Disclaimer

CYBER.CO.KE is a Cyber Services Business and is not affiliated with any government agency, including Kenya Revenue Authority (KRA). This is a Cyber Services Business and Customers Pay for Services requested.

In this blog post, I am going to share with you Two Common PIN Not on iTax Issues and How to Solve Them online at Cyber.co.ke Portal today.

Get to know the two common problems that are associated with the KRA PIN Numbers that have not yet been updated on KRA iTax Portal. These are the VAT Issue and PAYE Issue. This article seeks to address these key issues and how a taxpayer can solve them.

First, we need to understand what is meant by the term “PIN Not on iTax” in relation to KRA PIN. Basically, PIN Not on iTax Simply means that the KRA PIN has not yet been migrated / updated on the KRA iTax Portal.

READ ALSO: How To Apply For Removal of KRA Tax Obligation

How To Check If A KRA PIN Number Has Issues

Before we get any deeper into this article, we need to look at the options that we can use to see if the KRA PIN Number has issues or not. There are two options that you can use to check for if your KRA PIN is on iTax or not. These included:

- KRA iTax PIN Checker

- iTax Portal

KRA iTax PIN Checker

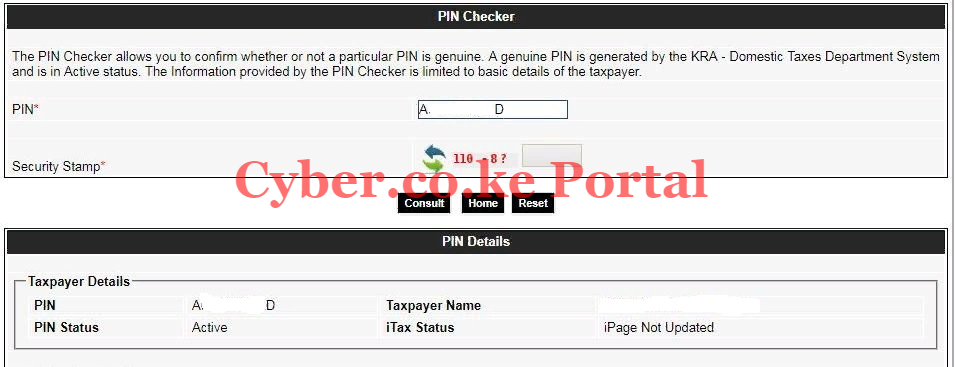

You can use the first option whereby you will be able to tell whether or not your KRA PIN is on iTax. The PIN Checker results will comes out as shown below:

To know whether a KRA PIN is on iTax or not, we take a look at the iTax Status section. If the iTax Status section shows: “iPage Not Updated” then that means that the KRA PIN is not yet Updated on iTax Portal. If the KRA PIN is already on iTax, the iTax Status section will show: “iPage Updated.”

You need to take not that the iTax Status depends on whether the KRA PIN was Registered on iTax or the KRA PIN was Updated on iTax. The main difference is that those PINs that were registered on iTax show “Registered” on the iTax Status section, while those PINs that were updated on iTax show “iPage Updated.”

These are the “newbies” – those who got there KRA PIN using iTax from 2014 onwards. People like us are are the “veterans” – those who got their KRA PIN using the now defunct Mapato System.

iTax Portal

The other method that you can use to check whether the KRA PIN is on iTax or not is by using the iTax Portal. If the PIN is not on iTax, you will get the following message as shown below:

If you get a popup saying: “A PIN is already linked to entered National Identity Number. Please update the iPage using iPage functionality,” then that simply means that the KRA PIN is not on iTax.

The good news if you get the above message is that here at Cyber.co.ke Portal, we specialize in offering Kenyans KRA Services online. You can request for your KRA PIN to be updated through or KRA PIN Update services. We shall have your KRA PIN Updated and sent to your email address.

Now that we have gone through the basics above, we can get down to business on the core purpose of this blog post i.e. the 2 common PIN Not on iTax issues and how to solve them. The reason why you need to note these issues down is because they prevent the KRA PIN from being Updated to iTax.

