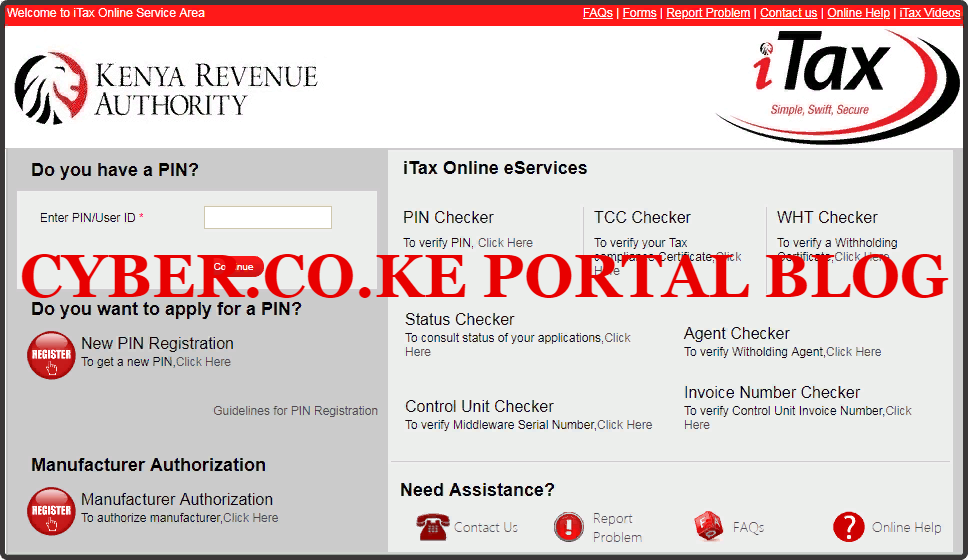

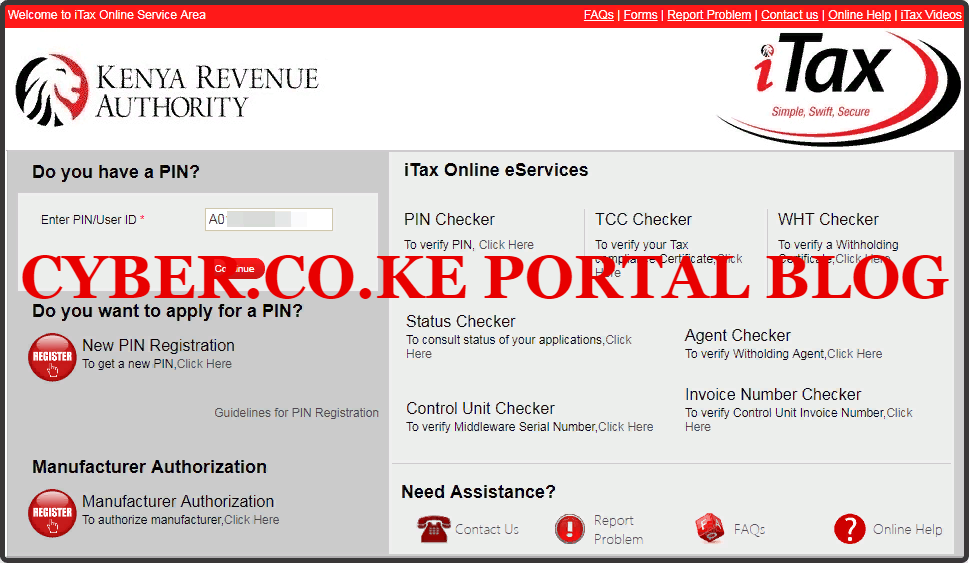

Step 1: Visit KRA Portal

The first step that you need to take in KRA Returns Portal Login Steps is to ensure that you visit the iTax Portal using the link provided above in the above description. Note, the above is an external link that will take you to the KRA iTax Portal.

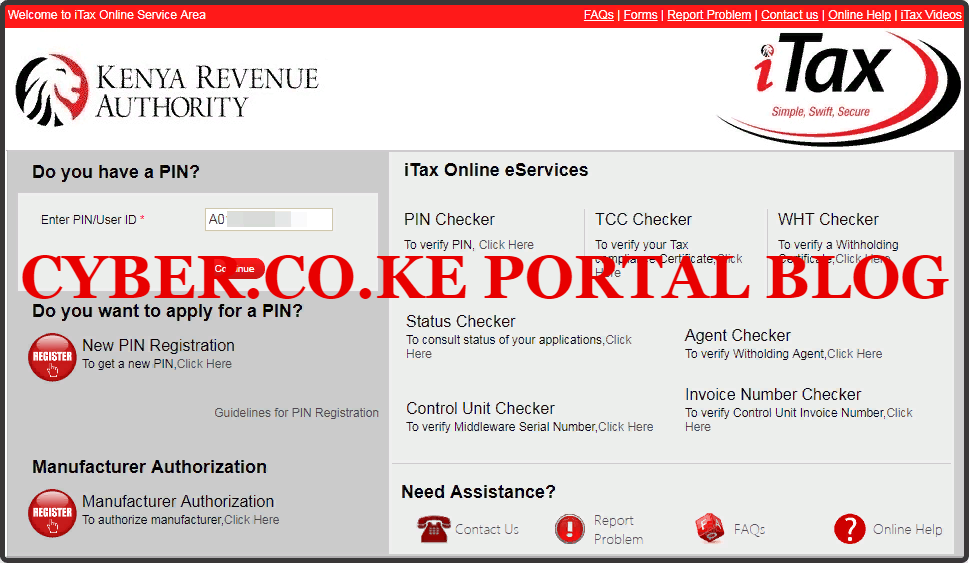

Step 2: Enter Your KRA PIN Number

Next, you will need to enter your KRA PIN Number. If you have forgotten your KRA PIN, you can request for KRA PIN Retrieval here at Cyber.co.ke Portal and your KRA PIN will be sent to your email address immediately. Once you have entered your KRA PIN, click on the “Continue” botton to proceed to the next step.

