Filing of KRA Returns is a very important undertaking that all taxpayers in Kenya need to do. Whether you are employed or not, you are required by Law to file your KRA Returns on or before the elapse of the 30th June deadline that is set by Kenya Revenue Authority (KRA).

Failure to which a penalty of Kshs. 2,000 will be imposed for late filing of KRA Returns. It is important that taxpayers to always file their KRA Returns on time before the elapse of the set deadlines. If you want to know if you have filed KRA Returns, you can easily check the same using your iTax (KRA Portal) account. To be able to view filed KRA Returns, you need to ensure that you are able to login into your iTax (KRA Portal) account using both your KRA PIN Number and KRA Password (iTax Password).

You need to use both of these credentials to login to your iTax account and view all your filed KRA Returns online. Viewing filed KRA Returns is important as it gives you an understanding of the current state of your KRA Returns on iTax (KRA Portal). In this blog post, I will be sharing the main steps that you need to follow so as to be able to view your filed KRA Returns online quickly and easily.

READ ALSO: Step-by-Step Process of Downloading KRA e-Return Receipt

How To View Filed KRA Returns

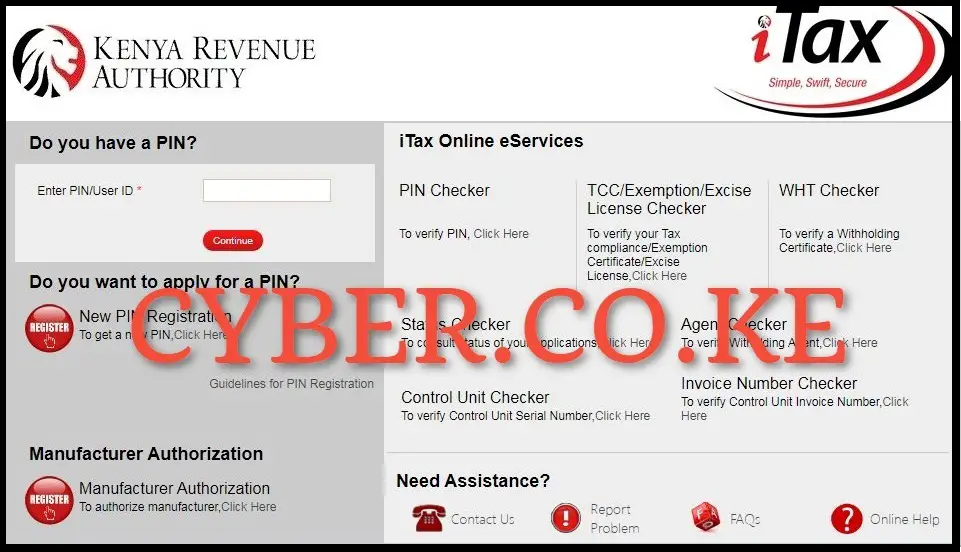

Step 1: Visit iTax (KRA Portal)

The process of viewing filed KRA Returns requires that you first visit iTax (KRA Portal) using https://itax.kra.go.ke/KRA-Portal/

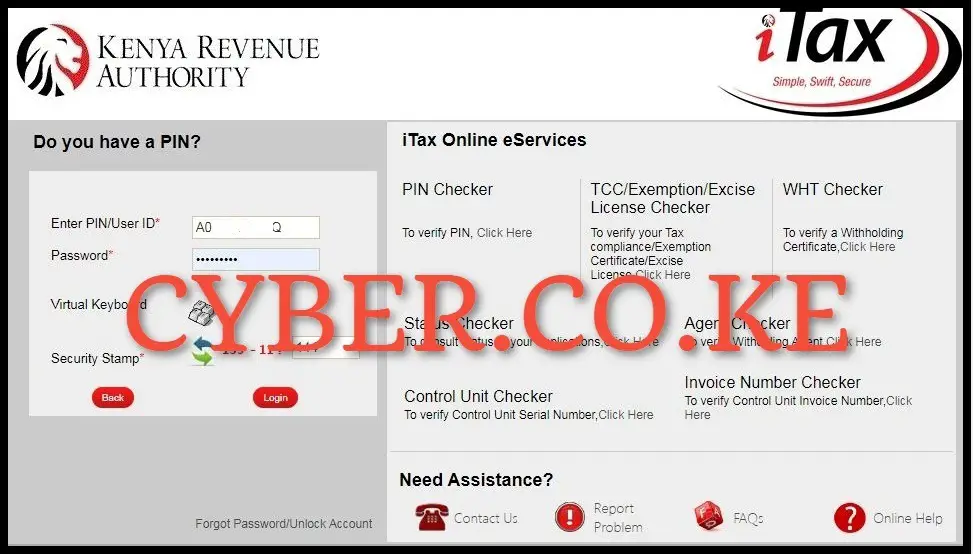

Step 2: Login Into iTax (KRA Portal)

Next, you need to enter your KRA PIN Number, KRA Password (iTax Password), solve the arithmetic question (security stamp) and then click on the “Login” button.