Two Common PIN Not on iTax Issues and How to Solve Them

Now, let is dive into this. The 2 common issues of PIN Not on iTax are as highlighted below:

- Value Added Tax (VAT) Issue

- Pay As You Earn (PAYE) Issue

Issue 1: Value Added Tax (VAT)

This is definitely the leading issue that has prevented many Kenyans from Updating their KRA PIN to iTax. You will need to take note that this issue majorly affects the PINs that were recieved via the old and defunct Mapato System.

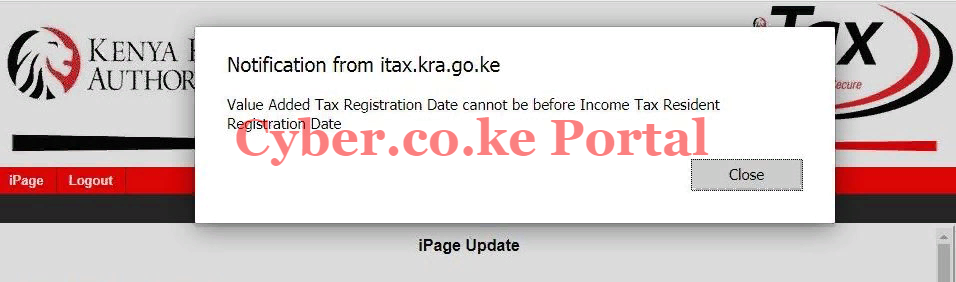

Value Added Tax (VAT) simply means that you are dealing in a business that charges VAT on taxable goods and services. If you are not in business and do not charge VAT, you should definitely apply for removal of this obligation. The most common challenge that majority of Kenyans face with PINs that have VAT obligation is as shown below:

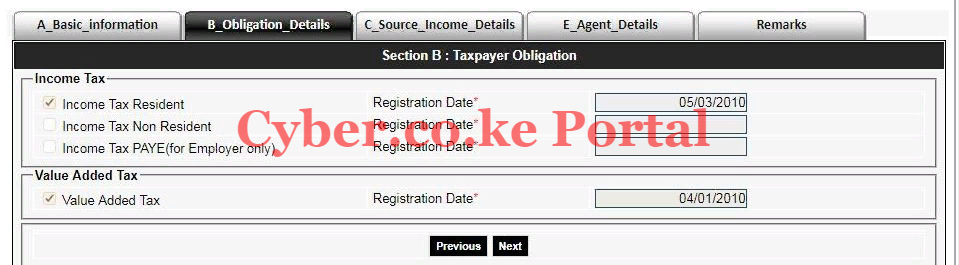

The above is the most common error for PINs Not on iTax. Basically, “Value Added Tax Registration Date cannot be before Income Tax Resident Registration Date” means that the VAT Obligation was added to your KRA PIN even before the KRA PIN was issued. This was the general error of the old Mapato System generated KRA PINs. Take a look below at what that issue means:

You will note that the Income Tax Resident Date as show above is “05/03/2010” while the Value Added Tax Date is “04/01/2010.” Note the huge difference. VAT Obligation was added to this PIN even before it was issued to the the Taxpayer. VAT was added in January while the Taxpayer got the PIN in March. This challenge is what majority of PINs not on iTax face. This got to be a System error with the old Mapato System.

The above error definitely means that the Taxpayer’s PIN cannot be updated to iTax and he/she needs to apply for removal of the VAT obligation. We shall talk about that later on in this blog.

Issue 2: Pay As You Earn (PAYE)

The second common issue preventing the update of KRA PINs to iTax is the PAYE (Pay As You Eran Issue). PAYE simply means that you are an employer and remit PAYE from your employees salaries. If you are not an employer and gave this obligation, you should definitely apply for removal of that obligation.