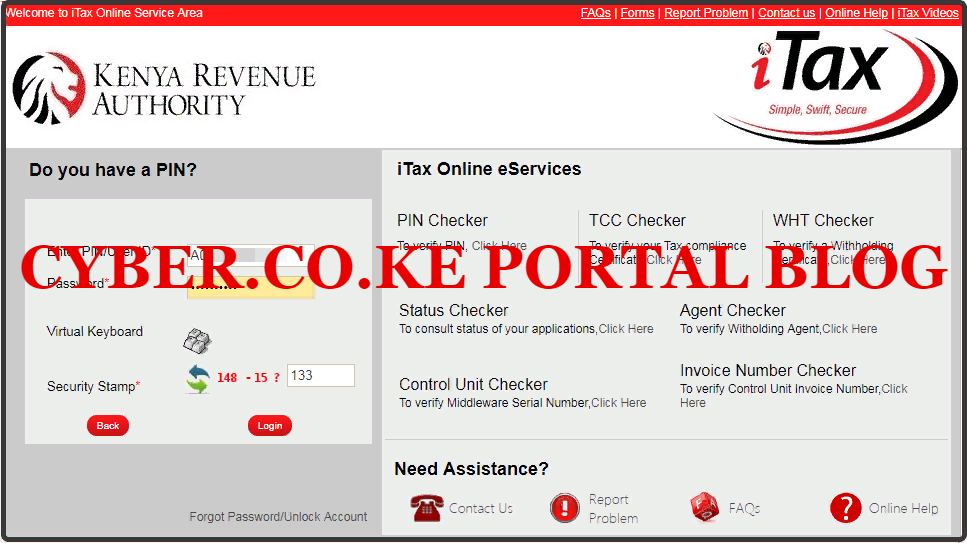

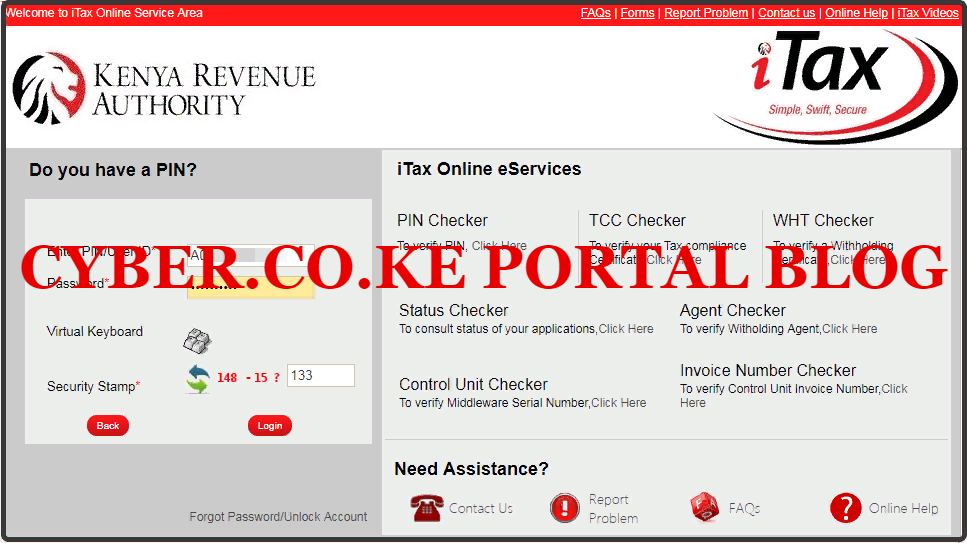

Step 3: Enter KRA Password (iTax Password) and Solve Arithmetic Question

In this step, you will be required to enter your KRA Password (iTax Password) and also solve the arithmetic question (security stamp). If you have forgotten your iTax Password, you can check our article on How To Reset KRA iTax Password. A new password will be sent to your email and you can use it to login. Once you have entered your iTax Password, click on the “Login” button to access your iTax Account.

Step 4: KRA Returns Portal Account Dashboard

In this last step, once you have entered the correct iTax Password and solved the arithmetic question (security stamp) as illustrated in Step 3 above, you will be logged in successfully and be able to see and access your KRA Returns Portal Account Dashboard. From here, then you will be able to File your KRA Returns.

As you have seen from the above steps of logging into KRA Returns Portal, you always need to ensure that you have with you the main requirements i.e. KRA PIN Number which you can get here at Cyber.co.ke Portal quickly and easily and the KRA Password. Once you have those two, then you need to follow the above Returns Portal login steps for you to be logged in successfully.

READ ALSO: How To File KRA Nil Returns Using KRA iTax Portal

If by any chance you want to be assisted in Filing KRA Returns, then you are in luck as here at Cyber.co.ke Portal, we offer KRA Returns Filing services to all taxpayers from all over the 47 counties. You can have your KRA Returns filed for you by just placing your order online for either KRA Nil Returns Filing or KRA Employment Returns Filing.