Step 3: Click on Returns then View Filed Return

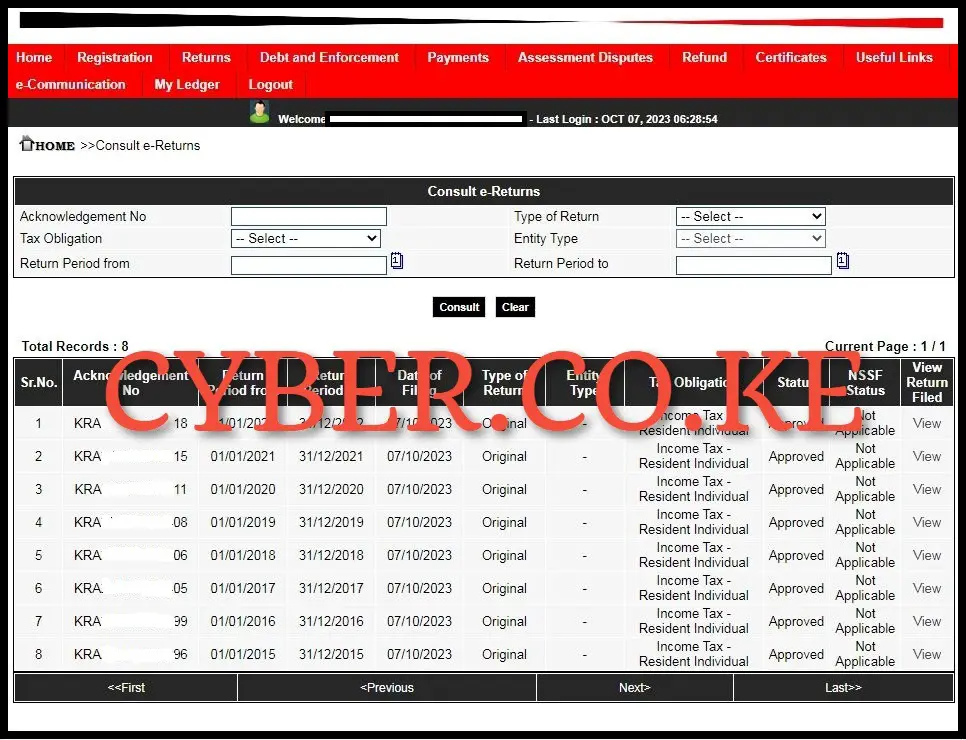

Once you are logged into iTax (KRA Portal), click on the “Returns” menu and then click on “View Filed Returns” from the drop down menu list to start the process of viewing all your filed KRA Returns on iTax (KRA Portal).

Step 4: Consult e-Returns

In this step, on the Consult e-Returns Form that will load, you will notice the following form fields; Acknowledgement Number, Type of Return, Tax Obligation, Entity Type, Return Period From and Return Period To. These fields are not mandatory to fill, but if you want you can always narrow down your search to a specific type or KRA Returns and KRA Tax Obligation. Click on the “Consult” button to view if you have filed KRA Returns on iTax Portal. The form will be populated with the details of all the KRA Returns that you have filed on KRA Portal. If you have never filed any KRA Returns, you will get a message telling you “No Records Found.“

READ ALSO: Step-by-Step Process of Downloading Tax Compliance Certificate (TCC)

The above 4 steps sums up the process of checking and viewing whether or not you have filed KRA Returns on iTax 9KRA Portal). It is important to take note that you first need to have with you both your KRA PIN Number and KRA Password (iTax Password) before proceeding to viewing filed KRA Returns on iTax (KRA Portal). As mentioned, if you have been filing KRA Returns, all the returns will be listed on the “Consult e-Return” form while if you have not been filing KRA Returns, you will see the message “No Records Found.” You need to ensure that you always file your KRA Returns as early as possible before the elapse of the 30th June deadline.

DON’T MISS OUT. CHECK OUT OUR TRENDING POPULAR BLOG POSTS IN KENYA.

How To Download KRA PIN Certificate Online (In 5 Steps)

How To File KRA Nil Returns For Students On iTax (KRA Portal)

How To File KRA Nil Returns For Unemployed On iTax (KRA Portal)

KRA PIN REGISTRATION

How To Check If You Have Filed KRA Returns (In 4 Steps)

How To Change or Reset iTax Password Online (In 7 Steps)

How To Change or Reset KRA Password Online (In 7 Steps)

KRA PIN RETRIEVAL

How To Change Email Address Registered On iTax (KRA Portal)

How To Apply For Tax Compliance Certificate On iTax (KRA Portal)

How To Download Tax Compliance Certificate On iTax (KRA Portal)

KRA PIN UPDATE

How To Generate KRA Payment Slip On iTax (KRA Portal)

How To Download KRA Returns Receipt Online (In 5 Steps)

How To Check Your KRA PIN Using KRA PIN Checker (iTax PIN Checker)

KRA PIN CHANGE OF EMAIL ADDRESS

Stay Tax Compliant in Kenya

Contact our customer support team today for fast and reliable assistance with all your KRA Services via Call, SMS or WhatsApp - 0723 737 740 or alternatively send us an email using: [email protected] for prompt and immediate assistance today.