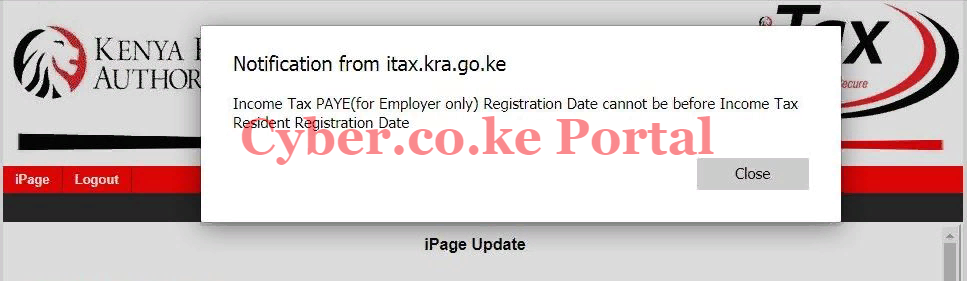

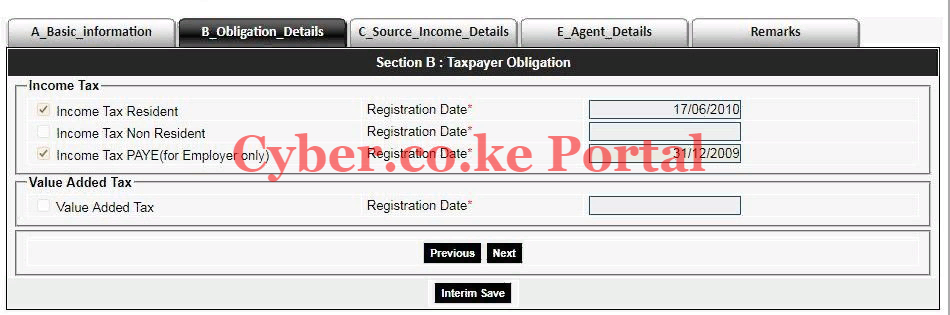

Just as with the issue with VAT as discussed above, PAYE also has the same issue. You can take a look at the screenshot below:

The above is the other type of error associated with KRA PINs that are not yet on iTax, Basically, “Income Tax PAYE (for employer only) registration date cannot be before Income Tax Resident Registration date” means that PAYE obligation was added to the KRA PIN before the PIN was issued. The screenshot below shows the major difference in those dates:

You will note the following, the PAYE obligation date is “31/12/2009″ while the KRA PIN was issued on “17/06/2010.” This is a huge discrepancy. The PIN won’t update on iTax till the PAYE obligation is removed.

Now that we have looked at the issued associated with KRA PINs that are not yet on iTax, we need to take a look at how to solve these two issue.

How To Solve KRA PIN Update Issues

1. VAT Issue

iTax gives a VAT error message when am trying to update KRA PIN on iTax: Value Added Tax (VAT) Registration Date cannot be before Income Tax Resident Registration Date. What do I do to reconcile the conflicting VAT and Income Tax Resident dates?

The VAT error means there is a problem with your KRA PIN. This means when you registered, you were given the VAT obligation which is for business people. If you do not have a business linked to your PIN, you should have been assigned Income Tax Individual obligation. What you should do is that you SHOULD NOT try to update it. Draft a letter requesting for removal of VAT and accrued penalties and then take it to any KRA station. If the request is approved, they will remove the VAT obligation and then after that, you can be able to update your pin.

2. PAYE Issue

iTax gives a PAYE error message when am trying to update KRA PIN on iTax: Pay As You Earn (PAYE) Registration Date cannot be before Income Tax Resident Registration Date. What do I do to reconcile the conflicting PAYE and Income Tax Resident dates?

The PAYE error means there is a problem with your KRA PIN. This means when you registered, you were given the PAYE obligation which is for employers only. If you are not an employer, you should have been assigned Income Tax Individual obligation. What you should do is that you SHOULD NOT try to update it. Draft a letter requesting for removal of PAYE and accrued penalties and then take it to any KRA station. If the request is approved, they will remove the PAYE obligation and then after that, you can be able to update your pin.

Download: APPLICATION FOR REMOVAL OF TAX OBLIGATION FORM

READ ALSO: How To Reprint KRA Tax Compliance Certificate

To sum everything up, those are the common issues affecting many of the KRA PINs that are not yet migrated to iTax. To be able to remove those obligation(s), you can check the article I wrote about How To Apply For Removal of KRA Tax Obligation.

Matthews Ohotto is a Writer at CYBER.CO.KE where he specializes in writing helpful and informative Step-by-Step Tutorials that empower Kenyans with practical skills and knowledge. He holds a Bachelor’s Degree in Business Information Technology (BBIT) from Jomo Kenyatta University of Agriculture and Technology (JKUAT). Get KRA Individual Services and KRA Returns Services in Kenya.